Region:Europe

Author(s):Dev

Product Code:KRAC0555

Pages:99

Published On:August 2025

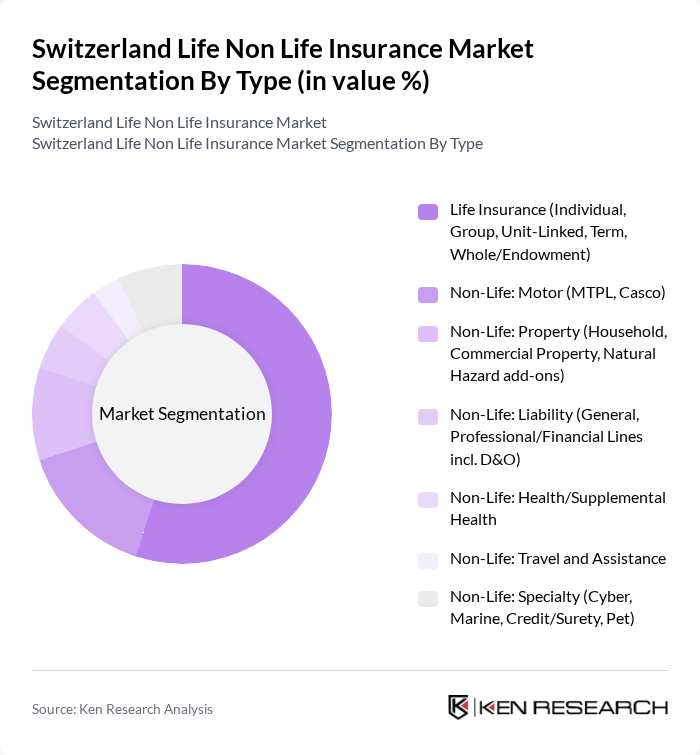

By Type:The market is segmented into Life Insurance and Non-Life Insurance, with various sub-segments under each category. Life Insurance includes Individual, Group, Unit-Linked, Term, and Whole/Endowment policies. Non-Life Insurance encompasses Motor (MTPL, Casco), Property (Household, Commercial Property, Natural Hazard add-ons), Liability (General, Professional/Financial Lines including D&O), Health/Supplemental Health, Travel and Assistance, and Specialty (Cyber, Marine, Credit/Surety, Pet) insurance. The Life Insurance segment leads due to high demand for retirement planning, occupational and private pension solutions, and savings/investment-linked products in a mature, high-income market.

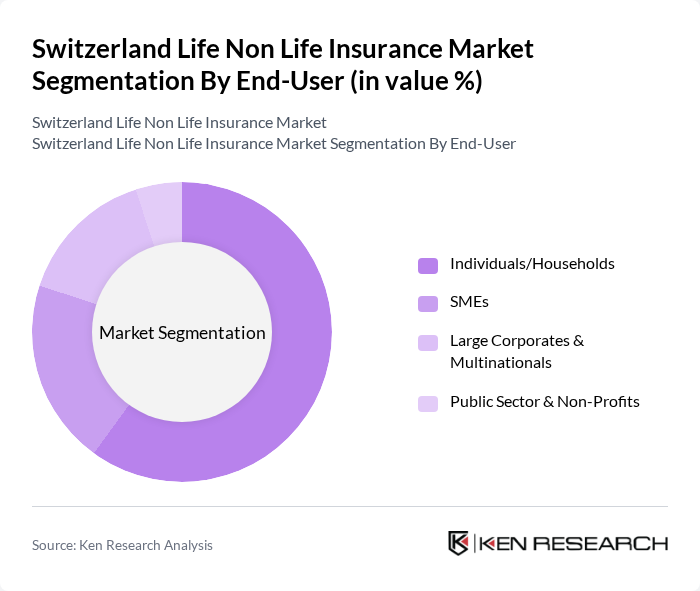

By End-User:The end-user segmentation includes Individuals/Households, SMEs, Large Corporates & Multinationals, and Public Sector & Non-Profits. The Individuals/Households segment is the largest due to widespread uptake of life/savings, pension-linked, motor and property coverages, and supplemental health products in a high insurance-penetration market; product breadth and distribution via agents, bancassurance, direct, and brokers support tailored offerings for varied consumer needs.

The Switzerland Life Non Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zurich Insurance Group AG (Zurich Schweiz), Swiss Life Holding AG, Helvetia Holding AG, Bâloise Holding AG (Basler Versicherungen), Allianz Suisse Versicherungs-Gesellschaft AG, Generali (Schweiz) Holding AG, AXA Versicherungen AG (AXA Switzerland), Vaudoise Assurances Holding SA, La Mobilière (Schweizerische Mobiliar Versicherungsgesellschaft AG), Swiss Re Ltd (incl. iptiQ Switzerland), Swisscard AECS GmbH Insurance Services (replace Credit Suisse Group AG), Raiffeisen Schweiz Genossenschaft (Bancassurance partnerships), CSS Versicherung AG (supplemental health), Aon Schweiz AG, Marsh AG (Switzerland) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Switzerland life non-life insurance market appears promising, driven by ongoing technological advancements and a shift towards personalized insurance solutions. As consumer preferences evolve, insurers are expected to leverage data analytics to tailor products more effectively. Additionally, the increasing focus on sustainability will likely lead to the development of eco-friendly insurance products, aligning with global trends. Overall, the market is poised for growth, adapting to changing consumer needs and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance (Individual, Group, Unit-Linked, Term, Whole/Endowment) Non-Life: Motor (MTPL, Casco) Non-Life: Property (Household, Commercial Property, Natural Hazard add-ons) Non-Life: Liability (General, Professional/Financial Lines incl. D&O) Non-Life: Health/Supplemental Health Non-Life: Travel and Assistance Non-Life: Specialty (Cyber, Marine, Credit/Surety, Pet) |

| By End-User | Individuals/Households SMEs Large Corporates & Multinationals Public Sector & Non-Profits |

| By Distribution Channel | Direct (Insurer-owned) Brokers and Tied Agents Digital/Online Platforms and Insurtech Bancassurance |

| By Policy Duration | Short-Term (?1 year, mainly P&C) Long-Term (>1 year, Life and Multi-year P&C) |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Claims Settlement Performance | High Settlement Ratio/Speed Medium Settlement Ratio/Speed Low Settlement Ratio/Speed |

| By Customer Segment | Young Adults (18–34) Families Seniors/Retirees Corporates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Policyholders | 150 | Individuals aged 30-60, Financial Advisors |

| Non-Life Insurance Customers | 120 | Homeowners, Small Business Owners |

| Insurance Brokers and Agents | 100 | Insurance Brokers, Independent Agents |

| Regulatory and Compliance Experts | 80 | Compliance Officers, Legal Advisors |

| Insurance Industry Analysts | 70 | Market Analysts, Research Directors |

The Switzerland Life Non-Life Insurance Market is valued at approximately CHF 180 billion, reflecting a robust growth driven by increasing retirement and wealth-protection needs among the high-income population, alongside advancements in digitalization and strong sector capitalization.