Region:Middle East

Author(s):Dev

Product Code:KRAB7423

Pages:90

Published On:October 2025

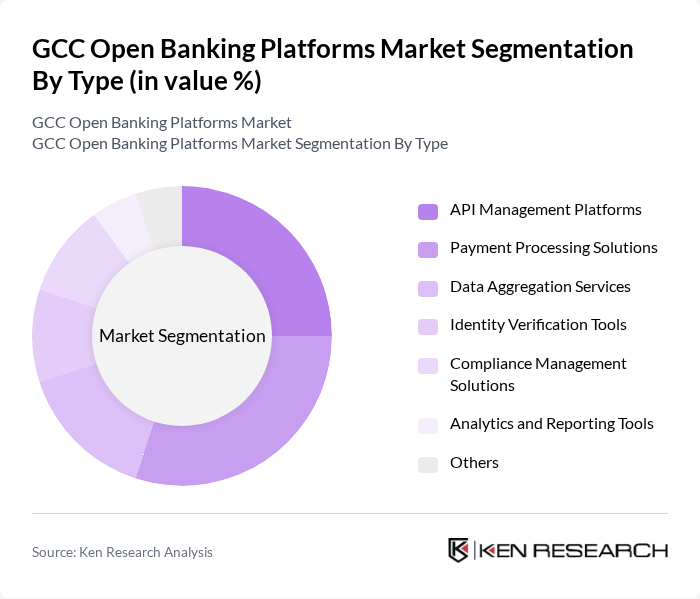

By Type:The market is segmented into various types, including API Management Platforms, Payment Processing Solutions, Data Aggregation Services, Identity Verification Tools, Compliance Management Solutions, Analytics and Reporting Tools, and Others. Each of these sub-segments plays a crucial role in the overall functionality and efficiency of open banking platforms.

The Payment Processing Solutions sub-segment is currently dominating the market due to the increasing volume of digital transactions and the need for secure, efficient payment methods. As consumers shift towards online shopping and digital wallets, the demand for robust payment processing solutions has surged. Additionally, the rise of fintech companies offering innovative payment solutions has further propelled this sub-segment's growth, making it a critical component of the open banking ecosystem.

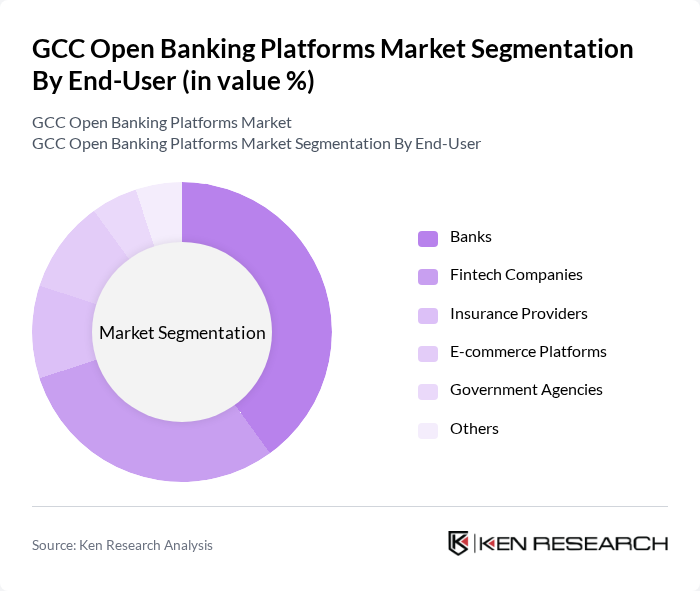

By End-User:The market is segmented by end-users, including Banks, Fintech Companies, Insurance Providers, E-commerce Platforms, Government Agencies, and Others. Each end-user category has unique requirements and contributes differently to the growth of open banking platforms.

Banks are the leading end-users in the market, primarily due to their established customer base and the need to enhance their service offerings through digital transformation. The integration of open banking solutions allows banks to provide personalized services, improve customer engagement, and streamline operations. Additionally, the regulatory push for open banking has compelled banks to adopt these platforms to remain competitive in the evolving financial landscape.

The GCC Open Banking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fidor Bank AG, Solarisbank AG, Temenos AG, Finastra, N26, Revolut, Stripe, Plaid, YAPILY, Tink, Open Bank Project, Token.io, TrueLayer, Salt Edge, Bankable contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC open banking platforms market appears promising, driven by increasing consumer demand for personalized financial services and the ongoing digital transformation in the banking sector. As regulatory frameworks evolve, banks are likely to enhance their collaboration with fintech companies, leading to innovative solutions that cater to diverse customer needs. Furthermore, the integration of advanced technologies such as AI and machine learning will enable banks to offer more tailored services, improving customer engagement and satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | API Management Platforms Payment Processing Solutions Data Aggregation Services Identity Verification Tools Compliance Management Solutions Analytics and Reporting Tools Others |

| By End-User | Banks Fintech Companies Insurance Providers E-commerce Platforms Government Agencies Others |

| By Deployment Model | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Others |

| By Customer Segment | Retail Customers Small and Medium Enterprises (SMEs) Large Enterprises |

| By Service Type | Account Information Services Payment Initiation Services Fund Confirmation Services |

| By Pricing Model | Subscription-Based Pricing Pay-Per-Use Pricing Freemium Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Open Banking Initiatives | 150 | Product Managers, Digital Transformation Leads |

| Fintech Adoption and Integration | 100 | CTOs, Business Development Managers |

| Consumer Attitudes Towards Open Banking | 200 | Retail Banking Customers, Digital Banking Users |

| Regulatory Impact on Open Banking | 80 | Compliance Officers, Regulatory Affairs Managers |

| Technology Providers in Open Banking | 70 | Sales Directors, Technical Account Managers |

The GCC Open Banking Platforms Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital banking solutions and regulatory support for open banking initiatives, enhancing customer experiences in financial services.