Region:Europe

Author(s):Geetanshi

Product Code:KRAA2802

Pages:85

Published On:August 2025

By Data Center Size:The data center size segmentation includes small, medium, large, massive, and mega data centers. Each size category addresses distinct market needs: small and medium centers support edge computing and localized workloads, while large, massive, and mega facilities cater to hyperscale cloud providers and enterprises requiring extensive IT infrastructure. The demand for massive and mega data centers is surging, driven by hyperscalers’ need for contiguous power blocks and advanced AI workloads.

By Tier Type:The tier type segmentation categorizes data centers by infrastructure and operational capabilities: Tier 1 & 2, Tier 3, and Tier 4. Tier 3 and Tier 4 data centers dominate due to their high availability, redundancy, and robust disaster recovery features, which are essential for mission-critical enterprise and cloud operations. The market’s focus on reliability and uptime continues to drive investment in Tier 3 and Tier 4 facilities.

The Frankfurt Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Equinix, Inc., Digital Realty Trust, Inc., NTT Global Data Centers EMEA GmbH, Telehouse Deutschland GmbH, Interxion (a Digital Realty Company), Global Switch Holdings Limited, KDDI Deutschland GmbH, Colt Technology Services Group Limited, AWS (Amazon Web Services), Microsoft Azure, Google Cloud Platform, IBM Cloud, OVHcloud, Leaseweb Deutschland GmbH, T-Systems International GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The Frankfurt data center market is poised for significant transformation as it adapts to emerging technologies and evolving consumer demands. With the increasing integration of AI and machine learning, data centers will enhance operational efficiency and data management capabilities. Additionally, the push for sustainability will drive investments in green technologies, ensuring compliance with environmental regulations. As 5G networks expand, the demand for edge computing solutions will also rise, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Data Center Size | Small Medium Large Massive Mega |

| By Tier Type | Tier 1 & 2 Tier 3 Tier 4 |

| By Absorption | Utilized Colocation Type Retail Wholesale Hyperscale End User Cloud & IT Media & Entertainment Government BFSI Manufacturing E-Commerce Other End User Non-Utilized |

| By Service Model | IaaS (Infrastructure as a Service) PaaS (Platform as a Service) SaaS (Software as a Service) Others |

| By Deployment Type | On-Premises Off-Premises Hybrid Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time Payment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 100 | Data Center Managers, IT Infrastructure Directors |

| Cloud Service Providers | 80 | Cloud Operations Managers, Business Development Executives |

| Energy Efficiency Initiatives | 60 | Energy Managers, Sustainability Officers |

| Data Center Construction Projects | 70 | Project Managers, Real Estate Developers |

| Regulatory Compliance in Data Centers | 40 | Compliance Officers, Legal Advisors |

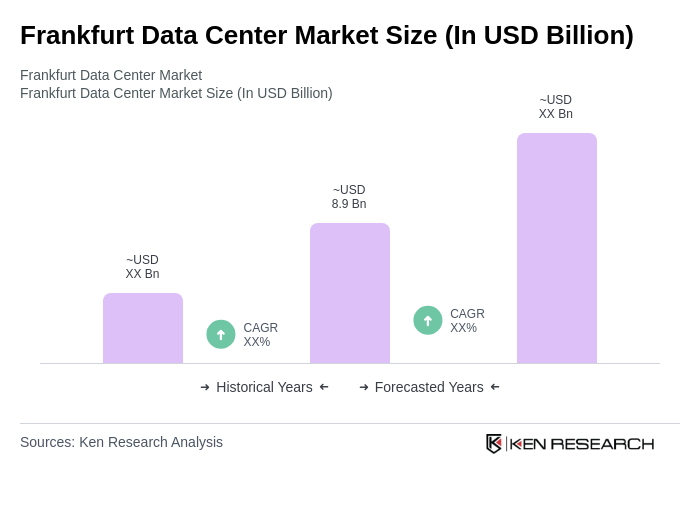

The Frankfurt Data Center Market is valued at approximately USD 8.9 billion, reflecting its status as Germany's largest data center hub, driven by increasing demand for cloud services and digital infrastructure expansion.