Region:Middle East

Author(s):Shubham

Product Code:KRAA2269

Pages:86

Published On:August 2025

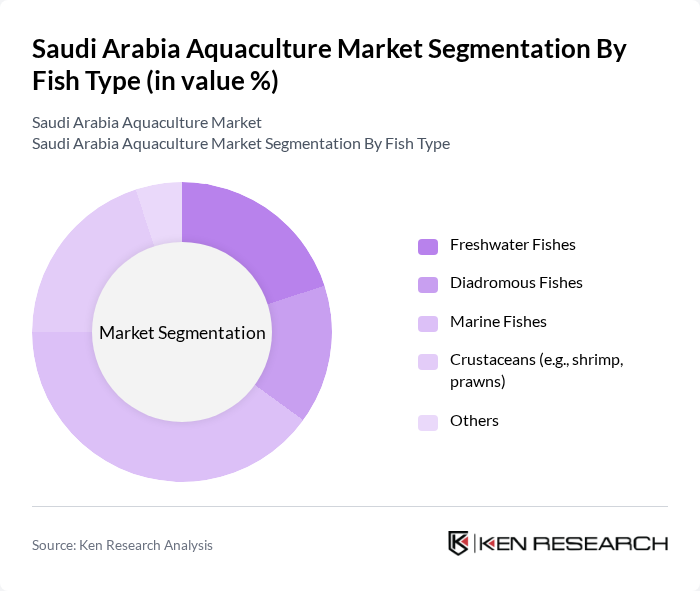

By Fish Type:The aquaculture market can be segmented into various fish types, including Freshwater Fishes, Diadromous Fishes, Marine Fishes, Crustaceans (e.g., shrimp, prawns), and Others. Among these,Marine Fishesare currently leading the market due to their high demand in both local and export markets. The increasing consumer preference for seafood, coupled with the growing health consciousness regarding the benefits of fish consumption, has significantly boosted the production and sales of marine species. Recent trends show a surge in the production of high-value species such as sea bream, sea bass, and shrimp, driven by technological improvements and better feed conversion ratios .

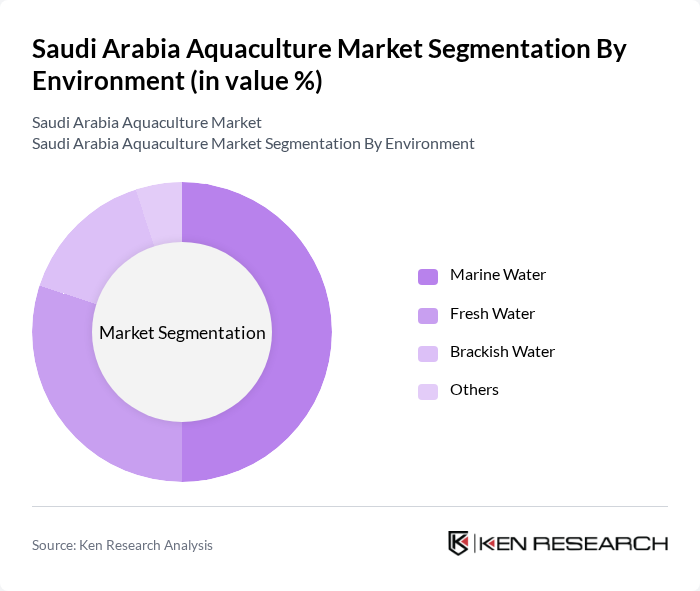

By Environment:The aquaculture market is also segmented by environment, including Marine Water, Fresh Water, Brackish Water, and Others.Marine Waterenvironments dominate the market due to the extensive coastline of Saudi Arabia, which provides ideal conditions for marine aquaculture. The increasing focus on sustainable practices and the rising demand for high-quality seafood have further propelled the growth of marine aquaculture in the region. Recent adoption of advanced water management and filtration systems has improved production yields and environmental outcomes .

The Saudi Arabia Aquaculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Fisheries Company, National Aquaculture Group (NAQUA), Al-Jazeera Fisheries, Gulf Fish, Red Sea Farms, Al-Watania Fisheries, Arabian Agricultural Services Company (ARASCO), Saudi Aquaculture Society, AquaTech, Skretting Saudi Arabia, Al-Faisal Fisheries, Al-Muhaidib Group, Bernaqua, Adisseo, Saudi Arabian Fish Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia aquaculture market appears promising, driven by increasing domestic demand and government initiatives aimed at enhancing production capabilities. In future, the sector is expected to witness significant advancements in sustainable practices and technology integration, fostering a more resilient industry. As consumer preferences shift towards locally sourced seafood, aquaculture will play a crucial role in meeting these demands while addressing environmental concerns, positioning itself as a vital component of the national food security strategy.

| Segment | Sub-Segments |

|---|---|

| By Fish Type | Freshwater Fishes Diadromous Fishes Marine Fishes Crustaceans (e.g., shrimp, prawns) Others |

| By Environment | Marine Water Fresh Water Brackish Water Others |

| By Distribution Channel | Traditional Retail Supermarkets and Hypermarkets Convenience Stores Online Channel Others |

| By Feed Type | Animal-Based Feed Plant-Based Feed Specialized Feeds Others |

| By Protein Composition | High Protein Feed Medium Protein Feed Low Protein Feed Others |

| By Region | Eastern Province Western Province Central Province Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aquaculture Farms | 100 | Farm Owners, Operations Managers |

| Aquaculture Feed Suppliers | 60 | Sales Managers, Product Development Specialists |

| Seafood Distribution Channels | 50 | Logistics Coordinators, Supply Chain Managers |

| Retail Seafood Outlets | 40 | Store Managers, Purchasing Agents |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

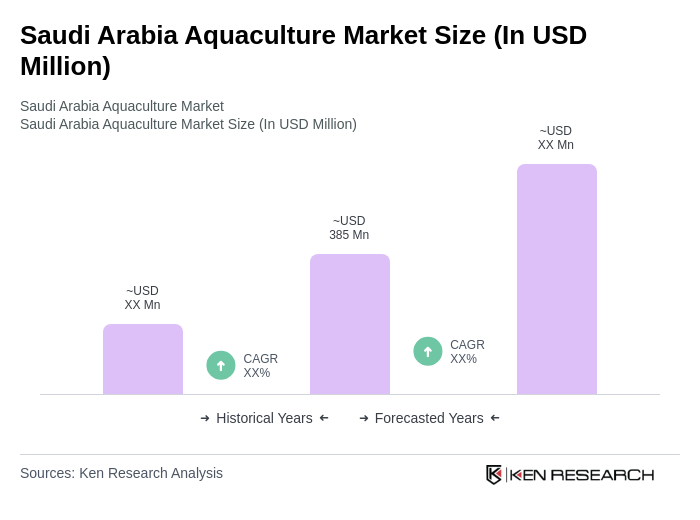

The Saudi Arabia Aquaculture Market is valued at approximately USD 385 million, reflecting a significant growth trend driven by increasing domestic seafood demand, government initiatives, and advancements in aquaculture technology.