Region:Middle East

Author(s):Rebecca

Product Code:KRAB7748

Pages:90

Published On:October 2025

Market.png)

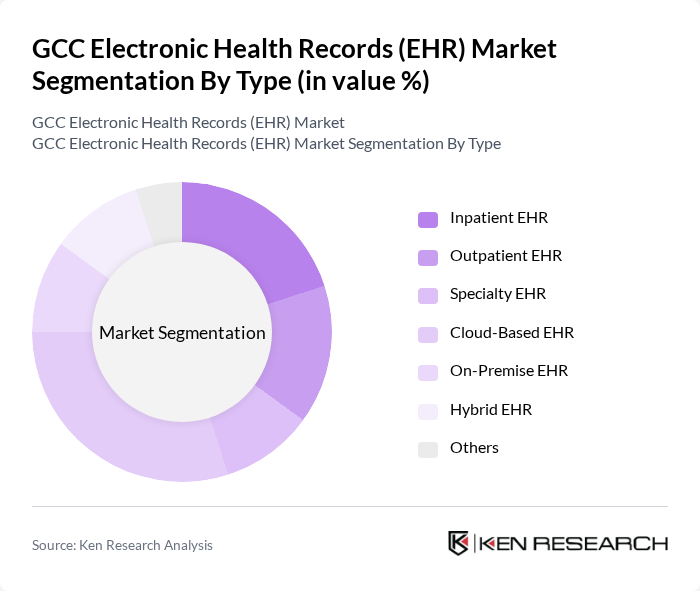

By Type:The market is segmented into various types of EHR systems, including Inpatient EHR, Outpatient EHR, Specialty EHR, Cloud-Based EHR, On-Premise EHR, Hybrid EHR, and Others. Among these, Cloud-Based EHR is gaining significant traction due to its flexibility, cost-effectiveness, and ease of access. The increasing trend of remote healthcare services and telemedicine has further accelerated the adoption of cloud-based solutions, making it the leading sub-segment in the market.

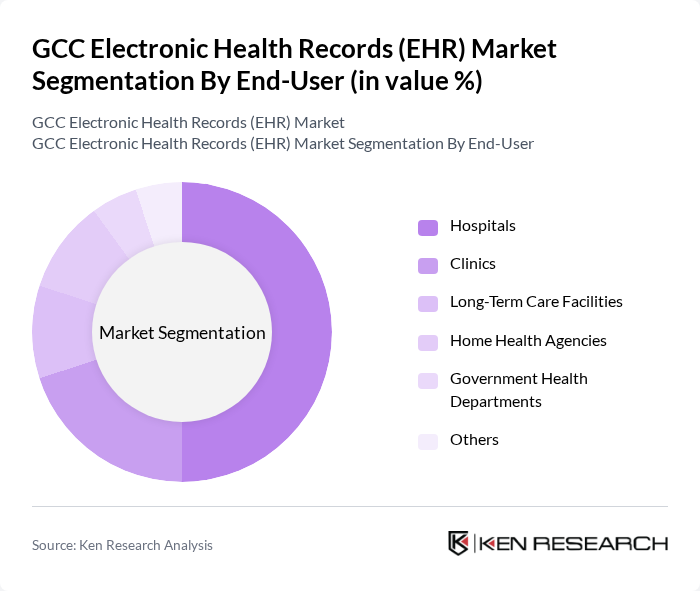

By End-User:The end-user segmentation includes Hospitals, Clinics, Long-Term Care Facilities, Home Health Agencies, Government Health Departments, and Others. Hospitals are the dominant end-user segment, driven by the need for comprehensive patient management systems and the increasing volume of patient data. The growing emphasis on improving patient care and operational efficiency in hospitals has led to a higher adoption rate of EHR systems in this segment.

The GCC Electronic Health Records (EHR) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, Inc., Meditech, NextGen Healthcare, Inc., Athenahealth, Inc., eClinicalWorks, GE Healthcare, Oracle Corporation, Siemens Healthineers, Philips Healthcare, IBM Watson Health, MEDHOST, Greenway Health, Infor Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC EHR market appears promising, driven by technological advancements and a strong push for healthcare digitization. As governments continue to invest in health IT infrastructure, the integration of AI and machine learning into EHR systems is expected to enhance patient care and operational efficiency. Furthermore, the increasing focus on interoperability will facilitate seamless data exchange among healthcare providers, ultimately improving patient outcomes and fostering a more connected healthcare ecosystem across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Inpatient EHR Outpatient EHR Specialty EHR Cloud-Based EHR On-Premise EHR Hybrid EHR Others |

| By End-User | Hospitals Clinics Long-Term Care Facilities Home Health Agencies Government Health Departments Others |

| By Deployment Model | Cloud-Based Deployment On-Premise Deployment Hybrid Deployment |

| By Functionality | Clinical Documentation Patient Management Revenue Cycle Management Reporting and Analytics |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Pricing Model | Subscription-Based Pricing One-Time License Fee Pay-Per-Use |

| By Integration Capability | Standalone EHR Integrated EHR with Other Systems Interoperable EHR |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospitals EHR Adoption | 150 | IT Directors, Chief Information Officers |

| Private Clinics EHR Implementation | 100 | Practice Managers, Healthcare Administrators |

| Pharmaceutical Companies' EHR Integration | 80 | Data Analysts, Compliance Officers |

| Patient Experience with EHR Systems | 120 | Patients, Caregivers |

| Telehealth and EHR Interoperability | 90 | Telehealth Coordinators, IT Specialists |

The GCC Electronic Health Records (EHR) Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital health solutions and government initiatives aimed at enhancing healthcare infrastructure across the region.