Region:Middle East

Author(s):Shubham

Product Code:KRAA2668

Pages:90

Published On:August 2025

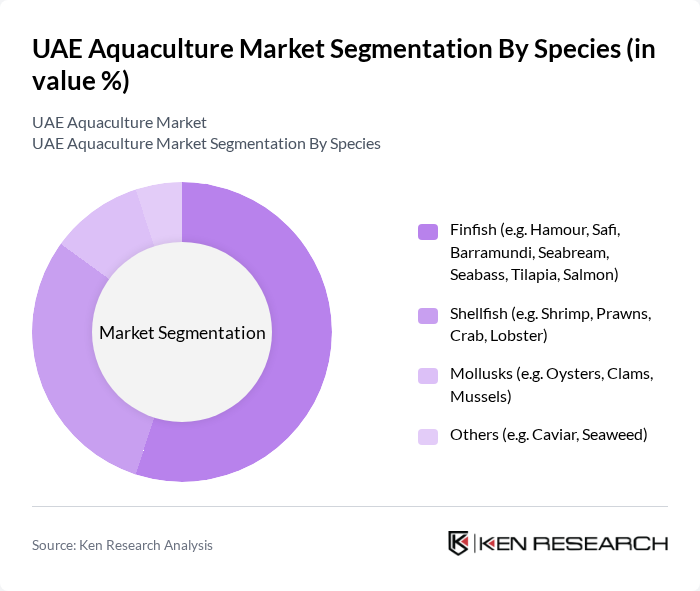

By Species:The aquaculture market is segmented into various species categories, including Finfish, Shellfish, Mollusks, and Others. Finfish, which includes popular varieties such as Hamour and Barramundi, dominates the market due to high consumer demand and culinary preferences. Shellfish, including shrimp and prawns, also holds a significant share, driven by their popularity in local cuisine. Mollusks and other species like caviar and seaweed contribute to niche markets, appealing to specific consumer segments.

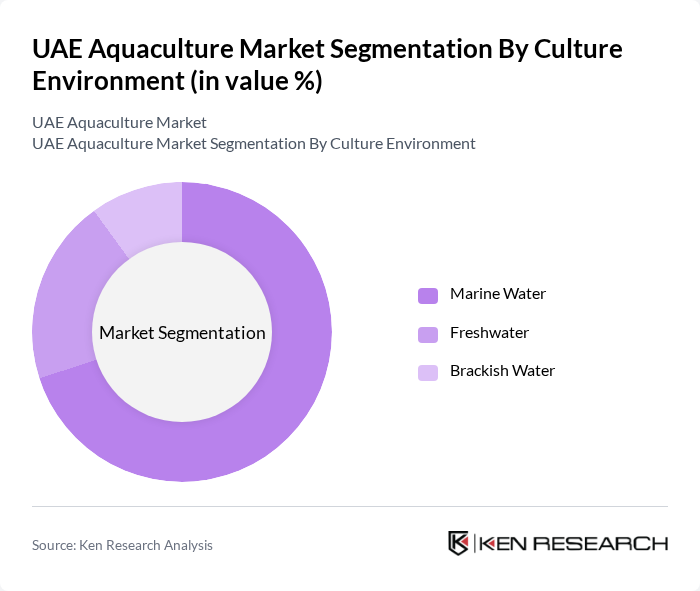

By Culture Environment:The market is categorized based on culture environments, including Marine Water, Freshwater, and Brackish Water. Marine water aquaculture is the most prevalent due to the UAE's extensive coastline and favorable conditions for species like finfish and shellfish. Freshwater aquaculture is growing, particularly for species like tilapia, while brackish water systems are utilized for specific species that thrive in mixed salinity environments.

The UAE Aquaculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Aquatech, Al Ain Fish Farm, Abu Dhabi Fish Farming Company, Fish Farm LLC (Dubai Fish Farm), Gulf Seafood LLC, Aqua Culture Technologies LLC, National Aquaculture Group (NAQUA), Blue Planet Environmental Solutions, Sea Harvest UAE, Al Marjan Island Aquaculture, Fish Farm UAE, Aqua Green LLC, Marine Harvest UAE, Aqua World LLC, Sustainable Seafood Company LLC contribute to innovation, geographic expansion, and service delivery in this space.

The UAE aquaculture market is poised for significant growth, driven by increasing consumer awareness of sustainable seafood and government initiatives aimed at enhancing local production. As technological advancements continue to improve efficiency and reduce costs, the sector is likely to attract more investments. Furthermore, the integration of eco-friendly practices will not only address environmental concerns but also cater to the rising demand for organic products, positioning the UAE as a key player in the regional aquaculture landscape.

| Segment | Sub-Segments |

|---|---|

| By Species | Finfish (e.g. Hamour, Safi, Barramundi, Seabream, Seabass, Tilapia, Salmon) Shellfish (e.g. Shrimp, Prawns, Crab, Lobster) Mollusks (e.g. Oysters, Clams, Mussels) Others (e.g. Caviar, Seaweed) |

| By Culture Environment | Marine Water Freshwater Brackish Water |

| By Production Method | Intensive Aquaculture (e.g. RAS Farms) Extensive Aquaculture Semi-Intensive Aquaculture |

| By Distribution Channel | Supermarkets & Hypermarkets Fish Markets Online Retail Food Service (Hotels, Restaurants, Catering) Export |

| By Region | Abu Dhabi Dubai Sharjah Ajman |

| By Certification Type | Organic Certification Sustainability Certification Quality Assurance Certification |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Marine Aquaculture Producers | 100 | Aquaculture Farm Owners, Production Managers |

| Freshwater Aquaculture Operators | 60 | Farm Managers, Technical Advisors |

| Aquaculture Feed Suppliers | 40 | Sales Managers, Product Development Specialists |

| Regulatory Bodies and Associations | 50 | Policy Makers, Industry Analysts |

| Consumers of Aquaculture Products | 90 | Household Decision Makers, Seafood Retailers |

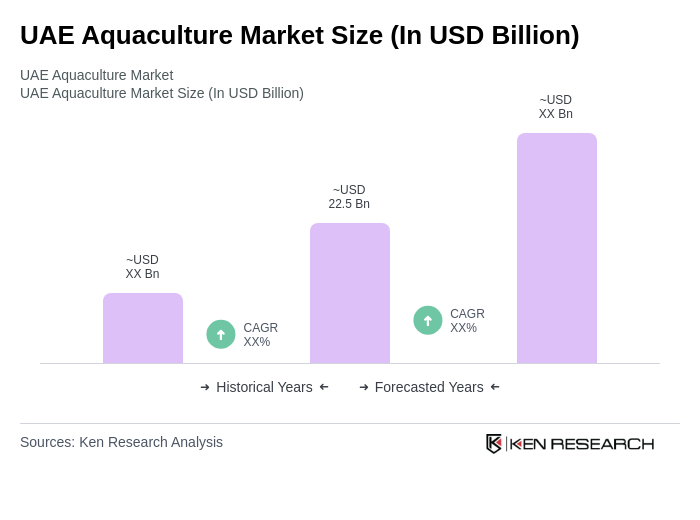

The UAE Aquaculture Market is valued at approximately USD 22.5 billion, reflecting significant growth driven by increasing seafood demand, government initiatives for sustainability, and advancements in aquaculture technology.