Region:Middle East

Author(s):Shubham

Product Code:KRAB7598

Pages:99

Published On:October 2025

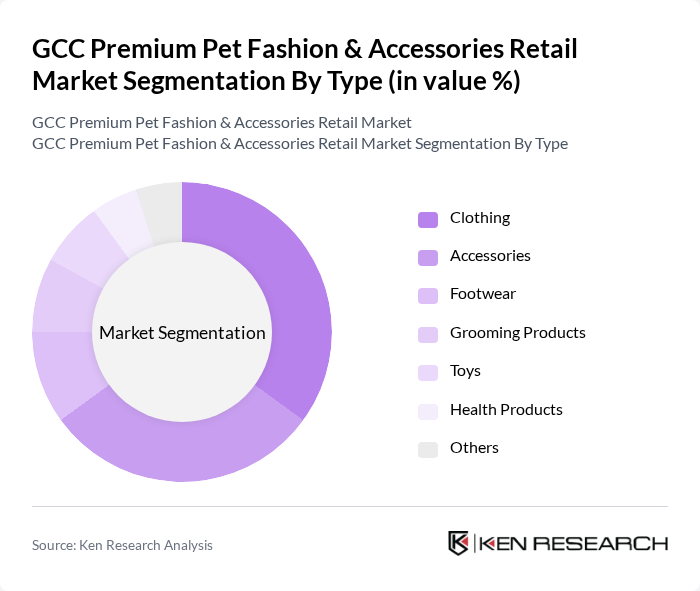

By Type:The segmentation by type includes various categories such as clothing, accessories, footwear, grooming products, toys, health products, and others. Among these, clothing and accessories are the most popular segments, driven by trends in pet fashion and the desire for personalization. Pet owners are increasingly purchasing stylish outfits and unique accessories to express their pets' personalities, leading to a significant market share for these subsegments.

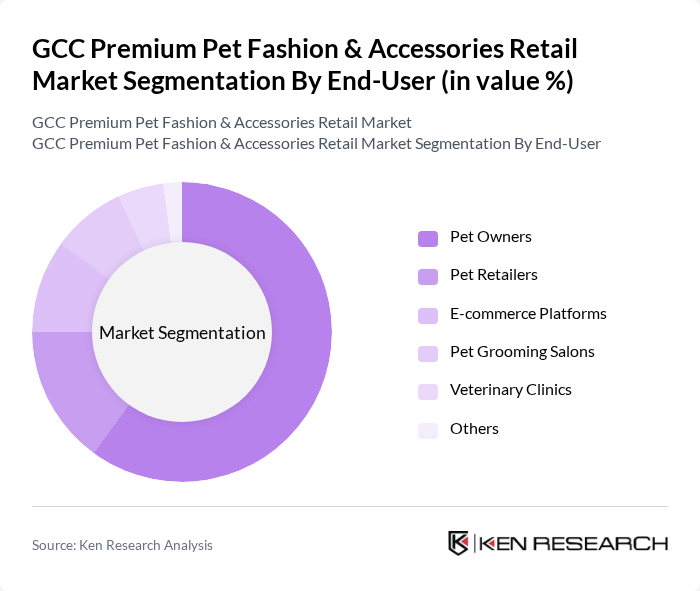

By End-User:The end-user segmentation includes pet owners, pet retailers, e-commerce platforms, pet grooming salons, veterinary clinics, and others. Pet owners represent the largest segment, as they are the primary consumers of premium pet fashion and accessories. The increasing trend of pet humanization has led to a rise in spending on pet-related products, with pet owners seeking high-quality and fashionable items for their pets.

The GCC Premium Pet Fashion & Accessories Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as PetSmart Inc., Petco Animal Supplies Inc., Chewy Inc., BarkBox Inc., PetFusion LLC, Pawsitively Posh Pets, Woof & Wonder, The Dog Bakery, Fable Pets, Posh Pet Boutique, The Green K9, Pet Accessories Online, PupJoy, Pet Fashionista, The Posh Puppy Boutique contribute to innovation, geographic expansion, and service delivery in this space.

The GCC premium pet fashion and accessories market is poised for dynamic growth, driven by evolving consumer preferences and increasing pet ownership. As disposable incomes rise, pet owners are likely to invest more in high-quality, fashionable products. Additionally, the trend towards sustainability will encourage brands to innovate eco-friendly offerings. The integration of technology in pet fashion, such as smart accessories, is expected to further enhance market appeal, creating a vibrant landscape for both established and emerging players in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Clothing Accessories Footwear Grooming Products Toys Health Products Others |

| By End-User | Pet Owners Pet Retailers E-commerce Platforms Pet Grooming Salons Veterinary Clinics Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Pet Expos and Trade Shows Subscription Services Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Cotton Polyester Leather Eco-friendly Materials Others |

| By Brand Positioning | Established Brands Emerging Brands Private Labels Others |

| By Distribution Mode | Direct Sales Wholesale Franchise Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Fashion Retailers | 100 | Store Owners, Retail Managers |

| Pet Accessory Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Pet Owners | 150 | Pet Owners, Pet Enthusiasts |

| Pet Influencers and Bloggers | 50 | Social Media Influencers, Content Creators |

| Pet Grooming Service Providers | 70 | Grooming Salon Owners, Service Managers |

The GCC Premium Pet Fashion & Accessories Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing pet ownership, rising disposable incomes, and the trend of treating pets as family members.