Region:Asia

Author(s):Shubham

Product Code:KRAB5650

Pages:100

Published On:October 2025

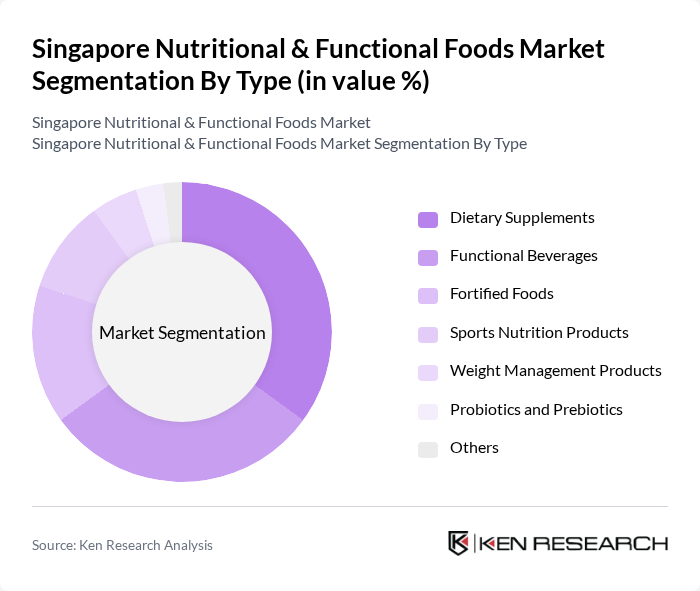

By Type:The market is segmented into various types, including Dietary Supplements, Functional Beverages, Fortified Foods, Sports Nutrition Products, Weight Management Products, Probiotics and Prebiotics, and Others. Among these, Dietary Supplements and Functional Beverages are the most prominent segments, driven by increasing consumer awareness regarding health and wellness. The demand for convenient and on-the-go nutrition options has led to a surge in the popularity of functional beverages, while dietary supplements are favored for their targeted health benefits.

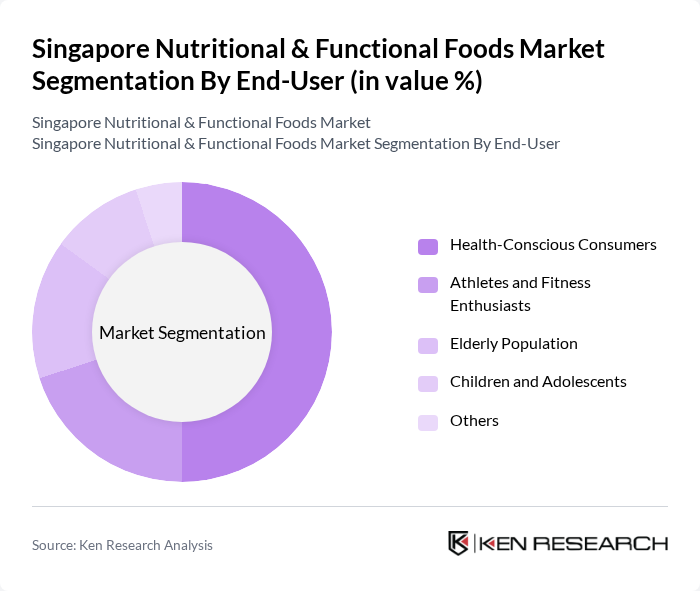

By End-User:The end-user segmentation includes Health-Conscious Consumers, Athletes and Fitness Enthusiasts, Elderly Population, Children and Adolescents, and Others. Health-Conscious Consumers dominate the market, driven by a growing trend towards preventive health measures and wellness. This segment is increasingly seeking products that support overall health, immunity, and vitality, leading to a rise in demand for nutritional and functional foods tailored to their needs.

The Singapore Nutritional & Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Singapore (Pte) Ltd., Abbott Laboratories (Singapore) Private Limited, Herbalife International Singapore Pte Ltd., Danone Nutricia Early Life Nutrition, GNC Holdings, Inc., Amway (Singapore) Pte Ltd., Blackmores Limited, DSM Nutritional Products, Yakult (Singapore) Pte Ltd., Unilever Singapore Pte Ltd., Nature's Way, Swisse Wellness, Herbalife Nutrition Ltd., Otsuka Pharmaceutical Co., Ltd., Suntory Beverage & Food Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore nutritional and functional foods market is poised for continued growth, driven by evolving consumer preferences towards health and wellness. Innovations in product formulations, particularly in plant-based and organic segments, are expected to gain traction. Additionally, the integration of technology in product development, such as personalized nutrition solutions, will likely enhance consumer engagement. As e-commerce continues to expand, brands that leverage digital platforms effectively will capture a larger share of the market, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dietary Supplements Functional Beverages Fortified Foods Sports Nutrition Products Weight Management Products Probiotics and Prebiotics Others |

| By End-User | Health-Conscious Consumers Athletes and Fitness Enthusiasts Elderly Population Children and Adolescents Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Health Food Stores Pharmacies Others |

| By Ingredient Source | Natural Ingredients Synthetic Ingredients Organic Ingredients Others |

| By Price Range | Premium Products Mid-Range Products Budget Products Others |

| By Packaging Type | Bottles Pouches Tubs Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Functional Foods | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Insights on Nutritional Products | 100 | Store Managers, Product Buyers |

| Healthcare Professionals' Perspectives | 80 | Nutritionists, Dietitians, General Practitioners |

| Market Trends in Dietary Supplements | 70 | Brand Managers, Marketing Executives |

| Consumer Attitudes Towards Health Claims | 120 | General Consumers, Health Advocates |

The Singapore Nutritional & Functional Foods Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing health awareness, rising disposable incomes, and a shift towards preventive healthcare among consumers.