Region:Middle East

Author(s):Shubham

Product Code:KRAD0863

Pages:96

Published On:November 2025

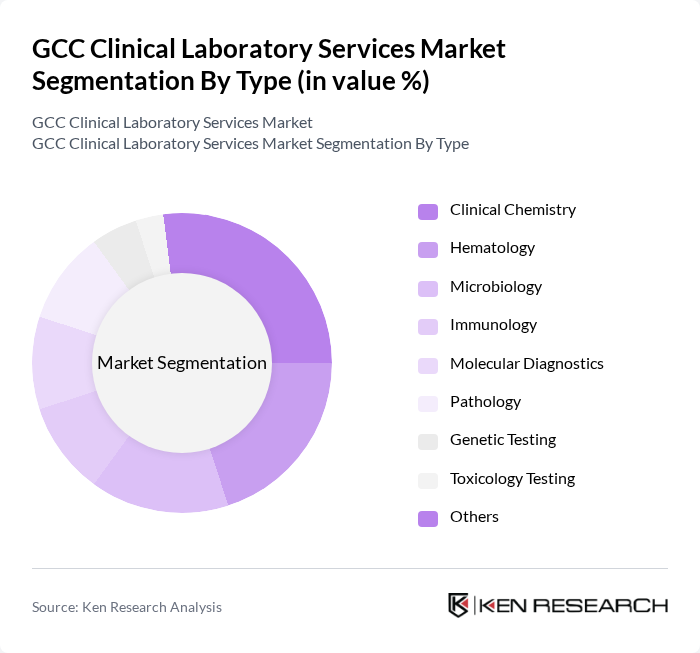

By Type:The market is segmented into various types of clinical laboratory services, including Clinical Chemistry, Hematology, Microbiology, Immunology, Molecular Diagnostics, Pathology, Genetic Testing, Toxicology Testing, and Others. Each of these segments plays a crucial role in the overall market dynamics, with clinical chemistry and hematology dominating due to their broad application in routine diagnostics, while molecular diagnostics and genetic testing are experiencing rapid growth driven by technological advancements and increased demand for personalized medicine .

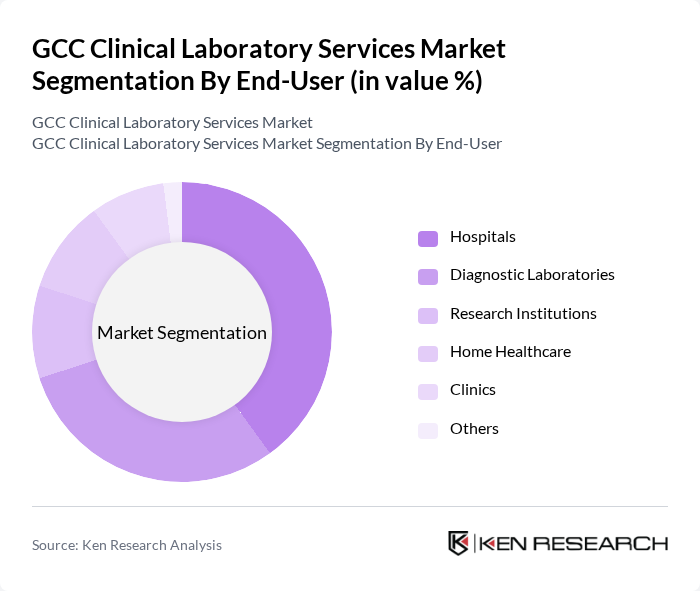

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, Home Healthcare, Clinics, and Others. Each segment serves a distinct purpose in the healthcare ecosystem, with hospitals and diagnostic laboratories being the primary consumers of clinical laboratory services. Hospitals account for the largest share due to their comprehensive diagnostic needs, while diagnostic laboratories are expanding rapidly with the adoption of specialized and high-throughput testing .

The GCC Clinical Laboratory Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Borg Medical Laboratories, MedLabs, Verita Healthcare Group, Sultan Healthcare, United Laboratories, GCC Labs, Saudi German Hospitals, Al Nahda International Medical Company, BioSystems Arabia, Health and Life Medical Center, Gulf Medical Company, AlMabani Group, Aster DM Healthcare, Dallah Healthcare, Abu Dhabi Health Services Company (SEHA) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the GCC clinical laboratory services market is poised for transformative growth, driven by the integration of advanced technologies and a heightened focus on personalized medicine. As healthcare providers increasingly adopt AI-driven solutions, laboratories will enhance their diagnostic capabilities, improving patient outcomes. Furthermore, the expansion of telemedicine will facilitate remote diagnostics, making laboratory services more accessible. These trends indicate a shift towards more efficient, patient-centered care, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Clinical Chemistry Hematology Microbiology Immunology Molecular Diagnostics Pathology Genetic Testing Toxicology Testing Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Home Healthcare Clinics Others |

| By Service Type | Routine Testing Specialized Testing Genetic Testing Bioanalytical and Lab Chemistry Services Toxicology Testing Services Others |

| By Sample Type | Blood Samples Urine Samples Tissue Samples Saliva Samples Others |

| By Technology | Automated Testing Manual Testing Point-of-Care Testing Next-Generation Sequencing (NGS) Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Public-Private Partnerships (PPPs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Laboratories | 45 | Laboratory Managers, Healthcare Administrators |

| Private Clinical Laboratories | 38 | Business Development Managers, Operations Directors |

| Diagnostic Imaging Services | 32 | Radiologists, Imaging Technologists |

| Specialized Testing Laboratories | 28 | Clinical Pathologists, Quality Assurance Managers |

| Laboratory Equipment Suppliers | 35 | Sales Managers, Product Specialists |

The GCC Clinical Laboratory Services Market is valued at approximately USD 2.5 billion, driven by factors such as the rising prevalence of chronic diseases and advancements in diagnostic technologies. This valuation is based on a five-year historical analysis.