Region:Global

Author(s):Geetanshi

Product Code:KRAA2304

Pages:81

Published On:August 2025

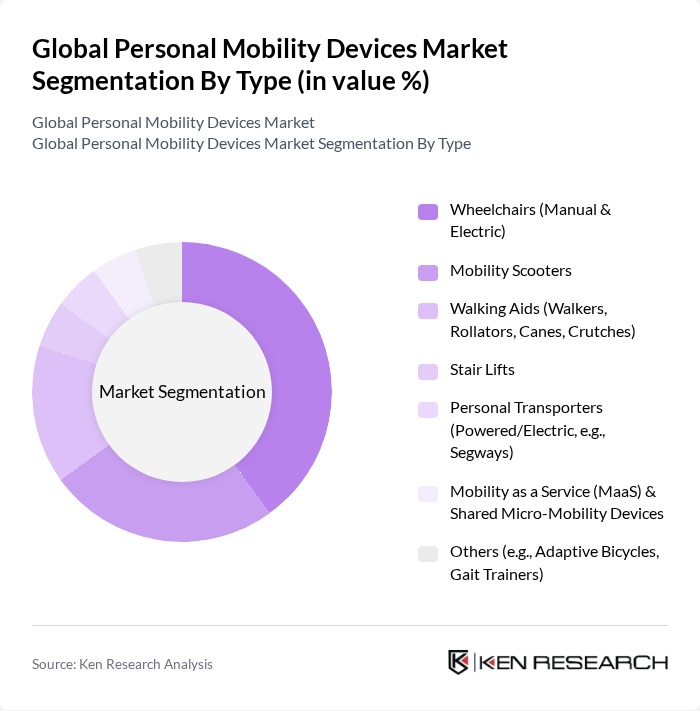

By Type:The market is segmented into various types of personal mobility devices, including wheelchairs, mobility scooters, walking aids, stair lifts, personal transporters, mobility as a service, and others. Among these, wheelchairs—both manual and electric—dominate the market due to their widespread use and essential role in enhancing mobility for individuals with disabilities and the elderly. The increasing demand for electric wheelchairs, which offer greater convenience, advanced controls, and ease of use, is particularly notable. Mobility scooters and walking aids are also experiencing significant growth, driven by the need for lightweight, portable, and smart-enabled devices .

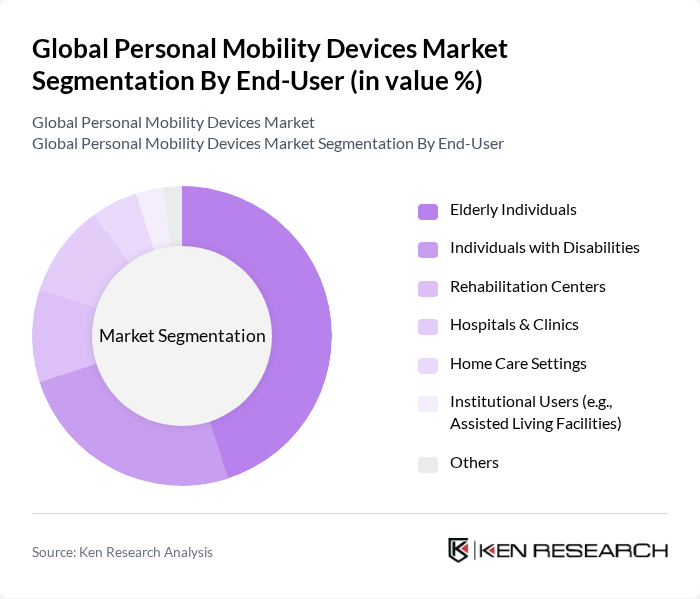

By End-User:The end-user segmentation includes elderly individuals, individuals with disabilities, rehabilitation centers, hospitals and clinics, home care settings, institutional users, and others. The elderly individuals segment is the largest due to the growing aging population, which necessitates mobility solutions to maintain independence and quality of life. Additionally, the increasing focus on home healthcare services and the rising prevalence of chronic conditions have further propelled the demand for mobility devices among this demographic .

