Region:Middle East

Author(s):Dev

Product Code:KRAB7398

Pages:87

Published On:October 2025

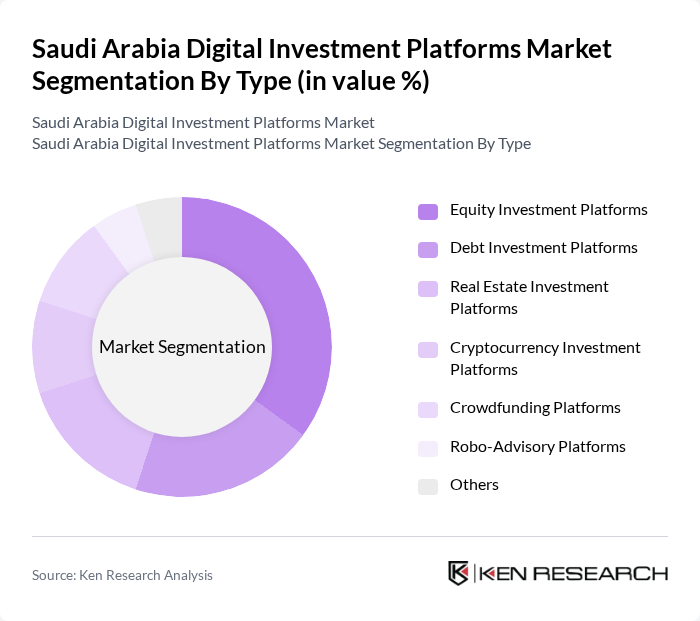

By Type:The market is segmented into various types of digital investment platforms, including Equity Investment Platforms, Debt Investment Platforms, Real Estate Investment Platforms, Cryptocurrency Investment Platforms, Crowdfunding Platforms, Robo-Advisory Platforms, and Others. Among these, Equity Investment Platforms are currently leading the market due to the increasing interest in stock trading and investment opportunities among individual and institutional investors. The rise of fintech solutions has also facilitated easier access to equity markets, driving growth in this segment.

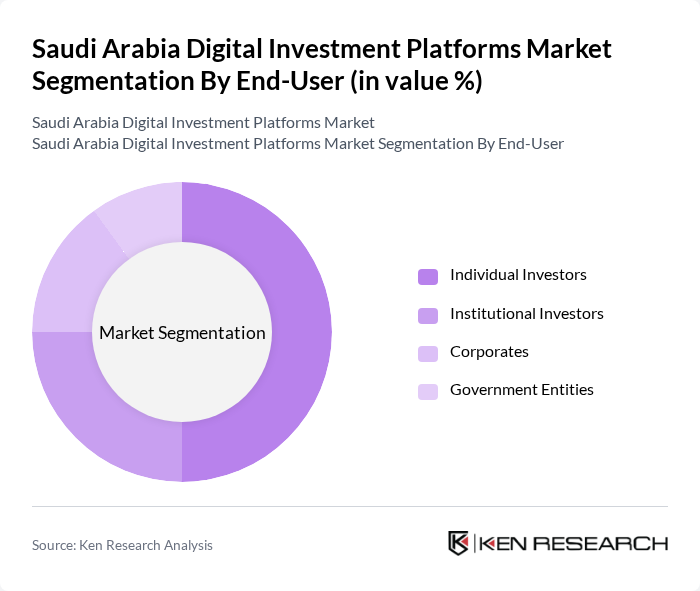

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Corporates, and Government Entities. Individual Investors dominate the market, driven by the increasing number of retail investors entering the market, facilitated by user-friendly digital platforms. The trend of self-directed investing and the availability of educational resources have empowered individuals to manage their investments more actively.

The Saudi Arabia Digital Investment Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Capital, NCB Capital, Riyad Capital, Samba Capital, Alinma Investment, Jadwa Investment, Albilad Investment, Emirates NBD, HSBC Saudi Arabia, Morgan Stanley Saudi Arabia, Citigroup Saudi Arabia, Deutsche Bank Saudi Arabia, Goldman Sachs Saudi Arabia, UBS Saudi Arabia, Credit Suisse Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia digital investment platforms market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance user experience and investment strategies. Additionally, as the government continues to support fintech innovation, the market is likely to witness increased collaboration between digital platforms and traditional financial institutions, fostering a more inclusive financial ecosystem that caters to diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Investment Platforms Debt Investment Platforms Real Estate Investment Platforms Cryptocurrency Investment Platforms Crowdfunding Platforms Robo-Advisory Platforms Others |

| By End-User | Individual Investors Institutional Investors Corporates Government Entities |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Wealth Management Retirement Planning Tax Optimization Portfolio Diversification |

| By Distribution Channel | Online Platforms Mobile Applications Financial Advisors Direct Sales |

| By Regulatory Compliance Level | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| By User Experience | User-Friendly Interfaces Advanced Analytical Tools Customer Support Services Educational Resources |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Financial Advisors |

| Institutional Investment Strategies | 100 | Portfolio Managers, Investment Analysts |

| Digital Platform User Experience | 80 | End Users, UX Researchers |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

| Fintech Adoption Trends | 90 | Tech Entrepreneurs, Startup Founders |

The Saudi Arabia Digital Investment Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased digital technology adoption and rising online investment activities among the population.