Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0617

Pages:82

Published On:December 2025

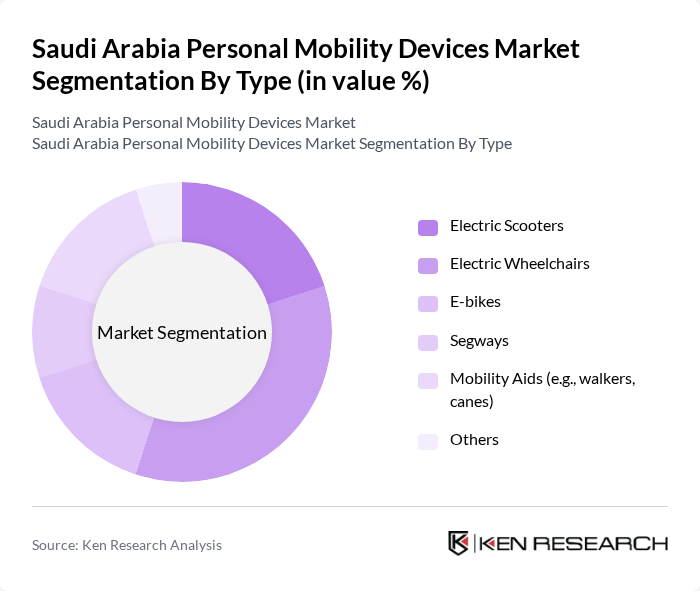

By Type:The market is segmented into various types of personal mobility devices, including electric scooters, electric wheelchairs, e-bikes, segways, mobility aids (such as walkers and canes), and others. Among these, electric wheelchairs and mobility aids are particularly popular due to their practicality and ease of use for individuals with mobility challenges. The increasing demand for lightweight and portable devices is also driving growth in the electric scooter and e-bike segments.

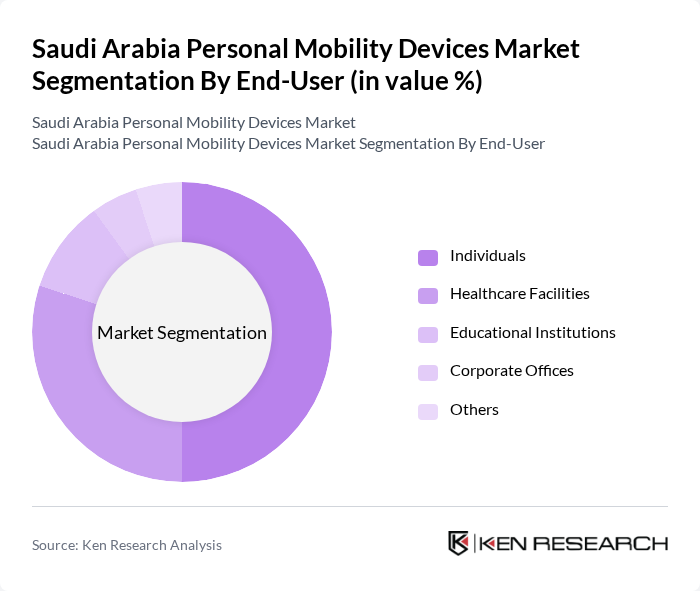

By End-User:The end-user segmentation includes individuals, healthcare facilities, educational institutions, corporate offices, and others. Individuals represent the largest segment, driven by the growing elderly population and increasing awareness of mobility solutions. Healthcare facilities also play a significant role, as they require various mobility devices for patient care and rehabilitation. The demand from educational institutions and corporate offices is gradually increasing as well.

The Saudi Arabia Personal Mobility Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pride Mobility Products Corporation, Invacare Corporation, Ottobock Healthcare, Medline Industries, and regional distributors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the personal mobility devices market in Saudi Arabia appears promising, driven by urbanization and government support. In the near future, advancements in technology, particularly in electric and hybrid mobility solutions, are expected to enhance user experience and accessibility. Additionally, the integration of smart technologies will likely create more efficient mobility options. As consumer awareness increases and infrastructure improves, the market is poised for significant growth, aligning with national sustainability goals and urban development plans.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Scooters Electric Wheelchairs E-bikes Segways Mobility Aids (e.g., walkers, canes) Others |

| By End-User | Individuals Healthcare Facilities Educational Institutions Corporate Offices Others |

| By Region | Riyadh Jeddah Dammam Khobar Others |

| By Application | Personal Use Commercial Use Medical Use Recreational Use Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand Preference | Local Brands International Brands Emerging Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for E-Scooters | 150 | Urban Residents, Young Professionals |

| Market Insights from Retailers | 100 | Retail Managers, Sales Executives |

| Government Policy Impact Assessment | 80 | Transportation Officials, Urban Planners |

| Usage Patterns of E-Bikes | 120 | Fitness Enthusiasts, Commuters |

| Feedback from Mobility Device Users | 90 | Current Users, Potential Buyers |

The Saudi Arabia Personal Mobility Devices Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by demographic changes and increasing mobility challenges among the elderly and those with chronic conditions.