Region:Middle East

Author(s):Rebecca

Product Code:KRAC8461

Pages:85

Published On:November 2025

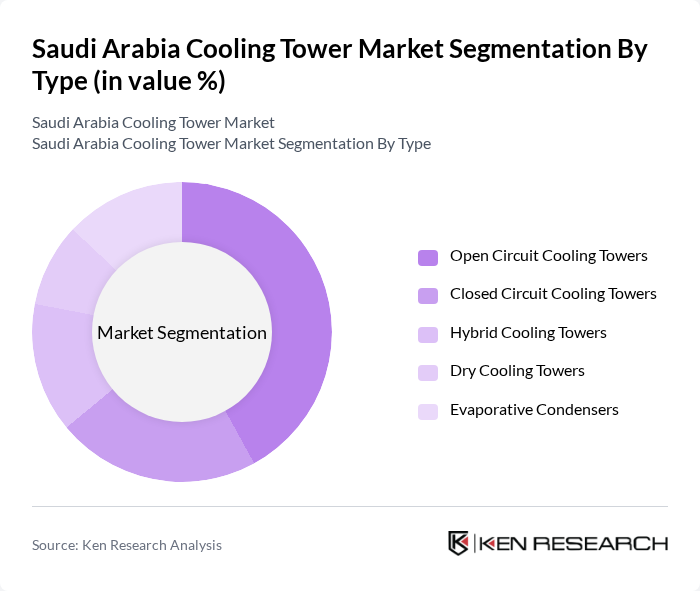

By Type:The market is segmented into various types of cooling towers, including Open Circuit Cooling Towers, Closed Circuit Cooling Towers, Hybrid Cooling Towers, Dry Cooling Towers, and Evaporative Condensers. Each type serves different applications and industries, catering to specific cooling needs .

The Open Circuit Cooling Towers segment is currently leading the market due to their widespread application in power generation and industrial processes. These towers are favored for their efficiency and cost-effectiveness, making them a popular choice among manufacturers and facility operators. The increasing focus on energy conservation and the need for effective cooling solutions in large-scale operations further enhance their market dominance .

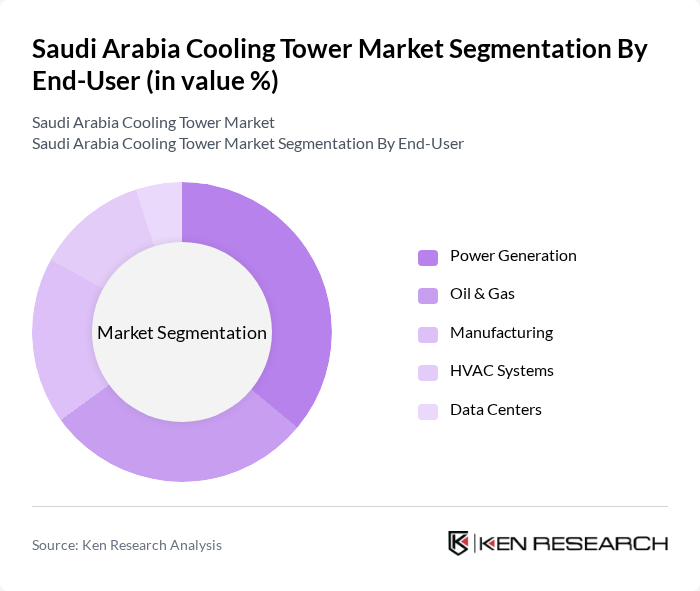

By End-User:The market is segmented based on end-users, including Power Generation, Oil & Gas, Manufacturing, HVAC Systems, and Data Centers. Each end-user category has distinct requirements and contributes differently to the overall market dynamics .

The Power Generation sector is the leading end-user of cooling towers, driven by the need for efficient cooling solutions in thermal power plants. The increasing demand for electricity in Saudi Arabia, coupled with the government's focus on expanding its energy infrastructure, has significantly boosted the adoption of cooling towers in this sector. Additionally, the Oil & Gas industry follows closely, utilizing cooling towers for various processes, including refining and petrochemical production .

The Saudi Arabia Cooling Tower Market is characterized by a dynamic mix of regional and international players. Leading participants such as SPX Cooling Technologies, Baltimore Aircoil Company, Evapco, Inc., Delta Cooling Towers, Hamon & Cie (International) SA, KTI-Plersch Kältetechnik GmbH, Paharpur Cooling Towers, Al Zamil Air Conditioning & Refrigeration Co. Ltd., Johnson Controls, Trane Technologies, GEA Group AG, Thermax Limited, BAC Middle East LLC, Saudi Cooling Towers Factory Co. Ltd., Carrier Global Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia cooling tower market is poised for significant transformation driven by technological advancements and sustainability initiatives. As industries increasingly prioritize energy efficiency, the integration of IoT in cooling tower management is expected to enhance operational efficiency and reduce costs. Furthermore, the growing emphasis on water conservation technologies will likely lead to innovative cooling solutions that align with environmental regulations, fostering a more sustainable approach to cooling in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Open Circuit Cooling Towers Closed Circuit Cooling Towers Hybrid Cooling Towers Dry Cooling Towers Evaporative Condensers |

| By End-User | Power Generation Oil & Gas Manufacturing HVAC Systems Data Centers |

| By Application | Industrial Cooling Commercial Cooling Process Cooling District Cooling |

| By Distribution Channel | Direct Sales Distributors Online Sales Partnerships |

| By Material | Fiberglass Reinforced Polymer (FRP) Steel Concrete Wood |

| By Size | Small Medium Large |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Cooling Systems | 85 | Facility Managers, Building Engineers |

| Industrial Cooling Applications | 70 | Operations Managers, Plant Engineers |

| Oil & Gas Sector Cooling Solutions | 55 | Project Managers, Technical Directors |

| HVAC Contractors and Installers | 65 | Business Owners, Lead Technicians |

| Energy Efficiency Consultants | 45 | Consultants, Policy Advisors |

The Saudi Arabia Cooling Tower Market is valued at approximately USD 195 million, driven by the rapid expansion of the industrial sector, particularly in oil and gas, power generation, and manufacturing, alongside the increasing demand for energy-efficient cooling solutions.