Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0998

Pages:81

Published On:October 2025

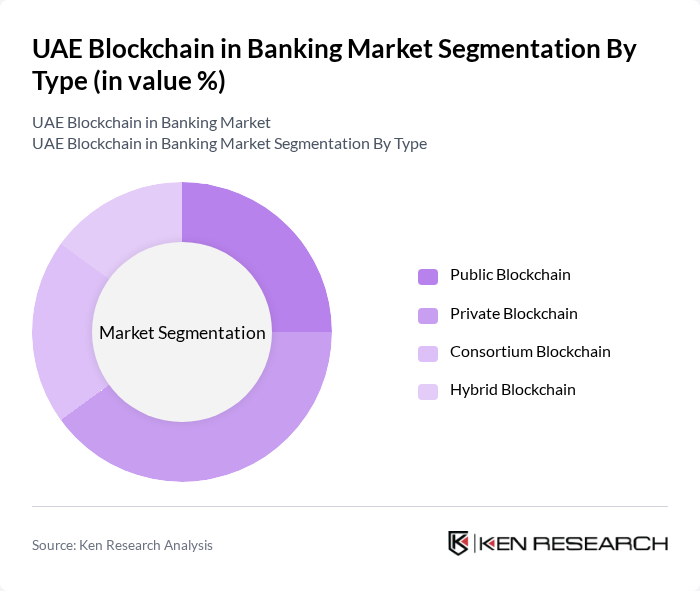

By Type:The market is segmented into four types: Public Blockchain, Private Blockchain, Consortium Blockchain, and Hybrid Blockchain. Each type serves different needs within the banking sector, with public blockchains offering transparency and decentralization, while private blockchains provide enhanced security and control for financial institutions. Consortium blockchains facilitate collaboration among multiple banks, and hybrid blockchains combine public and private features to balance transparency with confidentiality in sensitive banking operations .

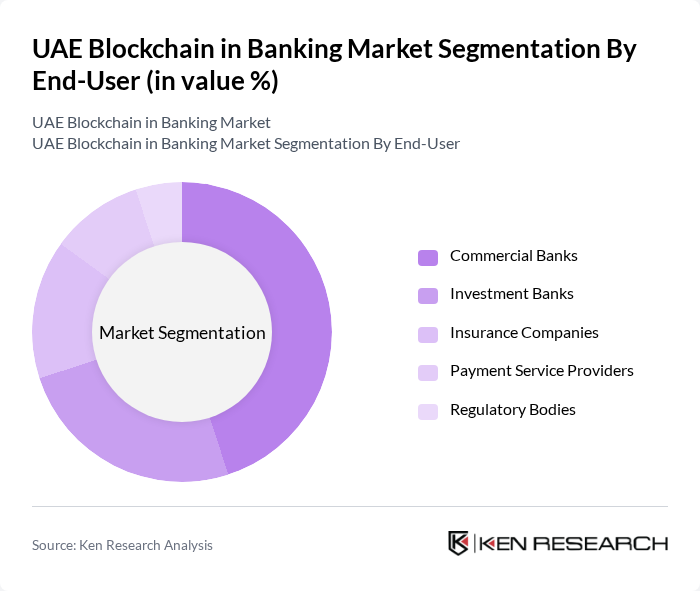

By End-User:The end-user segmentation includes Commercial Banks, Investment Banks, Insurance Companies, Payment Service Providers, and Regulatory Bodies. Each segment utilizes blockchain technology to enhance their services, with commercial banks leading the way due to their extensive transaction volumes and the need for secure, efficient operations. The BFSI sector (banking, financial services, and insurance) accounts for more than half of blockchain adoption in the UAE, driven by fraud reduction, operational efficiency, and regulatory compliance .

The UAE Blockchain in Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, First Abu Dhabi Bank (FAB), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank, Abu Dhabi Islamic Bank (ADIB), Commercial Bank of Dubai (CBD), Ripple, IBM Middle East, R3, Oracle Financial Services, ConsenSys, Infosys Finacle, Gate.io (Gate Ventures), Quest Global (People Tech Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE blockchain in banking market appears promising, driven by ongoing technological advancements and increasing regulatory support. As banks continue to integrate blockchain solutions, the focus will shift towards enhancing customer experience and operational efficiency. Additionally, the rise of decentralized finance (DeFi) and the potential for central bank digital currencies (CBDCs) will further reshape the banking landscape, encouraging innovation and collaboration among financial institutions and fintech startups.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Blockchain Private Blockchain Consortium Blockchain Hybrid Blockchain |

| By End-User | Commercial Banks Investment Banks Insurance Companies Payment Service Providers Regulatory Bodies |

| By Application | Cross-Border Payments Smart Contracts Identity Verification (KYC) Transaction Monitoring and AML Compliance Trade Finance Asset Management Fraud Detection |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Service Model | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) Consulting Services Integration Services Maintenance and Support Services |

| By Compliance Type | KYC Compliance AML Compliance GDPR Compliance Audit and Reporting |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Banking Sector | 100 | Banking Executives, IT Managers |

| Investment Banking and Asset Management | 60 | Portfolio Managers, Compliance Officers |

| Fintech Startups in Blockchain | 50 | Founders, Product Development Leads |

| Regulatory Bodies and Compliance | 40 | Regulators, Policy Makers |

| Blockchain Technology Providers | 45 | CTOs, Business Development Managers |

The UAE Blockchain in Banking Market is valued at approximately USD 290 million, reflecting significant growth driven by the adoption of blockchain technology to enhance operational efficiency, reduce transaction costs, and improve security in financial transactions.