Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4457

Pages:88

Published On:October 2025

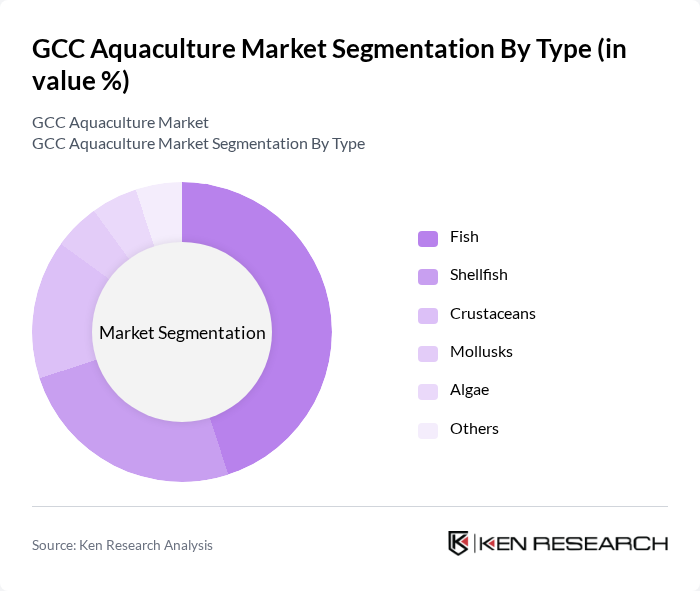

By Type:The aquaculture market can be segmented into various types, including Fish, Shellfish, Crustaceans, Mollusks, Algae, and Others. Among these, Fish is the dominant segment due to its high consumption rates and nutritional value. The increasing preference for fish as a healthy protein source drives its demand, while Shellfish and Crustaceans also see significant interest due to their culinary appeal and market value. The adoption of advanced farming technologies has further boosted the output and quality of these segments .

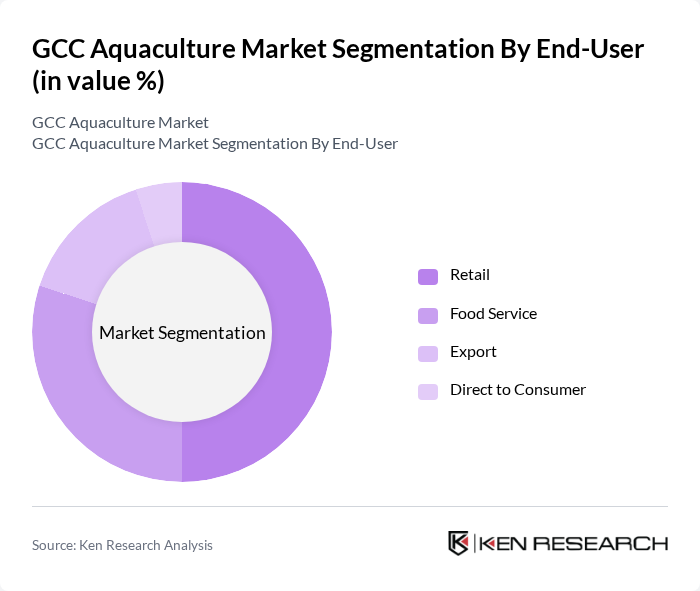

By End-User:The end-user segmentation includes Retail, Food Service, Export, and Direct to Consumer. The Retail segment is the largest, driven by increasing consumer demand for fresh and value-added seafood products. The Food Service sector also plays a crucial role, as restaurants and hotels seek high-quality seafood to meet evolving customer preferences. Export opportunities are expanding as regional producers look to tap into international markets, supported by the GCC's strategic geographic location and rising production capacity .

The GCC Aquaculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Aquaculture Group (NAQUA), Saudi Fisheries Company, Fish Farm LLC (UAE), Oman Fisheries Co. SAOG, Aqua Bridge (Saudi Arabia), Emirates Aquaculture Company, Tabuk Fish Company, SAMAQ (Saudi Arabia), Gloryal International Seafood Trading LLC, Bluefin Tuna Company (Oman), OFC (Oman Fisheries Company), Gulf Fisheries Company (Kuwait), Almarai Company (Saudi Arabia – aquaculture division), Al-Jazeera Fisheries (Qatar), Aqua Culture Technologies (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC aquaculture market appears promising, driven by increasing consumer demand for sustainable seafood and government initiatives aimed at enhancing local production. As technological advancements continue to evolve, the industry is likely to see improved efficiency and sustainability practices. Furthermore, collaboration between private enterprises and research institutions will foster innovation, ensuring that the sector adapts to changing market dynamics and environmental challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Fish Shellfish Crustaceans Mollusks Algae Others |

| By End-User | Retail Food Service Export Direct to Consumer |

| By Distribution Channel | Online Sales Supermarkets Fish Markets Wholesale |

| By Region | Saudi Arabia United Arab Emirates Qatar Oman Kuwait Others |

| By Production Method | Intensive Aquaculture Extensive Aquaculture Semi-Intensive Aquaculture Fresh Water Aquaculture Marine Water Aquaculture Brackish Water Aquaculture |

| By Certification Type | Organic Certification Sustainability Certification Quality Assurance Certification |

| By Price Range | Premium Mid-Range Budget |

| By Species | Carps Mackerel Milkfish Salmon Sea Bass Seabream Trout Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Marine Fish Farming | 100 | Aquaculture Farm Managers, Fisheries Biologists |

| Freshwater Aquaculture | 80 | Farm Owners, Aquaculture Technicians |

| Seafood Distribution Channels | 70 | Supply Chain Managers, Seafood Retailers |

| Regulatory Compliance in Aquaculture | 50 | Regulatory Affairs Specialists, Environmental Compliance Officers |

| Sustainability Practices in Aquaculture | 60 | Sustainability Consultants, Aquaculture Researchers |

The GCC Aquaculture Market is valued at approximately USD 3.0 billion, driven by increasing seafood demand, government investments, and advancements in aquaculture technology. This growth reflects a strong focus on sustainable practices and reducing reliance on fish imports.