The Global Personal Mobility Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Invacare Corporation, Sunrise Medical LLC, Permobil AB, Pride Mobility Products Corporation, Drive DeVilbiss Healthcare, Medline Industries, LP, Ottobock SE & Co. KGaA, Karman Healthcare, Inc., TGA Mobility Ltd., Hoveround Corporation, Electric Mobility Euro Ltd., Rollz International BV, NOVA Medical Products, Falcon Mobility Pte Ltd, Briggs Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of personal mobility devices is poised for transformative growth, driven by technological advancements and increasing consumer awareness. As the aging population expands and disability rates rise, demand for innovative mobility solutions will intensify. Companies are likely to focus on developing eco-friendly devices and integrating IoT technologies to enhance user experience. Additionally, partnerships with healthcare providers will facilitate better access to mobility solutions, ensuring that more individuals can benefit from these advancements in personal mobility.

| Segment | Sub-Segments |

|---|---|

| By Type | Wheelchairs (Manual & Electric) Mobility Scooters Walking Aids (Walkers, Rollators, Canes, Crutches) Stair Lifts Personal Transporters (Powered/Electric, e.g., Segways) Mobility as a Service (MaaS) & Shared Micro-Mobility Devices Others (e.g., Adaptive Bicycles, Gait Trainers) |

| By End-User | Elderly Individuals Individuals with Disabilities Rehabilitation Centers Hospitals & Clinics Home Care Settings Institutional Users (e.g., Assisted Living Facilities) Others |

| By Distribution Channel | Online Retail/E-commerce Offline Retail (Physical Stores, Pharmacies) Direct Sales (Manufacturer to Consumer) Medical Supply Stores Others (e.g., Rental Services) |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Material | Aluminum Steel Plastic Composite Materials (e.g., Carbon Fiber) |

| By Application | Indoor Use Outdoor Use Emergency/Temporary Use |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Scooters | 100 | Product Managers, Marketing Directors |

| Wheelchairs and Mobility Aids | 90 | Healthcare Professionals, Occupational Therapists |

| Personal Mobility Apps | 60 | App Developers, User Experience Designers |

| Shared Mobility Services | 80 | Operations Managers, Business Development Executives |

| Adaptive Vehicles | 40 | Automotive Engineers, Accessibility Consultants |

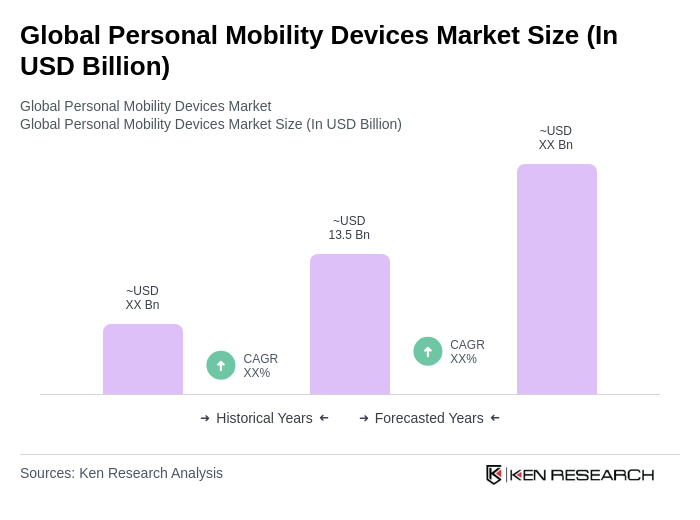

The Global Personal Mobility Devices Market is valued at approximately USD 13.5 billion, driven by factors such as an aging population, increasing disabilities, and technological advancements in mobility solutions.