Region:Middle East

Author(s):Dev

Product Code:KRAC0402

Pages:92

Published On:August 2025

By Type:

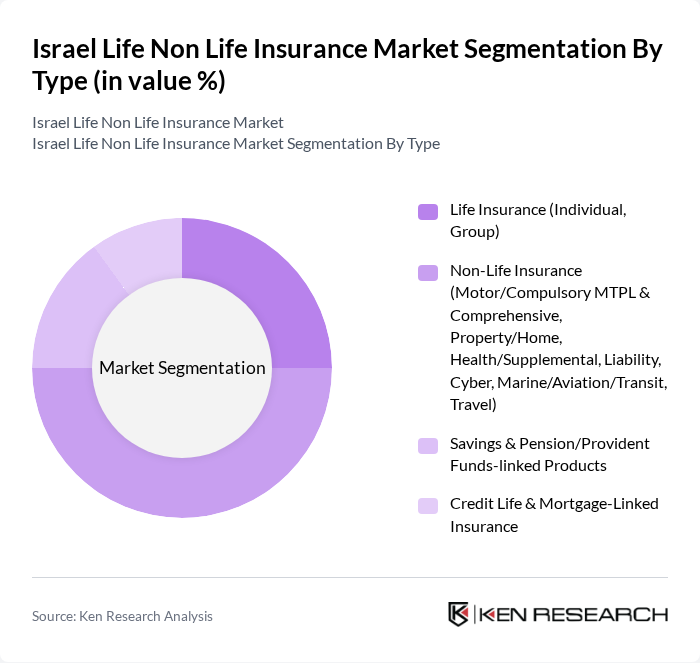

The segmentation by type includes Life Insurance (Individual, Group), Non-Life Insurance (Motor/Compulsory MTPL & Comprehensive, Property/Home, Health/Supplemental, Liability, Cyber, Marine/Aviation/Transit, Travel), Savings & Pension/Provident Funds-linked Products, and Credit Life & Mortgage-Linked Insurance. Non-Life Insurance is currently dominating the market due to the increasing need for comprehensive coverage against various risks, particularly in urban areas where the incidence of accidents and property damage is higher. The growing awareness of health insurance, especially post-pandemic, has also contributed to the rise in demand for health and supplemental insurance products.

By End-User:

This segmentation includes Individuals/Households, SMEs, Large Corporates, and Public Sector & Municipal Entities. The Individuals/Households segment is leading the market, driven by a growing awareness of personal financial security and the increasing number of households seeking life and health insurance products. The rise in disposable income and changing consumer behavior towards risk management have also contributed to the growth of this segment, making it a focal point for insurance providers.

The Israel Life Non Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Harel Insurance Investments and Financial Services Ltd., Clal Insurance Enterprises Holdings Ltd., Migdal Insurance and Financial Holdings Ltd., The Phoenix Holdings Ltd., Menora Mivtachim Holdings Ltd., Ayalon Insurance Company Ltd., The Israel Insurance Company Ltd. (HaBituah HaYisraeli), Direct Insurance – Financial Investments Ltd. (Bituach Yashir), AIG Israel Insurance Company Ltd., Mapfre Warranty Israel Ltd., Liberty Israel – Phoenix Smart (distribution partnership), Zurich Insurance (Israel) Ltd., Generali Israel Insurance Company Ltd. (subsidiary brand legacy), Shomera Insurance Company Ltd., Marsh Israel Insurance Broking & Risk Management Ltd. (brokerage) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Israeli life and non-life insurance market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms continue to expand, insurers are likely to enhance their service offerings, focusing on personalized products that cater to diverse customer needs. Additionally, the increasing emphasis on sustainability and ethical practices will shape product development, aligning with global trends. Overall, the market is poised for growth, supported by a robust regulatory framework and rising consumer demand for comprehensive coverage.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance (Individual, Group) Non-Life Insurance (Motor/Compulsory MTPL & Comprehensive, Property/Home, Health/Supplemental, Liability, Cyber, Marine/Aviation/Transit, Travel) Savings & Pension/Provident Funds-linked Products Credit Life & Mortgage-Linked Insurance |

| By End-User | Individuals/Households SMEs Large Corporates Public Sector & Municipal Entities |

| By Distribution Channel | Agents/Agencies Brokers Bancassurance Direct & Digital Channels (Insurer Websites/Apps, InsurTech/Aggregators) |

| By Policy Duration | Short-Term Policies (?1 year) Long-Term Policies (>1 year) |

| By Premium Payment Mode | Monthly Quarterly/Semi-Annual Annual Single Premium |

| By Coverage Type | Mandatory (e.g., Motor TPL) Voluntary/Comprehensive |

| By Customer Segment | High Net-Worth Individuals (HNWIs) Mass Affluent & Middle-Class Value-Sensitive/Low-Income |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Policyholders | 120 | Individuals aged 30-60, Middle to High Income |

| Health Insurance Customers | 100 | Families with children, Health-conscious individuals |

| Property Insurance Clients | 80 | Homeowners, Real Estate Investors |

| Casualty Insurance Users | 60 | Small Business Owners, Fleet Managers |

| Insurance Brokers and Agents | 90 | Insurance Sales Professionals, Agency Managers |

The Israel Life Non-Life Insurance Market is valued at approximately USD 25 billion, reflecting a significant growth trend driven by increased consumer awareness, rising disposable incomes, and urbanization over the past five years.