Region:Middle East

Author(s):Shubham

Product Code:KRAA2266

Pages:99

Published On:August 2025

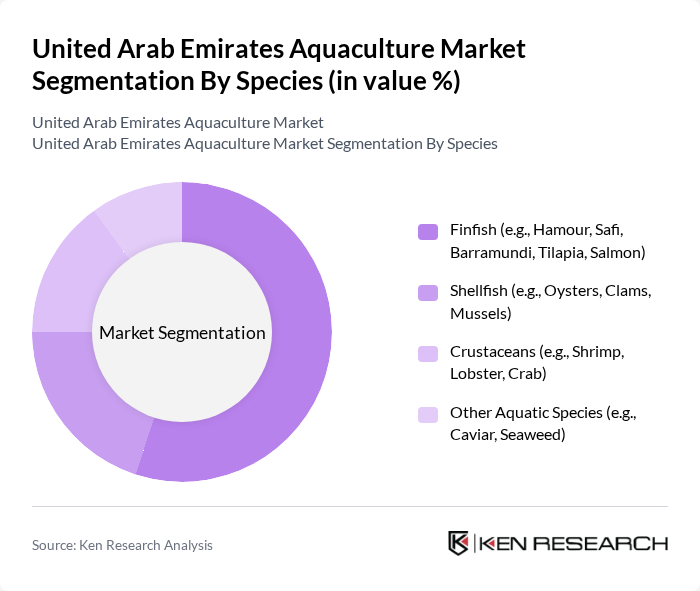

By Species:The aquaculture market in the UAE is segmented by species into finfish, shellfish, crustaceans, and other aquatic species. Among these, finfish—including Hamour, Barramundi, Safi, Tilapia, and Salmon—dominate the market due to high consumer demand and adaptability to local farming conditions. Shellfish and crustaceans also contribute significantly, driven by both local consumption and export opportunities .

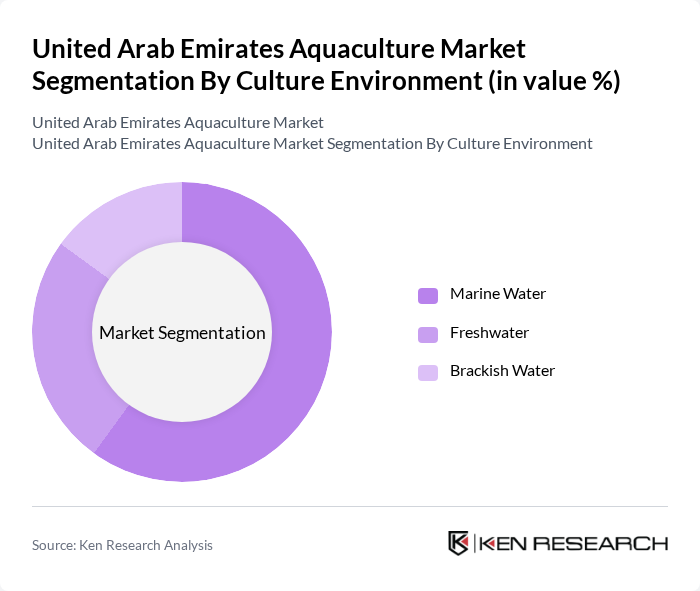

By Culture Environment:The market is also segmented by culture environment into marine water, freshwater, and brackish water. Marine water aquaculture is the most prevalent due to the UAE's extensive coastline and favorable conditions for species like finfish and shellfish. Freshwater aquaculture is expanding, particularly for tilapia and catfish, while brackish water systems are utilized for species that thrive in mixed salinity environments .

The United Arab Emirates Aquaculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fish Farm LLC, Emirates National Aquaculture, Asmak (International Fish Farming Holding Co. PJSC), Dubai Fish Farm, Al Jaraf Fisheries, Alserkal Group (Aquaculture Division), Emirates AquaTech, Al Marsa Fisheries, Blue Aqua International, Gulf Fish Farm, Al Marjan Fisheries, Sea Bream Aquaculture, Royal Fisheries, Al Wathba Fishery, Ocean Fish Farm contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE aquaculture market appears promising, driven by increasing consumer demand for locally sourced and sustainable seafood. With government initiatives aimed at enhancing production capabilities and technological advancements improving operational efficiency, the sector is poised for growth. Additionally, the focus on environmental sustainability and food security will likely lead to further investments and innovations, positioning the UAE as a leader in sustainable aquaculture practices in the region.

| Segment | Sub-Segments |

|---|---|

| By Species | Finfish (e.g., Hamour, Safi, Barramundi, Tilapia, Salmon) Shellfish (e.g., Oysters, Clams, Mussels) Crustaceans (e.g., Shrimp, Lobster, Crab) Other Aquatic Species (e.g., Caviar, Seaweed) |

| By Culture Environment | Marine Water Freshwater Brackish Water |

| By Rearing System | Pond Culture Cage Systems Recirculating Aquaculture Systems (RAS) Integrated Multi-Trophic Aquaculture |

| By End-User | Retail (Supermarkets, Hypermarkets, Fish Markets) Food Service (Hotels, Restaurants, Catering) Export Others |

| By Distribution Channel | Direct Sales Online Retail Wholesale Others |

| By Product Form | Fresh Frozen Processed Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aquaculture Farms | 100 | Farm Owners, Operations Managers |

| Seafood Distribution Networks | 60 | Distribution Managers, Supply Chain Coordinators |

| Retail Seafood Outlets | 50 | Store Managers, Seafood Buyers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

| Research Institutions and Academia | 40 | Researchers, Aquaculture Professors |

The United Arab Emirates Aquaculture Market is valued at approximately USD 20 billion, reflecting significant growth driven by increasing seafood demand, government initiatives for local production, and a focus on sustainable practices in food production.