Region:Middle East

Author(s):Dev

Product Code:KRAB7552

Pages:86

Published On:October 2025

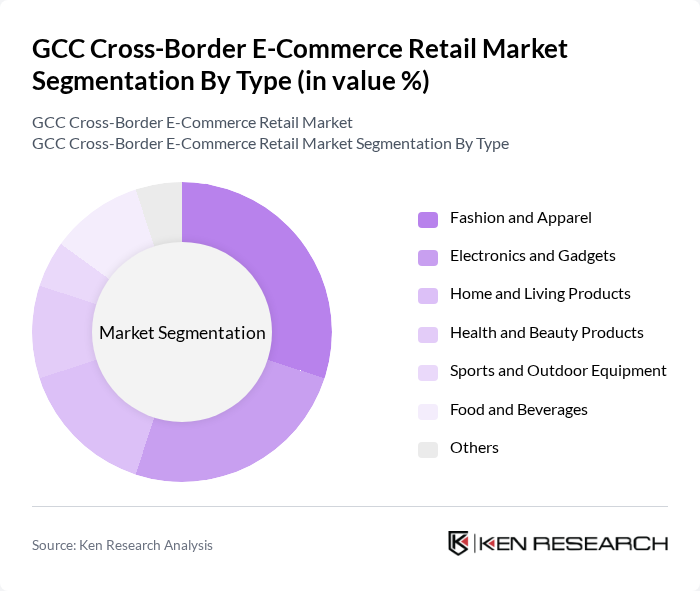

By Type:The market is segmented into various types, including Fashion and Apparel, Electronics and Gadgets, Home and Living Products, Health and Beauty Products, Sports and Outdoor Equipment, Food and Beverages, and Others. Each of these segments caters to different consumer needs and preferences, with varying levels of demand and growth potential.

The Fashion and Apparel segment is currently dominating the market, driven by the increasing trend of online shopping for clothing and accessories. Consumers are increasingly seeking variety and convenience, leading to a surge in demand for fashion items from international retailers. The segment benefits from social media marketing and influencer collaborations, which significantly enhance brand visibility and consumer engagement. Electronics and Gadgets follow closely, as technological advancements and the growing reliance on smart devices continue to fuel consumer interest in this category.

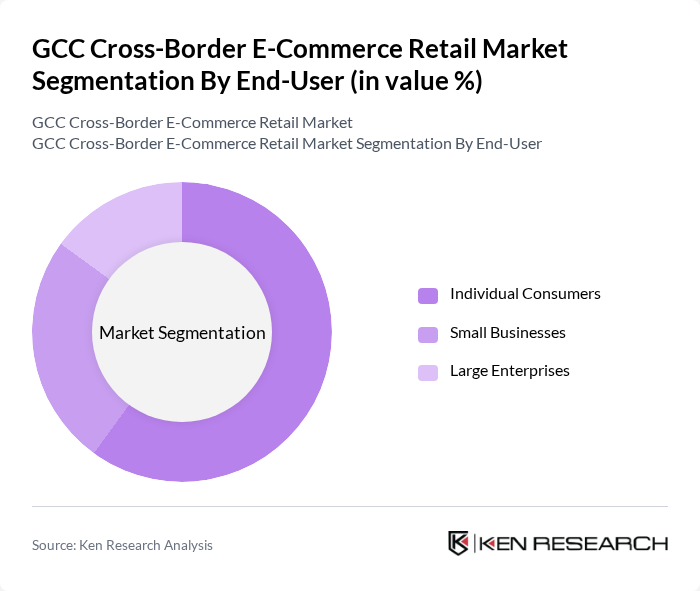

By End-User:The market is segmented into Individual Consumers, Small Businesses, and Large Enterprises. Each end-user category has distinct purchasing behaviors and requirements, influencing the overall dynamics of the market.

Individual Consumers represent the largest segment, driven by the convenience of online shopping and the growing trend of purchasing goods from international retailers. The ease of access to a wide range of products and competitive pricing has made cross-border shopping appealing to consumers. Small Businesses are also increasingly participating in cross-border e-commerce, seeking unique products to offer their customers, while Large Enterprises leverage their established brands to tap into the growing online market.

The GCC Cross-Border E-Commerce Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon, Noon.com, Souq.com, Carrefour, Namshi, Ounass, Jarir Bookstore, Xcite, Al-Futtaim Group, Landmark Group, Sharaf DG, Jumia, Carrefour UAE, Lulu Hypermarket, Aliexpress contribute to innovation, geographic expansion, and service delivery in this space.

The GCC cross-border e-commerce market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As mobile commerce continues to expand, with mobile transactions projected to account for 60% of total e-commerce sales in future, businesses must adapt to this shift. Additionally, the integration of AI in customer service is expected to enhance user experiences, while sustainability initiatives will increasingly influence purchasing decisions. These trends will shape the future landscape of cross-border e-commerce in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion and Apparel Electronics and Gadgets Home and Living Products Health and Beauty Products Sports and Outdoor Equipment Food and Beverages Others |

| By End-User | Individual Consumers Small Businesses Large Enterprises |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers |

| By Shipping Method | Standard Shipping Express Shipping Click and Collect |

| By Customer Demographics | Age Groups Income Levels Geographic Locations |

| By Product Origin | Local Products International Products Imported Goods |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-Border E-Commerce Retailers | 150 | E-commerce Managers, Business Development Executives |

| Logistics Providers for E-Commerce | 100 | Operations Managers, Logistics Coordinators |

| Consumer Insights on Cross-Border Shopping | 200 | Online Shoppers, Market Researchers |

| Regulatory Bodies and Trade Associations | 50 | Policy Makers, Trade Analysts |

| Payment Solutions Providers | 80 | Product Managers, Financial Analysts |

The GCC Cross-Border E-Commerce Retail Market is valued at approximately USD 30 billion, driven by increased internet penetration, smartphone usage, and a growing preference for online shopping among consumers in the region.