France Sports Nutrition & Energy Drinks Market Overview

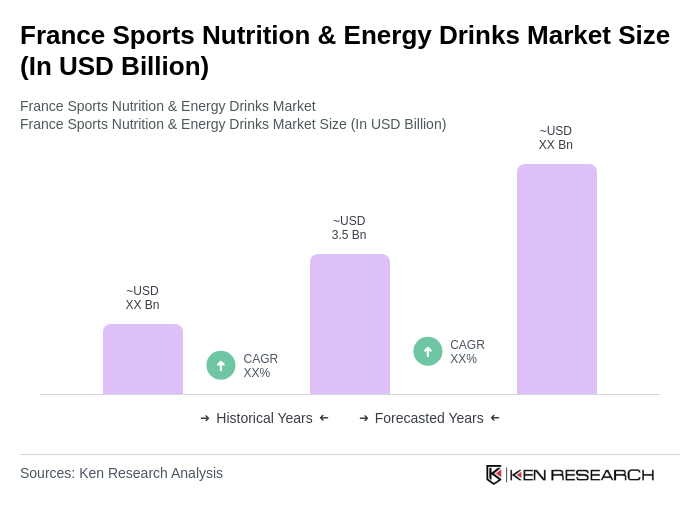

- The France Sports Nutrition & Energy Drinks Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing health consciousness among consumers, a rise in fitness activities, and the growing popularity of sports events. The demand for energy drinks and nutritional supplements has surged as individuals seek to enhance their performance and recovery.

- Key cities such as Paris, Lyon, and Marseille dominate the market due to their large populations and vibrant fitness cultures. These urban centers are home to numerous gyms, sports clubs, and health-conscious consumers, which contribute to the high demand for sports nutrition products. Additionally, the presence of major retailers and distribution channels in these cities facilitates easy access to a variety of products.

- In 2023, the French government implemented regulations aimed at improving the labeling and safety standards of energy drinks. This regulation mandates that all energy drink products must clearly display their caffeine content and any potential health risks associated with excessive consumption. The initiative aims to protect consumers, particularly young individuals, from the adverse effects of high-caffeine beverages.

France Sports Nutrition & Energy Drinks Market Segmentation

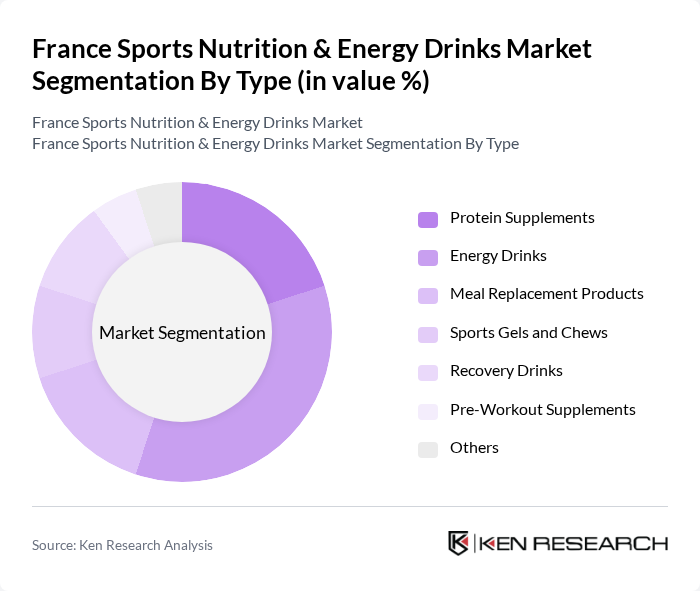

By Type:The market is segmented into various types, including Protein Supplements, Energy Drinks, Meal Replacement Products, Sports Gels and Chews, Recovery Drinks, Pre-Workout Supplements, and Others. Among these, Energy Drinks have emerged as the leading sub-segment, driven by the increasing demand for quick energy sources among consumers, particularly athletes and fitness enthusiasts. The convenience and instant energy boost provided by energy drinks have made them a popular choice, contributing significantly to market growth.

By End-User:The market is categorized based on end-users, including Athletes, Fitness Enthusiasts, Casual Consumers, and Health-Conscious Individuals. Athletes represent the largest segment, as they require specialized nutrition to enhance performance and recovery. The increasing participation in competitive sports and fitness activities has led to a higher demand for tailored nutrition solutions, making this segment a key driver of market growth.

France Sports Nutrition & Energy Drinks Market Competitive Landscape

The France Sports Nutrition & Energy Drinks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., The Coca-Cola Company, PepsiCo, Inc., Red Bull GmbH, Glanbia plc, Herbalife Nutrition Ltd., BSN (Bio-Engineered Supplements and Nutrition), MusclePharm Corporation, Isagenix International LLC, Optimum Nutrition, MyProtein, Dymatize Enterprises, LLC, EAS (Energy Athletic Supplements), Quest Nutrition, CytoSport, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

France Sports Nutrition & Energy Drinks Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The French population is increasingly prioritizing health, with 63% of adults actively seeking healthier food options. This trend is supported by a report from the French Ministry of Health, indicating that 45% of consumers are now more aware of nutritional labels. The rise in health consciousness is driving demand for sports nutrition and energy drinks, as consumers look for products that enhance performance and support overall well-being.

- Rise in Fitness Activities:In future, approximately 30% of the French population engages in regular fitness activities, a significant increase from previous years. According to the National Institute of Statistics and Economic Studies (INSEE), gym memberships have surged by 20% since 2020. This growing fitness culture is propelling the demand for sports nutrition products, as individuals seek supplements that can enhance their athletic performance and recovery.

- Expansion of E-commerce Platforms:E-commerce sales of sports nutrition and energy drinks in France reached €500 million, reflecting a 25% increase from the previous year. The French e-commerce market is projected to grow by 15% in future, according to Statista. This growth is facilitating easier access to a wider range of products, allowing consumers to purchase specialized nutrition items conveniently, thus driving market growth.

Market Challenges

- Regulatory Compliance Issues:The sports nutrition market in France faces stringent regulatory compliance challenges, particularly regarding nutritional labeling and health claims. In future, the French government has increased inspections by 30% to ensure compliance with EU regulations. This heightened scrutiny can lead to increased operational costs for manufacturers, potentially impacting product availability and pricing strategies in the market.

- Intense Competition:The French sports nutrition market is characterized by intense competition, with over 200 brands vying for market share. According to an industry report, the top five brands account for only 35% of the market, indicating a fragmented landscape. This competition pressures companies to innovate continuously and invest heavily in marketing, which can strain resources and affect profitability.

France Sports Nutrition & Energy Drinks Market Future Outlook

The future of the France sports nutrition and energy drinks market appears promising, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, brands are expected to leverage data analytics to tailor products to individual needs. Additionally, the demand for sustainable practices will likely push companies to adopt eco-friendly packaging solutions, aligning with consumer values. These trends will shape the market landscape, fostering innovation and growth in the coming years.

Market Opportunities

- Growth in Vegan and Plant-Based Products:The demand for vegan and plant-based sports nutrition products is on the rise, with sales increasing by 40%. This trend is driven by a growing consumer base seeking ethical and sustainable options. Companies that innovate in this segment can capture a significant share of the market, appealing to health-conscious and environmentally aware consumers.

- Increasing Demand for Natural Ingredients:In future, 55% of consumers prefer products with natural ingredients, according to a survey by the French Food Agency. This shift presents an opportunity for brands to reformulate existing products or introduce new lines that emphasize clean labels and transparency. By focusing on natural ingredients, companies can differentiate themselves and attract a loyal customer base.