Region:Middle East

Author(s):Rebecca

Product Code:KRAD5057

Pages:93

Published On:December 2025

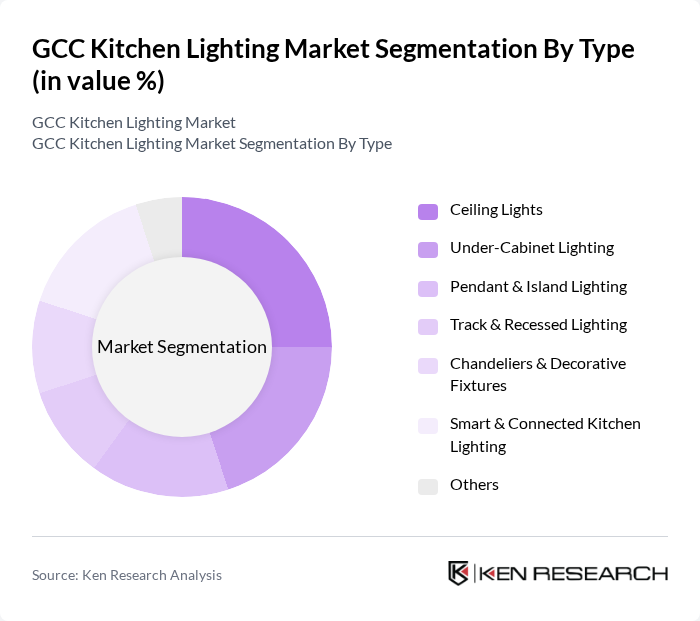

By Type:The market is segmented into various types of kitchen lighting solutions, including Ceiling Lights, Under-Cabinet Lighting, Pendant & Island Lighting, Track & Recessed Lighting, Chandeliers & Decorative Fixtures, Smart & Connected Kitchen Lighting, and Others. Each type serves distinct purposes and caters to different consumer preferences.

The Ceiling Lights segment is currently dominating the market due to their versatility and widespread use in both residential and commercial kitchens. They provide general illumination and can be designed to fit various aesthetic preferences, making them a popular choice among homeowners and designers alike. Under-Cabinet Lighting is also gaining traction as it enhances task lighting and adds ambiance, particularly in modern kitchen designs. The trend towards smart lighting solutions is expected to grow, driven by consumer interest in energy efficiency and automation.

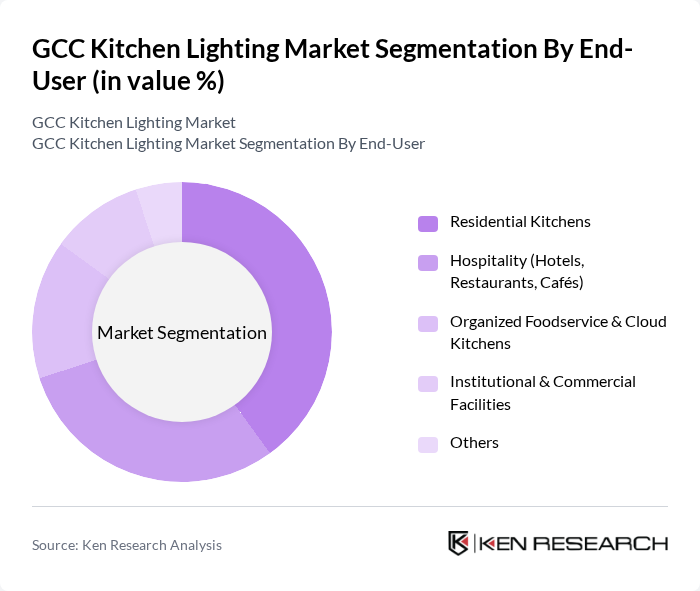

By End-User:The market is segmented by end-user categories, including Residential Kitchens, Hospitality (Hotels, Restaurants, Cafés), Organized Foodservice & Cloud Kitchens, Institutional & Commercial Facilities, and Others. Each segment reflects different lighting needs and preferences based on the environment and usage.

The Residential Kitchens segment leads the market, driven by the increasing trend of home renovations and the desire for modern, functional kitchen spaces. Homeowners are investing in high-quality lighting solutions that enhance both aesthetics and functionality. The Hospitality sector follows closely, as restaurants and hotels seek to create inviting atmospheres that attract customers. The rise of cloud kitchens has also contributed to the demand for efficient and effective kitchen lighting solutions.

The GCC Kitchen Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (Philips Lighting), Osram Licht AG, GE Lighting (a Savant company), Acuity Brands, Inc., Zumtobel Group AG, Fagerhult Group, Hubbell Lighting (Hubbell Incorporated), Legrand S.A., Lutron Electronics Co., Inc., Panasonic Holdings Corporation, Schneider Electric SE, Havells India Ltd., Bajaj Electricals Ltd., NVC International Holdings Limited, Noor LED / Noor Al Khaleej Lighting (GCC Regional Player) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC kitchen lighting market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As consumers increasingly prioritize energy efficiency and smart home integration, manufacturers are likely to innovate further, enhancing product offerings. Additionally, government regulations promoting energy-efficient solutions will continue to shape market dynamics. The focus on aesthetic appeal in kitchen design will also drive demand for customizable lighting solutions, ensuring a vibrant market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ceiling Lights Under-Cabinet Lighting Pendant & Island Lighting Track & Recessed Lighting Chandeliers & Decorative Fixtures Smart & Connected Kitchen Lighting Others |

| By End-User | Residential Kitchens Hospitality (Hotels, Restaurants, Cafés) Organized Foodservice & Cloud Kitchens Institutional & Commercial Facilities Others |

| By Application | Task Lighting (Worktops, Sinks, Hobs) Ambient / General Kitchen Lighting Accent & Display Lighting (Cabinets, Shelves) Decorative & Statement Lighting (Islands, Dining Zones) Others |

| By Installation Type | New Residential & Commercial Construction Renovation & Retrofit Installations DIY / Modular Installations Professional Design-Build Installations Others |

| By Distribution Channel | Modern Trade & Home Improvement Stores Specialist Lighting Showrooms Builders, Contractors & System Integrators Online Retail & Marketplaces Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Consumer Segment | Mid- to High-Income Homeowners Tenants in Premium & Serviced Apartments Interior Designers & Kitchen Consultants Contractors, Developers & Fit-Out Firms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Kitchen Lighting Trends | 120 | Homeowners, Interior Designers |

| Commercial Kitchen Lighting Solutions | 90 | Restaurant Owners, Facility Managers |

| Retail Market Insights | 70 | Retail Managers, Product Buyers |

| Energy Efficiency Adoption | 60 | Energy Consultants, Sustainability Officers |

| Technological Innovations in Lighting | 80 | Product Developers, R&D Managers |

The GCC Kitchen Lighting Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the demand for energy-efficient lighting solutions and modern kitchen designs that prioritize aesthetics and functionality.