GCC Animal Health Market Overview

- The GCC Animal Health Market is valued at USD 1.3 billion, based on a five-year historical analysis. Growth is primarily driven by increasing pet ownership, rising awareness of animal health, and the growing demand for high-quality animal products. The market is further influenced by advancements in veterinary medicine, the increasing prevalence of zoonotic diseases, and the adoption of precision farming technologies and organic animal care products, which necessitate better animal health management and support innovation in the sector .

- Key players in this market include Saudi Arabia and the UAE, which dominate due to their large livestock populations and significant investments in veterinary healthcare. The robust agricultural sector, increasing disposable incomes, and the UAE’s strategic location as a trade hub further contribute to market growth. Saudi Arabia and the UAE together account for over 60% of the GCC animal health market share .

- In 2023, the Saudi Food and Drug Authority (SFDA) issued the "Regulation on Veterinary Medicines and Biological Products, 2023," mandating the vaccination of livestock against specific diseases to enhance food safety and public health. This regulation requires livestock owners to comply with vaccination schedules for notifiable diseases, maintain vaccination records, and ensure traceability of animal-derived food products .

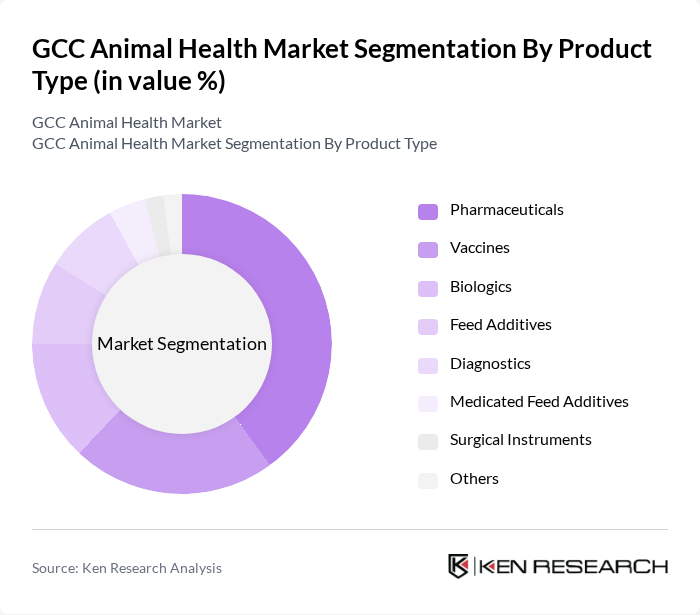

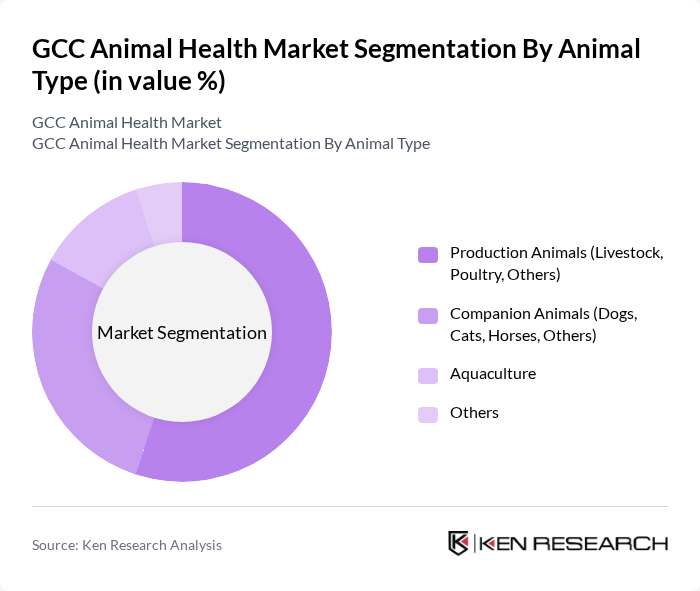

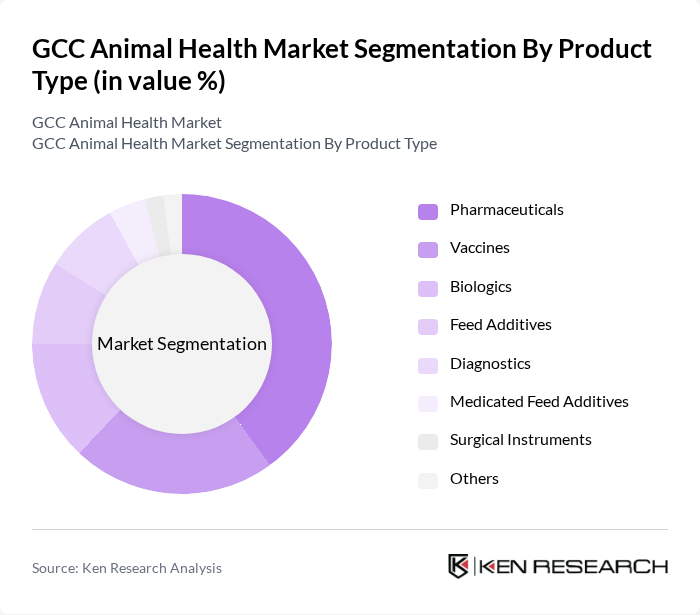

GCC Animal Health Market Segmentation

By Product Type:The product type segmentation includes Pharmaceuticals, Vaccines, Biologics, Feed Additives, Diagnostics, Medicated Feed Additives, Surgical Instruments, and Others. Pharmaceuticals are crucial for treating various animal diseases, while vaccines play a significant role in disease prevention. Biologics and feed additives enhance animal health and productivity, and diagnostics are essential for disease detection. Surgical instruments are vital for veterinary procedures, and other products encompass a range of health-related items .

By Animal Type:The animal type segmentation includes Production Animals (Livestock, Poultry, Others), Companion Animals (Dogs, Cats, Horses, Others), Aquaculture, and Others. Production animals are essential for food production, while companion animals are increasingly viewed as family members, driving demand for health products. Aquaculture is growing due to the rising consumption of seafood, and other categories include various animal types requiring health management .

GCC Animal Health Market Competitive Landscape

The GCC Animal Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis, Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Virbac, IDEXX Laboratories, Neogen Corporation, Vetoquinol, Phibro Animal Health, Alltech, Kemin Industries, MSD Animal Health (Merck & Co., Inc.), Almarai (GCC Regional Leader), National Veterinary Services Company (NVSC, Saudi Arabia), Arab Pesticides & Veterinary Drugs Mfg. Co. (Jordan, active in GCC), Gulf Pharmaceutical Industries (Julphar, UAE) contribute to innovation, geographic expansion, and service delivery in this space.

GCC Animal Health Market Industry Analysis

Growth Drivers

- Increasing Pet Ownership:The GCC region has witnessed a significant rise in pet ownership, with over 30% of households owning pets as of in future. This trend is driven by urbanization and changing lifestyles, leading to an estimated 10 million pet dogs and cats in the region. The pet care market is projected to reach $1.8 billion in future, reflecting a growing demand for veterinary services and products, thus boosting the animal health sector significantly.

