Region:North America

Author(s):Shubham

Product Code:KRAA1853

Pages:81

Published On:August 2025

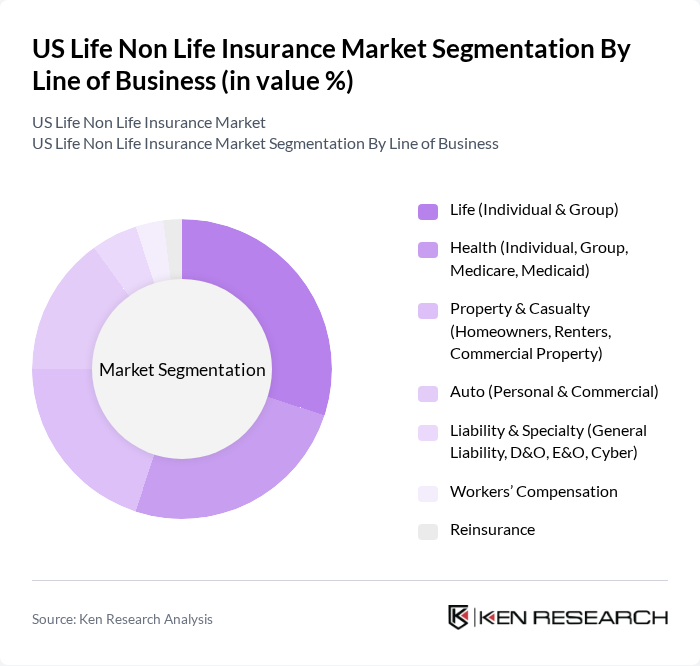

By Line of Business:

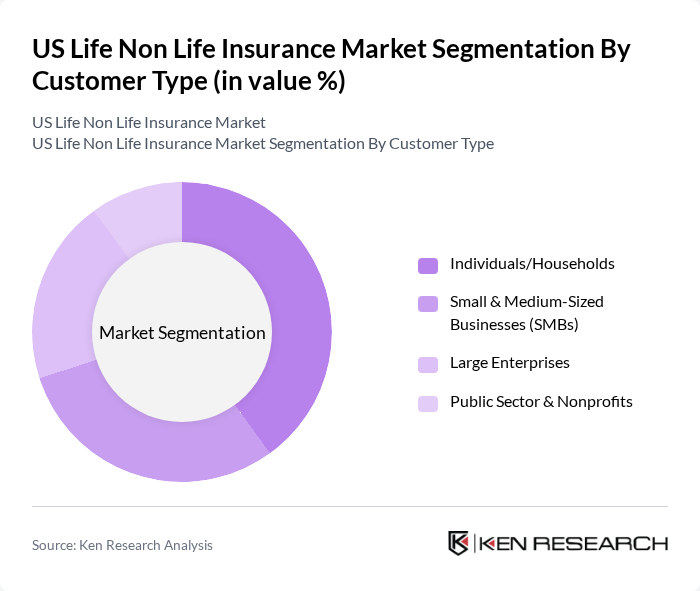

By Customer Type:

The US Life Non Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as State Farm Mutual Automobile Insurance Company, Berkshire Hathaway Inc. (GEICO, General Re), The Allstate Corporation, Prudential Financial, Inc., MetLife, Inc., American International Group, Inc. (AIG), Chubb Limited, The Travelers Companies, Inc., Liberty Mutual Insurance, Nationwide Mutual Insurance Company, New York Life Insurance Company, Massachusetts Mutual Life Insurance Company (MassMutual), The Hartford Financial Services Group, Inc., American Family Insurance, USAA (United Services Automobile Association), UnitedHealth Group Incorporated, Cigna Group, Elevance Health, Inc. (Anthem), Progressive Corporation, Humana Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US life and non-life insurance market appears promising, driven by technological innovations and evolving consumer preferences. As insurers increasingly adopt digital platforms, customer engagement is expected to improve significantly. Furthermore, the demand for personalized insurance products will likely rise, reflecting a shift towards tailored solutions that meet individual needs. This evolution will create opportunities for insurers to enhance their offerings and strengthen customer loyalty in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Line of Business | Life (Individual & Group) Health (Individual, Group, Medicare, Medicaid) Property & Casualty (Homeowners, Renters, Commercial Property) Auto (Personal & Commercial) Liability & Specialty (General Liability, D&O, E&O, Cyber) Workers’ Compensation Reinsurance |

| By Customer Type | Individuals/Households Small & Medium-Sized Businesses (SMBs) Large Enterprises Public Sector & Nonprofits |

| By Distribution Channel | Captive/Exclusive Agents Independent Agents & Brokers Direct-to-Consumer (Online & Direct Response) Bancassurance & Affinity Partners |

| By Life Policy Type | Term Life Whole Life Universal & Indexed Universal Life Variable Life & Variable Universal Life |

| By P&C Policy Type | Homeowners & Renters Personal Auto Commercial Auto Commercial Property General Liability & Umbrella Specialty (Cyber, D&O, E&O, Inland Marine) |

| By Premium Size | Sub-$1,000 $1,000–$5,000 Above $5,000 |

| By Customer Demographics (Life & Health) | Age Cohort Income Tier Household Composition |

| By Coverage Amount (Life) | <$250,000 $250,000–$1 Million >$1 Million |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Policyholders | 140 | Individuals aged 30-60, Financial Advisors |

| Health Insurance Consumers | 120 | Families, HR Managers from Corporates |

| Property Insurance Clients | 100 | Homeowners, Real Estate Agents |

| Casualty Insurance Stakeholders | 80 | Business Owners, Risk Managers |

| Insurance Brokers and Agents | 90 | Licensed Insurance Agents, Brokerage Firm Executives |

The US Life Non Life Insurance Market is valued at approximately USD 2.0 trillion, reflecting the combined scale of life and non-life premiums, including health insurance, based on a five-year historical analysis.