Region:Asia

Author(s):Dev

Product Code:KRAB1918

Pages:88

Published On:January 2026

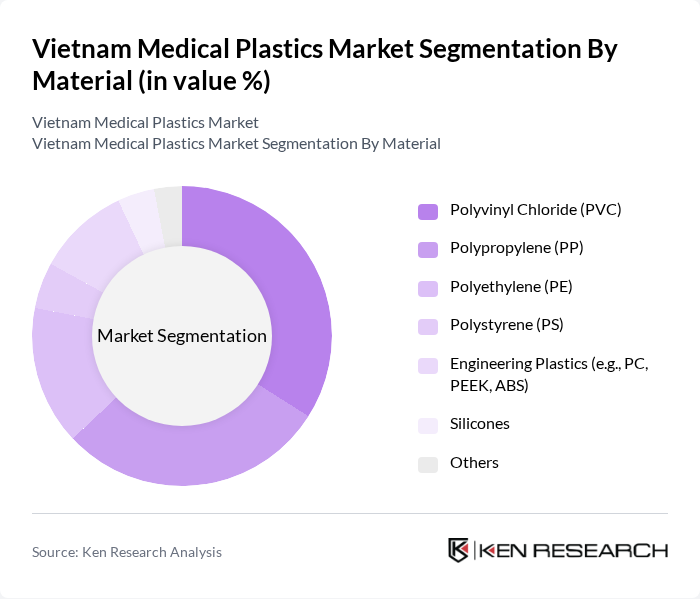

By Material:The material segmentation of the market includes various types of plastics used in medical applications. The primary materials are Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), Engineering Plastics (e.g., PC, PEEK, ABS), Silicones, and Others. Among these, PVC and PP are the most widely used due to their versatility, cost-effectiveness, ease of processing, and favorable properties for applications such as tubing, IV bags, syringes, and device housings.

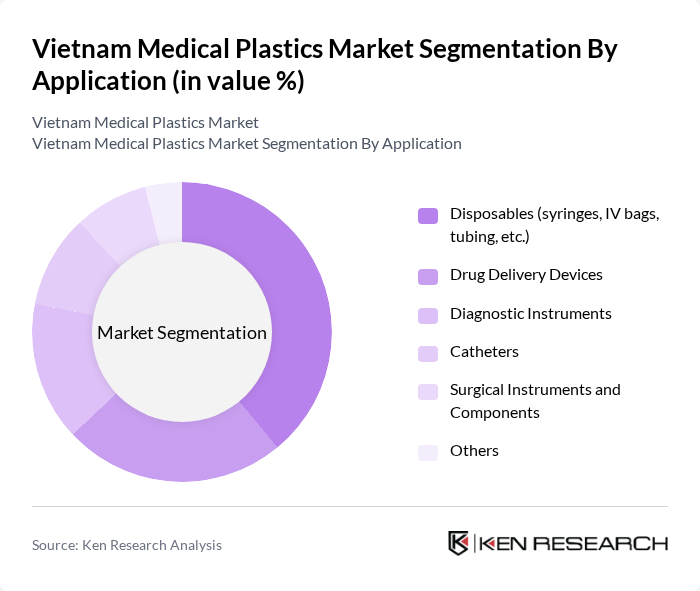

By Application:The application segmentation encompasses various uses of medical plastics in healthcare. Key applications include Disposables (syringes, IV bags, tubing, etc.), Drug Delivery Devices, Diagnostic Instruments, Catheters, Surgical Instruments and Components, and Others. The disposables segment is particularly dominant due to the increasing demand for single-use products in hospitals and clinics, driven by hygiene and safety concerns, infection control requirements, and alignment with international standards for sterile medical supplies.

The Vietnam Medical Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as An Phat Holdings JSC, Rang Dong Plastic Joint Stock Company, Binh Minh Plastics JSC, Tien Phong Plastic JSC, Tan Dai Hung Plastic J.S. Co., Nhat Tan Plastic Manufacturing and Trading Co., Ltd., RKW Vietnam Co., Ltd., SCG Chemicals Vietnam Co., Ltd., Dow Vietnam LLC, BASF Vietnam Co., Ltd., Avient Vietnam Co., Ltd., Nhua Y Te (Medical Plastics) Vietnam JSC, CPI Vietnam Plastic Limited Company, Nghi Son Refinery and Petrochemical LLC (NSRP), and other emerging local medical plastic converters contribute to innovation, geographic expansion, and service delivery in this space, supported by growing demand for high-quality medical-grade resins and components.

The Vietnam medical plastics market is poised for significant growth, driven by technological advancements and increasing healthcare investments. The integration of smart technologies in medical devices is expected to enhance product functionality and patient outcomes. Additionally, the shift towards sustainable materials will likely reshape the industry, as manufacturers seek to meet environmental standards. These trends indicate a dynamic market landscape, with opportunities for innovation and expansion in future.

| Segment | Sub-Segments |

|---|---|

| By Material | Polyvinyl Chloride (PVC) Polypropylene (PP) Polyethylene (PE) Polystyrene (PS) Engineering Plastics (e.g., PC, PEEK, ABS) Silicones Others |

| By Application | Disposables (syringes, IV bags, tubing, etc.) Drug Delivery Devices Diagnostic Instruments Catheters Surgical Instruments and Components Others |

| By End-Use Device Category | Single-use Medical Devices Reusable Medical Devices Medical Packaging and Containers Implants and Prosthetics Others |

| By Processing Technology | Injection Molding Extrusion Blow Molding Thermoforming D Printing / Additive Manufacturing Others |

| By Material Properties | Biocompatible Plastics Antimicrobial Plastics High-Temperature and Sterilization-Resistant Plastics Flexible and Elastomeric Plastics Bio-based and Recyclable Plastics Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Regulatory Compliance | ISO 13485 and related Quality Management Standards CE Marking FDA and other International Approvals Local Ministry of Health Approvals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 90 | Procurement Managers, Supply Chain Coordinators |

| Medical Device Manufacturers | 70 | Product Development Managers, Quality Assurance Heads |

| Healthcare Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Research Institutions | 60 | Research Scientists, Academic Professors |

| End-users in Clinics | 80 | Clinic Managers, Medical Practitioners |

The Vietnam Medical Plastics Market is valued at approximately USD 150 million, driven by increasing demand for medical devices, rising healthcare expenditures, and advancements in medical technology, particularly in single-use and implantable products.