Region:Middle East

Author(s):Rebecca

Product Code:KRAA9287

Pages:99

Published On:November 2025

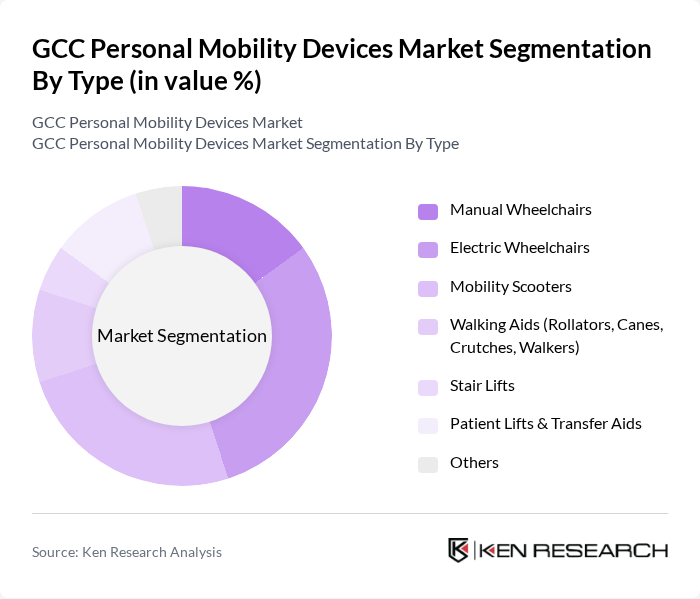

By Type:The market is segmented into various types of mobility devices, including Manual Wheelchairs, Electric Wheelchairs, Mobility Scooters, Walking Aids (Rollators, Canes, Crutches, Walkers), Stair Lifts, Patient Lifts & Transfer Aids, and Others. Among these, Electric Wheelchairs and Mobility Scooters are gaining significant traction due to their advanced features, ease of use, and integration with smart technologies. The increasing preference for electric mobility solutions is driven by the growing demand for independence, enhanced safety, and improved maneuverability among users .

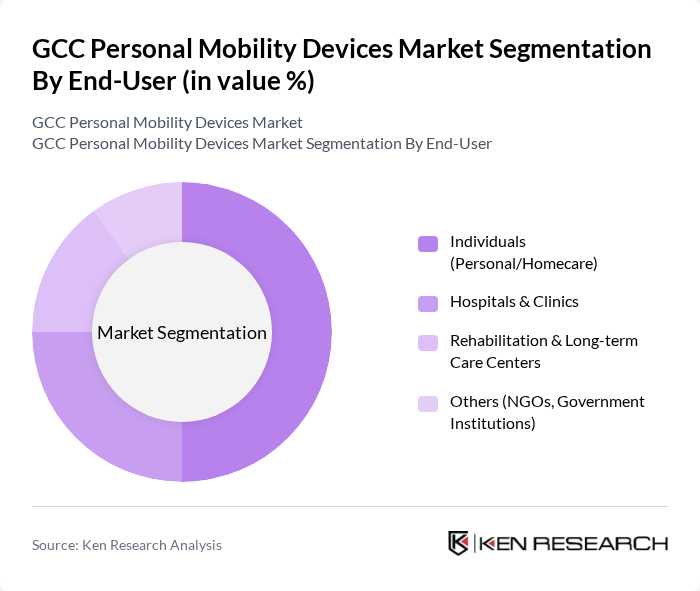

By End-User:The end-user segmentation includes Individuals (Personal/Homecare), Hospitals & Clinics, Rehabilitation & Long-term Care Centers, and Others (NGOs, Government Institutions). The Individuals segment is currently leading the market, driven by the increasing number of elderly individuals seeking mobility solutions for personal use. The growing trend of home healthcare services, coupled with rising disposable incomes and improved access to advanced mobility aids, is contributing to the demand for personal mobility devices among individuals .

The GCC Personal Mobility Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sunrise Medical, Invacare Corporation, Permobil AB, Pride Mobility Products Corp., Drive DeVilbiss Healthcare, Medline Industries, LP, Ottobock SE & Co. KGaA, Karman Healthcare, Inc., TGA Mobility Ltd., Meyra GmbH, Handicare Group AB, Alinker Inventions Ltd., EasyStand (Altimate Medical, Inc.), Max Mobility, LLC (SmartDrive), Zinger Chair (First Street for Boomers and Beyond, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC personal mobility devices market appears promising, driven by demographic shifts and technological advancements. As the aging population grows, the demand for innovative mobility solutions will likely increase. Additionally, the integration of smart technologies and IoT in mobility devices is expected to enhance user experience, making them more appealing. Furthermore, partnerships with healthcare providers will facilitate better access to mobility aids, ensuring that more individuals can benefit from these essential devices, thereby expanding the market significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Wheelchairs Electric Wheelchairs Mobility Scooters Walking Aids (Rollators, Canes, Crutches, Walkers) Stair Lifts Patient Lifts & Transfer Aids Others |

| By End-User | Individuals (Personal/Homecare) Hospitals & Clinics Rehabilitation & Long-term Care Centers Others (NGOs, Government Institutions) |

| By Age Group | Seniors (65+ years) Adults (18-64 years) Children (0-17 years) Others |

| By Distribution Channel | Online Retailers Specialty Stores Direct Sales Multi-brand Stores Others |

| By Region | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Price Range | Budget Mid-Range Premium Others |

| By Technology | Smart Mobility Devices (IoT-enabled, Connected) Traditional Mobility Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Electric Scooters | 120 | Urban Commuters, College Students |

| Healthcare Professionals' Perspectives | 90 | Physiotherapists, Occupational Therapists |

| Retailer Feedback on Mobility Devices | 70 | Store Managers, Sales Representatives |

| Government Policy Impact Assessment | 50 | Urban Planners, Policy Makers |

| Market Trends from Manufacturers | 60 | Product Managers, Business Development Executives |

The GCC Personal Mobility Devices Market is valued at approximately USD 550 million, driven by factors such as an aging population, increased prevalence of disabilities, and a growing demand for advanced mobility solutions that enhance quality of life.