Region:Middle East

Author(s):Dev

Product Code:KRAB8013

Pages:94

Published On:October 2025

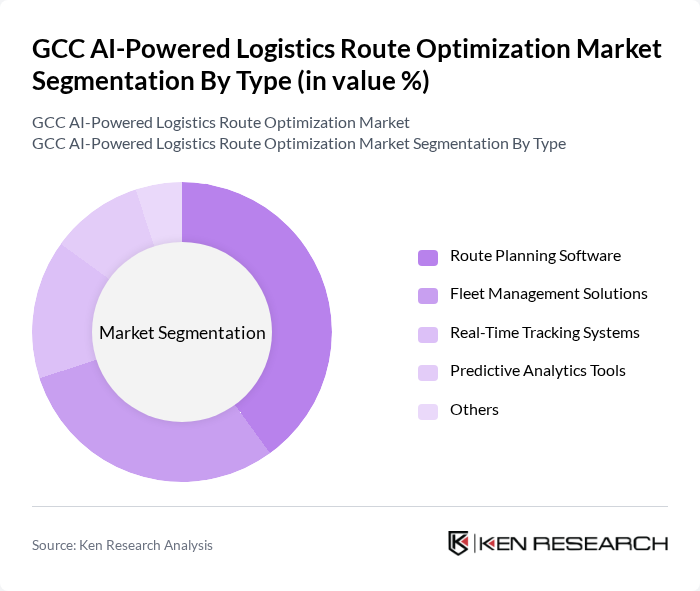

By Type:The market is segmented into various types, including Route Planning Software, Fleet Management Solutions, Real-Time Tracking Systems, Predictive Analytics Tools, and Others. Among these, Route Planning Software is the most dominant segment, driven by the increasing need for efficient route management and cost reduction in logistics operations. Fleet Management Solutions also hold a significant share, as companies seek to optimize their fleet operations and reduce operational costs.

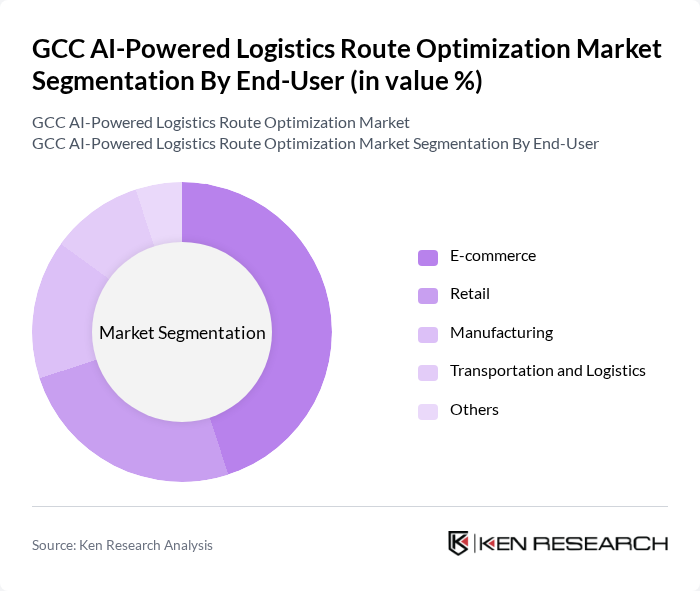

By End-User:The end-user segmentation includes E-commerce, Retail, Manufacturing, Transportation and Logistics, and Others. The E-commerce sector is the leading end-user, as the rapid growth of online shopping has increased the demand for efficient logistics and delivery solutions. Transportation and Logistics also represent a significant portion of the market, as companies in this sector seek to enhance their operational efficiency and reduce costs through AI-powered solutions.

The GCC AI-Powered Logistics Route Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Siemens AG, JDA Software Group, Inc., Manhattan Associates, Inc., Descartes Systems Group Inc., Trimble Inc., Locus.sh, FourKites, Inc., Project44, Inc., Transporeon Group AG, Cargomatic, Inc., ClearMetal, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI-powered logistics route optimization market appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to invest in AI technologies, the integration of real-time data analytics and autonomous delivery solutions will reshape logistics operations. Furthermore, the emergence of blockchain technology is expected to enhance transparency and security in supply chains, fostering greater trust among stakeholders. These trends will likely lead to a more streamlined and efficient logistics landscape in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Route Planning Software Fleet Management Solutions Real-Time Tracking Systems Predictive Analytics Tools Others |

| By End-User | E-commerce Retail Manufacturing Transportation and Logistics Others |

| By Application | Freight Transportation Last-Mile Delivery Supply Chain Optimization Inventory Management Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| By Geographic Focus | Urban Areas Rural Areas Suburban Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Optimization | 100 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain Efficiency | 80 | Operations Directors, Production Managers |

| E-commerce Delivery Solutions | 120 | eCommerce Operations Managers, Logistics Analysts |

| AI Technology Adoption in Logistics | 90 | IT Managers, Technology Officers |

| Transportation Network Optimization | 70 | Fleet Managers, Route Planners |

The GCC AI-Powered Logistics Route Optimization Market is valued at approximately USD 1.2 billion, driven by the increasing demand for efficient logistics solutions, advancements in AI technologies, and the rise of e-commerce in the region.