Region:Middle East

Author(s):Rebecca

Product Code:KRAB7376

Pages:100

Published On:October 2025

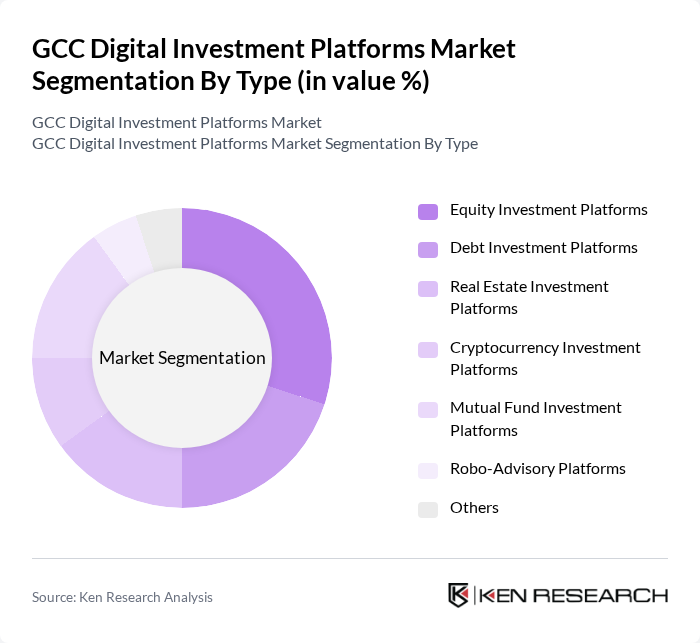

By Type:This segmentation includes various types of digital investment platforms that cater to different investment needs and preferences. The subsegments are Equity Investment Platforms, Debt Investment Platforms, Real Estate Investment Platforms, Cryptocurrency Investment Platforms, Mutual Fund Investment Platforms, Robo-Advisory Platforms, and Others. Each type serves distinct investor demographics and investment strategies, contributing to the overall market dynamics.

The Equity Investment Platforms subsegment is currently dominating the market due to the increasing interest in stock trading and investment among individual investors. This trend is fueled by the rise of mobile trading applications that offer user-friendly interfaces and real-time market data. Additionally, the growing number of millennials entering the investment space has led to a surge in demand for equity platforms, which provide easy access to stock markets and investment education resources. As a result, equity platforms are expected to maintain their leadership position in the GCC Digital Investment Platforms Market.

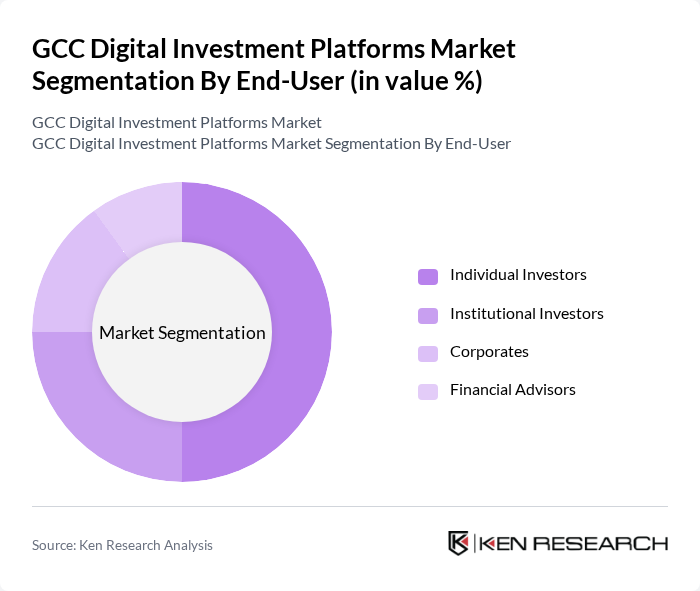

By End-User:This segmentation categorizes the market based on the type of users utilizing digital investment platforms. The subsegments include Individual Investors, Institutional Investors, Corporates, and Financial Advisors. Each user group has unique investment needs and behaviors, influencing the design and functionality of the platforms.

Individual Investors represent the largest segment in the market, driven by the increasing accessibility of investment platforms and a growing interest in personal finance management. The rise of digital literacy and the availability of educational resources have empowered more individuals to take control of their investments. This trend is further supported by the proliferation of mobile applications that simplify the investment process, making it more appealing to a broader audience. Consequently, individual investors are expected to continue leading the market.

The GCC Digital Investment Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Souqalmal.com, Sarwa, EFG Hermes, Fawry, Al Rajhi Capital, Abu Dhabi Investment Authority (ADIA), Emirates NBD, Dubai Investments, QNB Group, Riyad Capital, Noor Bank, First Abu Dhabi Bank (FAB), National Bank of Kuwait (NBK), Alinma Bank, Boursa Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The GCC digital investment platforms market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As more individuals embrace digital financial services, platforms will increasingly leverage artificial intelligence and machine learning to enhance user experiences. Additionally, the integration of sustainable investment options will attract environmentally conscious investors, further expanding the market. The collaboration between fintech firms and traditional banks will also facilitate broader access to investment opportunities, fostering a more inclusive financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Investment Platforms Debt Investment Platforms Real Estate Investment Platforms Cryptocurrency Investment Platforms Mutual Fund Investment Platforms Robo-Advisory Platforms Others |

| By End-User | Individual Investors Institutional Investors Corporates Financial Advisors |

| By Investment Size | Small Investments (Under $1,000) Medium Investments ($1,000 - $10,000) Large Investments (Over $10,000) |

| By Platform Accessibility | Mobile Applications Web-Based Platforms Hybrid Platforms |

| By Investment Strategy | Active Investment Strategies Passive Investment Strategies Automated Investment Strategies |

| By Geographic Focus | Domestic Investments International Investments |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Financial Advisors |

| Institutional Investment Trends | 100 | Institutional Fund Managers, Wealth Management Executives |

| Regulatory Impact Assessment | 80 | Regulatory Officials, Compliance Officers |

| Technology Adoption in Investment | 70 | IT Managers, Digital Transformation Leads |

| Market Entry Strategies for New Platforms | 60 | Startup Founders, Business Development Managers |

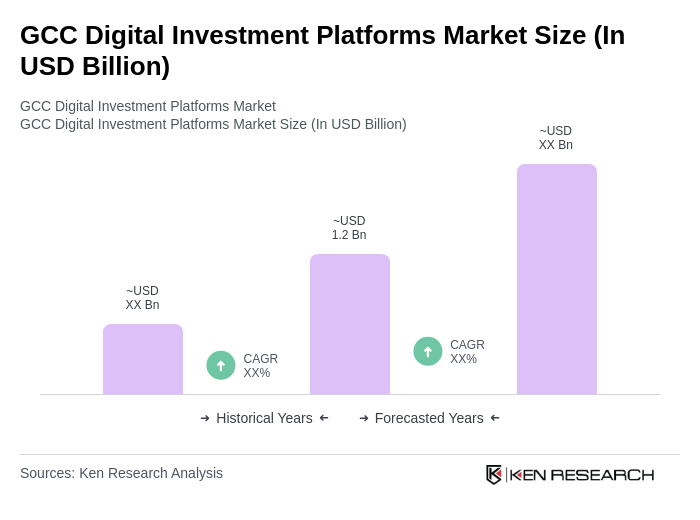

The GCC Digital Investment Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital financial services and mobile internet penetration in the region.