Region:Middle East

Author(s):Rebecca

Product Code:KRAD7558

Pages:94

Published On:December 2025

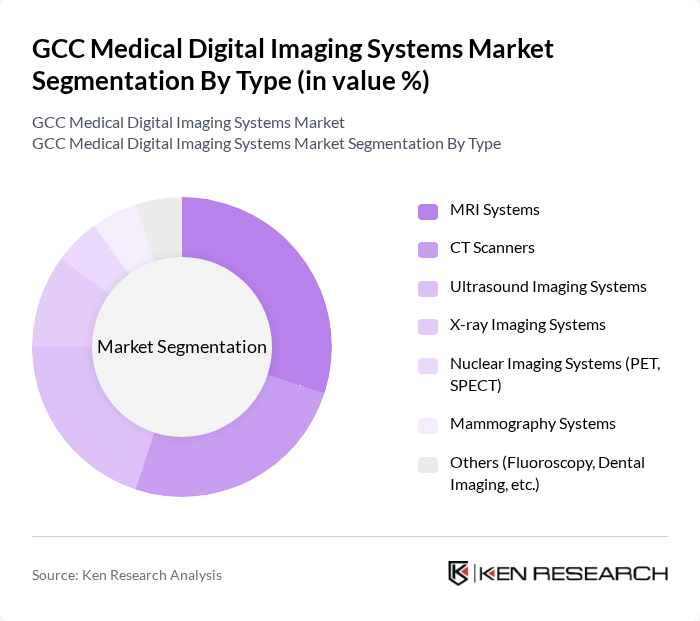

By Type:The market is segmented into various types of medical imaging systems, including MRI Systems, CT Scanners, Ultrasound Imaging Systems, X-ray Imaging Systems, Nuclear Imaging Systems (PET, SPECT), Mammography Systems, and Others (Fluoroscopy, Dental Imaging, etc.). Each of these sub-segments plays a crucial role in the overall market dynamics, with specific applications and technological advancements such as AI-based reconstruction, low-dose protocols, and portable and point-of-care systems driving their growth.

The MRI Systems segment is currently dominating the market due to its advanced soft-tissue imaging capabilities and high demand in hospitals and diagnostic centers for neurology, musculoskeletal, cardiology, and oncology applications. The increasing prevalence of neurological disorders, cancer, and cardiovascular diseases, along with the need for detailed cross?sectional imaging in complex cases, is driving the adoption of MRI technology in the GCC. Additionally, technological advancements such as high-field and wide?bore MRI systems, faster sequences, and AI-assisted image reconstruction and workflow are enhancing diagnostic accuracy and efficiency, further supporting its strong position within the overall modality mix.

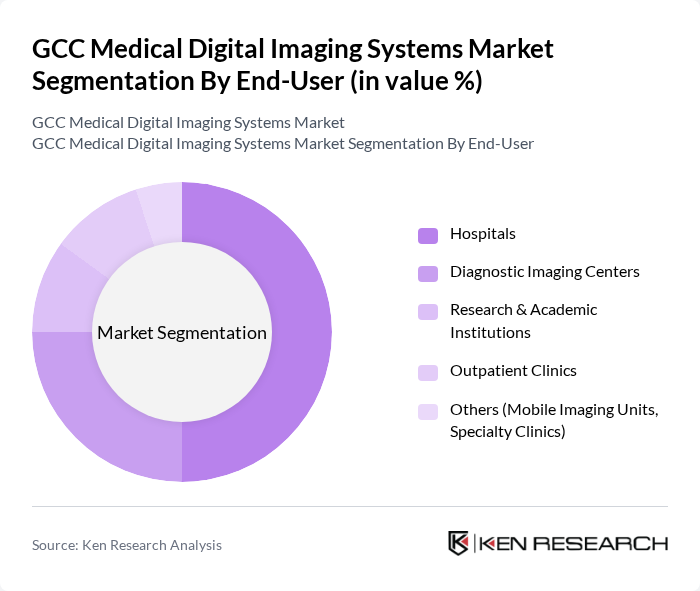

By End-User:The market is segmented by end-users, including Hospitals, Diagnostic Imaging Centers, Research & Academic Institutions, Outpatient Clinics, and Others (Mobile Imaging Units, Specialty Clinics). Each segment has unique requirements and contributes differently to the overall market growth, with hospitals focusing on integrated enterprise imaging platforms, diagnostic centers on high-throughput and sub-specialty services, and outpatient and mobile setups on portability and point-of-care access.

Hospitals are the leading end-user segment, accounting for a significant share of the market. This dominance is attributed to the high volume of diagnostic imaging procedures performed in multi-specialty and tertiary care settings, driven by the increasing patient population, higher case complexity, and the need for comprehensive inpatient and emergency services. Furthermore, hospitals are investing in advanced multimodality imaging suites, enterprise PACS/VNA, and AI-enabled decision support tools to enhance diagnostic accuracy, reduce turnaround times, and improve patient care pathways, reinforcing their position in the market.

The GCC Medical Digital Imaging Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips Healthcare (Royal Philips), Canon Medical Systems Corporation, Fujifilm Healthcare Corporation, Hitachi, Ltd. (Fujifilm Healthcare MRI & CT Business), Agfa HealthCare NV, Carestream Health, Inc., Hologic, Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Samsung Medison Co., Ltd. (Samsung Electronics), Varian Medical Systems, Inc. (Siemens Healthineers Company), Neusoft Medical Systems Co., Ltd., Esaote S.p.A., United Imaging Healthcare Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC medical digital imaging systems market appears promising, driven by ongoing technological advancements and increasing healthcare investments. The integration of AI and machine learning into imaging systems is expected to enhance diagnostic capabilities significantly. Additionally, the growing emphasis on patient-centric care will likely lead to the development of more accessible and efficient imaging solutions, ensuring that healthcare providers can meet the rising demand for quality diagnostic services across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | MRI Systems CT Scanners Ultrasound Imaging Systems X-ray Imaging Systems Nuclear Imaging Systems (PET, SPECT) Mammography Systems Others (Fluoroscopy, Dental Imaging, etc.) |

| By End-User | Hospitals Diagnostic Imaging Centers Research & Academic Institutions Outpatient Clinics Others (Mobile Imaging Units, Specialty Clinics) |

| By Application | Oncology Cardiology Neurology Orthopedics Women’s Health Others |

| By Technology | Digital Imaging (DR/CR) Analog Imaging Hybrid Imaging (PET-CT, SPECT-CT, PET-MRI) AI-Enabled Imaging & Advanced Visualization Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Distribution Channel | Direct Sales (OEM to End-User) Authorized Distributors & Local Agents Tender & Group Purchasing Organizations Online & E-Procurement Platforms Others |

| By Pricing / Commercial Model | Capital Equipment Purchase Leasing & Pay-per-use Models Managed Equipment Services (MES) / Long-term Service Contracts Outcome- / Value-Based Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Directors |

| Private Clinics and Diagnostic Centers | 100 | Clinic Owners, Medical Directors |

| Healthcare Procurement Managers | 80 | Procurement Officers, Supply Chain Managers |

| Medical Equipment Distributors | 70 | Sales Managers, Product Specialists |

| Regulatory Bodies and Health Authorities | 50 | Policy Makers, Regulatory Affairs Managers |

The GCC Medical Digital Imaging Systems Market is valued at approximately USD 2.2 billion, driven by advancements in digital imaging technology, increased healthcare expenditure, and a rising prevalence of chronic diseases in the region.