Region:Europe

Author(s):Geetanshi

Product Code:KRAB3398

Pages:99

Published On:October 2025

By Type:The market is segmented into various types of logistics services that cater to the e-grocery sector. Among these, Last-Mile Delivery and Warehousing Solutions are particularly significant. Last-Mile Delivery is essential for customer satisfaction and retention, while Warehousing Solutions enable efficient inventory management and rapid order fulfillment. The surge in online grocery orders has intensified demand for these services, with micro-fulfillment hubs and cold chain logistics gaining prominence to support perishable goods delivery.

By End-User:The e-grocery market serves various end-users, including Supermarkets & Hypermarkets, Convenience Stores, and Online Grocery Platforms. Online Grocery Platforms lead the segment, driven by consumer preferences for convenience, time-saving, and price comparison. The adoption of click-and-collect services and omnichannel models has further accelerated growth among urban and suburban shoppers.

The France Smart Logistics for E-Grocery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrefour, Auchan, E.Leclerc, Intermarché, Amazon France, Chronodrive, Deliveroo France, Uber Eats France, Ocado Group, Monoprix, Franprix, Cdiscount, Système U, Picard Surgelés, METRO France, La Poste/Colissimo, DHL France, FedEx France, DPD France, CEVA Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-grocery market in France appears promising, driven by technological advancements and changing consumer preferences. As the market adapts to increasing demand for online shopping, companies are likely to invest more in automation and AI to enhance efficiency. Furthermore, the trend towards sustainability will shape logistics strategies, with a focus on reducing carbon footprints. Overall, the e-grocery sector is poised for continued growth, with innovative solutions addressing both consumer needs and operational challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Warehousing Solutions Inventory Management Systems Order Fulfillment Services Cold Chain Logistics Packaging Solutions Reverse Logistics Returns Processing Centers Mega Fulfillment Centers Others |

| By End-User | Supermarkets & Hypermarkets Convenience Stores Online Grocery Platforms Food Delivery Aggregators Restaurants & Foodservice Local Producers Others |

| By Sales Channel | Direct Sales Online Sales Third-Party Logistics Providers (3PL/4PL) Retail Partnerships Click-and-Collect Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Packaging Type | Eco-Friendly Packaging Standard Packaging Custom Packaging Temperature-Controlled Packaging Others |

| By Service Type | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban E-Grocery Delivery Operations | 120 | Logistics Coordinators, Delivery Managers |

| Rural E-Grocery Supply Chain | 80 | Supply Chain Analysts, Regional Managers |

| Technology Integration in Logistics | 60 | IT Managers, Systems Integrators |

| Consumer Preferences in E-Grocery | 100 | Frequent Online Shoppers, Market Researchers |

| Logistics Cost Management | 70 | Financial Analysts, Operations Directors |

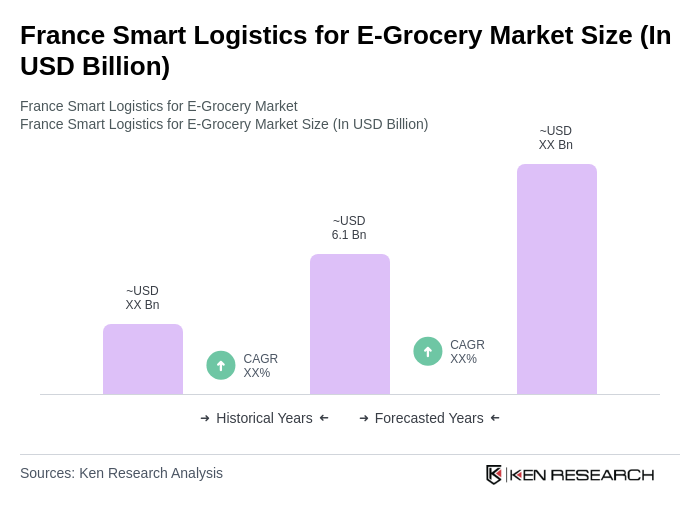

The France Smart Logistics for E-Grocery Market is valued at approximately USD 6.1 billion, reflecting a significant growth driven by the increasing demand for online grocery shopping and advancements in logistics technology.