Region:Europe

Author(s):Rebecca

Product Code:KRAB4138

Pages:96

Published On:October 2025

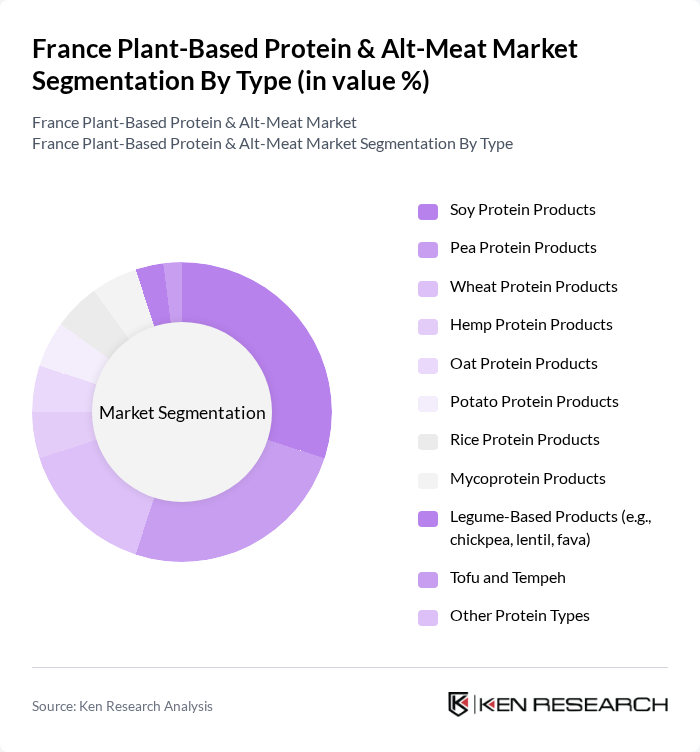

By Type:The market is segmented into various types of plant-based proteins, including soy, pea, wheat, hemp, oat, potato, rice, mycoprotein, legume-based products, tofu, tempeh, and other protein types. Among these, soy protein products are currently leading the market due to their high protein content and versatility in food applications. Pea protein is also gaining traction, particularly in the beverage sector, as consumers seek alternatives that are allergen-friendly and sustainable. The market is witnessing diversification with the inclusion of fava bean, rice, and canola protein, catering to specific dietary needs and preferences. Mycoprotein and legume-based products are also expanding, driven by consumer demand for variety and improved sensory characteristics .

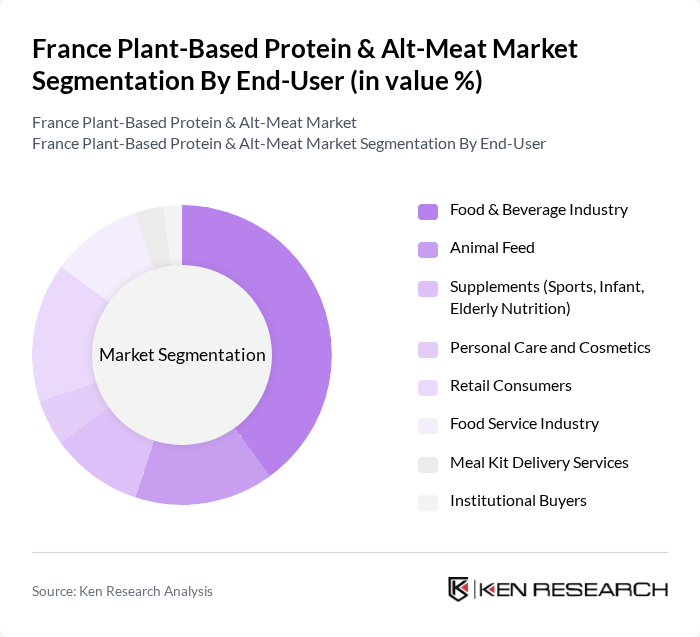

By End-User:The end-user segmentation includes the food and beverage industry, animal feed, supplements, personal care and cosmetics, retail consumers, food service industry, meal kit delivery services, and institutional buyers. The food and beverage industry is the dominant segment, driven by the increasing incorporation of plant-based proteins in various food products, including snacks, dairy alternatives, and meat substitutes. Retail consumers are also significantly contributing to the market growth as they seek healthier and sustainable options. The supplements segment is expanding, fueled by demand for sports, infant, and elderly nutrition. Food service and meal kit delivery services are leveraging plant-based proteins to meet evolving consumer preferences for convenience and health .

The France Plant-Based Protein & Alt-Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roquette Frères, Bonduelle, Nutrition & Santé, Danone (Alpro, Sojasun), Beyond Meat, Nestlé (Garden Gourmet), The Vegetarian Butcher (Unilever), Herta (Nestlé/Planted), Vivera, Quorn Foods, Tofurky, Heura Foods, Cargill, La Vie Foods, Umiami contribute to innovation, geographic expansion, and service delivery in this space.

The future of the plant-based protein and alt-meat market in France appears promising, driven by evolving consumer preferences and increasing awareness of health and sustainability. As flexitarian diets gain traction, more consumers are likely to incorporate plant-based options into their meals. Additionally, the rise of e-commerce platforms is expected to enhance accessibility, allowing consumers to explore diverse plant-based products. With ongoing innovations and strategic partnerships, the market is poised for significant growth in future, reflecting broader global trends towards sustainable eating.

| Segment | Sub-Segments |

|---|---|

| By Type | Soy Protein Products Pea Protein Products Wheat Protein Products Hemp Protein Products Oat Protein Products Potato Protein Products Rice Protein Products Mycoprotein Products Legume-Based Products (e.g., chickpea, lentil, fava) Tofu and Tempeh Other Protein Types |

| By End-User | Food & Beverage Industry Animal Feed Supplements (Sports, Infant, Elderly Nutrition) Personal Care and Cosmetics Retail Consumers Food Service Industry Meal Kit Delivery Services Institutional Buyers |

| By Application | Bakery Breakfast Cereals Condiments/Sauces Confectionery Dairy and Dairy Alternative Products Meat/Poultry/Seafood and Meat Alternative Products RTE/RTC Food Products Snacks and Convenience Foods Frozen Foods Sauces and Condiments |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Health Food Stores Specialty Stores |

| By Price Range | Premium Products Mid-Range Products Budget Products |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Nutritional Profile | High Protein Low Carb Fortified Products Organic Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Plant-Based Proteins | 120 | Health-conscious Consumers, Vegans, Flexitarians |

| Retail Insights on Alt-Meat Sales | 60 | Store Managers, Category Buyers |

| Food Service Industry Adoption of Plant-Based Menus | 50 | Restaurant Owners, Chefs, Menu Planners |

| Manufacturing Perspectives on Production Challenges | 40 | Production Managers, Quality Control Specialists |

| Nutritionist Views on Health Benefits of Alt-Meat | 40 | Registered Dietitians, Nutrition Consultants |

The France Plant-Based Protein & Alt-Meat Market is valued at approximately USD 330 million, reflecting a significant growth trend driven by increasing consumer demand for sustainable and healthy food options, alongside the rise of vegetarian and vegan diets.