Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7180

Pages:85

Published On:December 2025

Market.png)

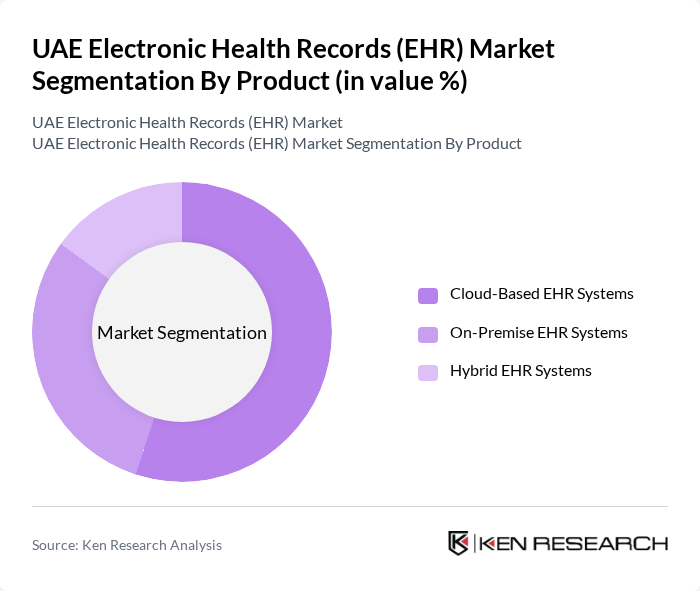

By Product:The segmentation by product includes Cloud-Based EHR Systems, On-Premise EHR Systems, and Hybrid EHR Systems. Among these, Cloud-Based EHR Systems are leading the market due to their scalability, cost-effectiveness, and ease of access, in line with findings that web/cloud-based EHR is the largest revenue-generating product segment in the UAE. The growing trend of remote healthcare services, telemedicine, and mobile health applications has further accelerated the adoption of cloud solutions, making them the preferred choice for many healthcare providers in both public and private sectors.

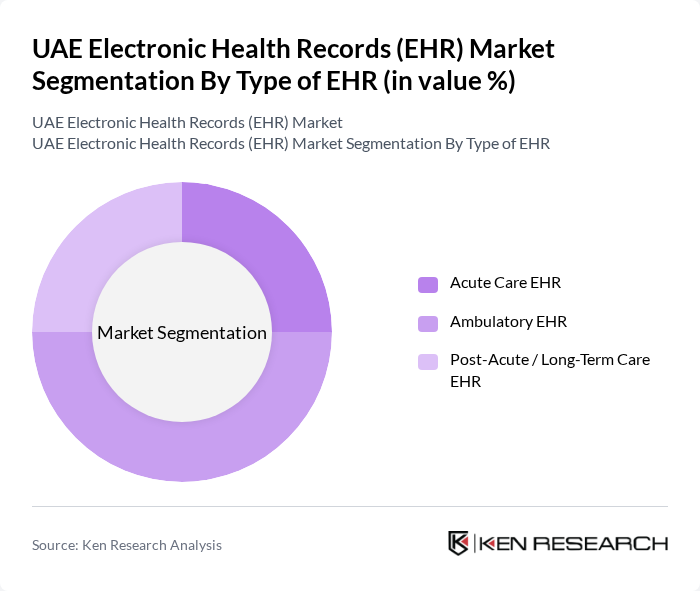

By Type of EHR:The types of EHR include Acute Care EHR, Ambulatory EHR, and Post-Acute / Long-Term Care EHR. The Ambulatory EHR segment is currently dominating the market, driven by the increasing number of outpatient facilities, specialty clinics, and day-surgery centers, and the need for efficient patient management in non-hospital settings. This trend is further supported by the growing emphasis on preventive care, chronic disease management, and patient engagement tools that are often integrated into ambulatory and primary care digital platforms.

The UAE Electronic Health Records (EHR) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Health (Formerly Cerner Corporation), Epic Systems Corporation, InterSystems Corporation, Tasy EMR (Philips Healthcare), Dedalus Group, DXC Technology, Allscripts / Veradigm Inc., GE HealthCare Technologies Inc., Siemens Healthineers, NextGen Healthcare, Inc., eClinicalWorks LLC, AdvancedMD, Inc., CureMD Healthcare, Unite Integrated Health Information & Technology Solutions (Unite EMR), Altibbi Health Tech / Local Regional EHR Vendors (e.g., Medcare EMR, local HIS providers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE EHR market appears promising, driven by technological advancements and a strong push for healthcare digitization. As the government continues to invest in health IT infrastructure, the integration of AI and machine learning into EHR systems is expected to enhance data analytics capabilities. Additionally, the growing emphasis on interoperability will facilitate seamless data exchange among healthcare providers, improving patient care and operational efficiency across the sector.

| Segment | Sub-Segments |

|---|---|

| By Product | Cloud-Based EHR Systems On-Premise EHR Systems Hybrid EHR Systems |

| By Type of EHR | Acute Care EHR Ambulatory EHR Post-Acute / Long-Term Care EHR |

| By End-User | Hospitals Clinics and Polyclinics Long-Term Care & Rehabilitation Facilities Pharmacies Diagnostic Laboratories & Imaging Centers Home Healthcare Providers |

| By Deployment Model | Public Sector EHR Platforms (Government / Authority-Run) Private Provider EHR Platforms Managed / Hosted EHR Services |

| By Clinical Specialty | General Practice / Family Medicine Pediatrics Cardiology Oncology Obstetrics & Gynecology Others (Dermatology, Orthopedics, etc.) |

| By Emirate | Abu Dhabi Dubai Sharjah Northern Emirates (Ajman, Ras Al Khaimah, Fujairah, Umm Al Quwain) |

| By Functionality | Clinical Documentation & Computerized Physician Order Entry (CPOE) Patient Administration & Scheduling e-Prescribing & Medication Management Revenue Cycle & Practice Management Analytics, Reporting & Population Health Management |

| By Integration Capability | Standalone EHR Integrated EHR with Hospital Information System (HIS) EHR Integrated with Health Information Exchange (HIE) Platforms (e.g., Malaffi, NABIDH) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital EHR Implementation | 60 | IT Managers, Chief Information Officers |

| Private Clinic EHR Adoption | 50 | Practice Managers, Healthcare Administrators |

| Patient Experience with EHR Systems | 150 | Patients, Caregivers |

| Healthcare IT Vendor Insights | 40 | Sales Executives, Product Managers |

| Regulatory Impact on EHR Usage | 50 | Policy Makers, Health Economists |

The UAE Electronic Health Records (EHR) Market is valued at approximately USD 120 million, reflecting significant growth driven by the adoption of digital health solutions and government initiatives aimed at enhancing healthcare infrastructure.