- Rising Demand for Livestock Products:The GCC's livestock sector is expanding, with a reported increase in meat consumption by 6% annually, reaching approximately 1.6 million tons in future. This surge is fueled by population growth and dietary shifts towards protein-rich foods. Consequently, the demand for veterinary services and health products for livestock is expected to rise, driving investments in animal health solutions to ensure food safety and quality.

- Advancements in Veterinary Technology:The GCC is experiencing rapid advancements in veterinary technology, with investments exceeding $250 million in future. Innovations such as telemedicine, diagnostic tools, and health monitoring systems are enhancing animal care. The integration of technology in veterinary practices is expected to improve treatment outcomes and operational efficiency, thereby increasing the overall demand for animal health products and services in the region.

Market Challenges

- High Cost of Veterinary Services:The cost of veterinary services in the GCC can be prohibitive, with average consultation fees ranging from $60 to $180. This financial barrier limits access to essential care for many pet owners and livestock farmers, particularly in lower-income segments. As a result, the high cost of services poses a significant challenge to the growth of the animal health market, potentially leading to untreated health issues in animals.

- Regulatory Hurdles:The GCC animal health market faces stringent regulatory frameworks that can delay the approval of veterinary products and services. For instance, the average time for product registration can exceed 20 months, hindering market entry for new innovations. These regulatory challenges can stifle competition and limit the availability of advanced animal health solutions, ultimately affecting the overall market growth and development.

GCC Animal Health Market Future Outlook

The GCC animal health market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The shift towards preventive healthcare is expected to gain momentum, with increased adoption of telemedicine and digital health solutions. Additionally, the focus on sustainability in animal farming will likely lead to innovative practices and products that enhance animal welfare. As these trends evolve, the market will adapt, fostering a more robust and responsive animal health ecosystem in the region.

Market Opportunities

- Expansion of Telemedicine in Veterinary Care:The rise of telemedicine presents a unique opportunity for the GCC animal health market. With an estimated 45% of pet owners expressing interest in remote consultations, this trend can enhance access to veterinary care, particularly in rural areas. The integration of telehealth solutions can streamline services, reduce costs, and improve overall animal health outcomes.

- Growth in Organic and Natural Pet Products:The demand for organic and natural pet products is on the rise, with the market projected to reach $600 million in future. This trend is driven by increasing consumer awareness of health and wellness. Companies that invest in developing organic veterinary products can capitalize on this growing segment, meeting the needs of health-conscious pet owners and enhancing their market presence.