Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0987

Pages:80

Published On:October 2025

By Type:The digital investment platforms market is segmented into equity investment platforms, debt investment platforms, real estate investment platforms, cryptocurrency investment platforms, crowdfunding platforms, robo-advisory platforms, digital asset trading platforms, and hybrid investment platforms. Among these, equity investment platforms are currently leading the market due to their popularity among retail and institutional investors seeking to diversify their portfolios. The increasing trend of online trading, adoption of mobile-first investment solutions, and integration of AI-driven analytics have significantly contributed to the growth of this sub-segment .

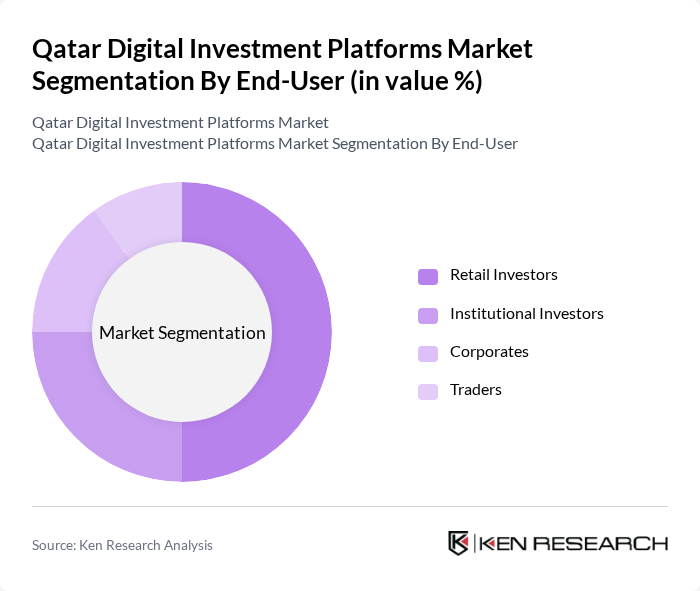

By End-User:The end-user segmentation of the digital investment platforms market includes retail investors, institutional investors, corporates, and traders. Retail investors are the dominant segment, driven by the increasing accessibility of investment platforms and the growing trend of self-directed investing. The rise of mobile applications, user-friendly interfaces, and educational content has made it easier for individual investors to participate in the market, leading to a surge in retail investment activities .

The Qatar Digital Investment Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Investment Authority, QNB Group, Doha Bank, Qatar Islamic Bank, Masraf Al Rayan, Commercial Bank of Qatar, Dukhan Bank, Barwa Bank, Qatar National Bank Alahli, Qatar Financial Centre, Qatar Development Bank, Doha Venture Capital, QInvest, Qatar Stock Exchange, Qatar FinTech Hub, Cwallet, Invest Qatar, Binance, CoinMENA, BitOasis, Sarwa, MEEZA contribute to innovation, geographic expansion, and service delivery in this space .

The future of Qatar's digital investment platforms appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence and machine learning into investment platforms is expected to enhance user experience and decision-making. Additionally, the growing trend towards sustainable investments will likely attract a new demographic of socially conscious investors. As the regulatory framework stabilizes, more players may enter the market, fostering innovation and competition, ultimately benefiting consumers and the economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Investment Platforms Debt Investment Platforms Real Estate Investment Platforms Cryptocurrency Investment Platforms Crowdfunding Platforms Robo-Advisory Platforms Digital Asset Trading Platforms Hybrid Investment Platforms |

| By End-User | Retail Investors Institutional Investors Corporates Traders |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Personal Finance Management Wealth Management Retirement Planning Tax Optimization Digital Asset Trading |

| By User Experience | Mobile Applications Web Platforms Hybrid Solutions |

| By Regulatory Compliance | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| By Policy Support | Subsidies for Digital Platforms Tax Exemptions for Startups Regulatory Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fintech Startups | 65 | Founders, CEOs, Product Managers |

| Investment Platforms | 55 | Operations Managers, Marketing Directors |

| Venture Capital Firms | 45 | Investment Analysts, Partners |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| End Users of Digital Investment Platforms | 85 | Retail Investors, Financial Advisors |

The Qatar Digital Investment Platforms Market is valued at approximately USD 480 million, reflecting significant growth driven by the increasing adoption of digital financial services and innovations in fintech.