Region:Europe

Author(s):Geetanshi

Product Code:KRAB5712

Pages:89

Published On:October 2025

By Type:The market is segmented into various types, including Prebiotics & Probiotics, Dietary Supplements, Functional Beverages, Fortified Foods, Sports Nutrition Products, Weight Management Products, and Others. Among these, Prebiotics & Probiotics have emerged as the leading sub-segment, representing the largest revenue generating ingredient category. Vitamins represent the fastest growing segment, driven by increasing consumer focus on health and wellness, particularly products that support immune health and overall well-being.

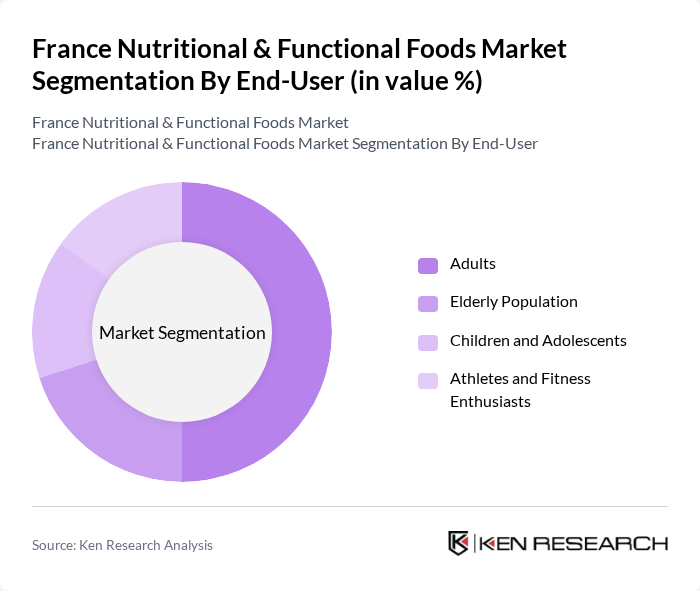

By End-User:The end-user segmentation includes Adults, Elderly Population, Children and Adolescents, and Athletes and Fitness Enthusiasts. The Adults segment dominates the market, driven by a growing awareness of health issues and the desire for preventive healthcare solutions. This demographic is increasingly seeking products that enhance their health and well-being, leading to a surge in demand for nutritional and functional foods. The growing geriatric population also contributes significantly to market expansion, as older consumers seek products for cognitive support and overall wellness maintenance.

The France Nutritional & Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danone S.A., Nestlé S.A., Lactalis Group, Groupe Bel, Pierre Fabre Group, Laboratoire PYC, Lesaffre, Roquette Frères, Herbalife Nutrition Ltd., Unilever PLC, Abbott Laboratories, Arla Foods, FrieslandCampina, The Kraft Heinz Company, General Mills, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France nutritional and functional foods market appears promising, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, brands are expected to innovate with new product formulations that cater to specific dietary needs. Additionally, the integration of technology in food production and distribution will enhance efficiency and transparency, further appealing to health-conscious consumers seeking quality and sustainability in their food choices.

| Segment | Sub-Segments |

|---|---|

| By Type | Prebiotics & Probiotics Dietary Supplements (Vitamins, Minerals, Botanicals, Proteins & Amino Acids, Fatty Acids, Carotenoids, Dietary Fibers) Functional Beverages Fortified Foods Sports Nutrition Products Weight Management Products Others (including Nutraceuticals, Omega-3 Products) |

| By End-User | Adults Elderly Population Children and Adolescents Athletes and Fitness Enthusiasts |

| By Distribution Channel | Supermarkets and Hypermarkets Health Food Stores Online Retail Pharmacies & Drugstores |

| By Price Range | Premium Products Mid-Range Products Budget Products |

| By Packaging Type | Bottles Pouches Tubs Sachets |

| By Ingredient Source | Natural Ingredients Synthetic Ingredients |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle Choices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutritional Supplements Market | 100 | Health Food Store Managers, Nutritionists |

| Functional Beverages Segment | 60 | Product Development Managers, Beverage Industry Analysts |

| Fortified Foods Category | 50 | Food Scientists, Retail Buyers |

| Consumer Health Trends | 80 | Health Conscious Consumers, Fitness Trainers |

| Market Distribution Channels | 40 | Supply Chain Managers, E-commerce Specialists |

The France Nutritional & Functional Foods Market is valued at approximately USD 16.8 billion, reflecting a significant growth trend driven by increasing health consciousness and demand for natural and organic products among consumers.