GCC Recreational Vehicle Rental Market Overview

- The GCC Recreational Vehicle Rental Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing popularity of road trips, a rise in domestic tourism, and the growing trend of outdoor recreational activities among the population. The market has seen a surge in demand for rental services, particularly during holiday seasons and major events. Enhanced consumer interest in experiential travel, flexible vacationing, and outdoor lifestyles are further accelerating market expansion.

- Key players in this market include the United Arab Emirates, Saudi Arabia, and Qatar. The UAE dominates due to its well-developed tourism infrastructure, luxury offerings, and a high influx of international tourists. Saudi Arabia's growing interest in tourism, especially with initiatives like Vision 2030, and Qatar's investment in tourism for events like the FIFA World Cup have also contributed to their market prominence. Major events and government-backed tourism initiatives continue to drive demand for recreational vehicle rentals in these countries.

- In 2023, the Saudi Arabian government implemented regulations to promote the recreational vehicle rental industry, including a licensing framework for rental companies and safety standards for vehicles. This initiative aims to enhance consumer confidence and ensure a safe and enjoyable experience for tourists and locals alike. The operational framework is governed by the "Tourism Law, 2023" issued by the Ministry of Tourism, Saudi Arabia, establishing mandatory licensing requirements, vehicle safety inspections, and compliance thresholds for all rental operators.

GCC Recreational Vehicle Rental Market Segmentation

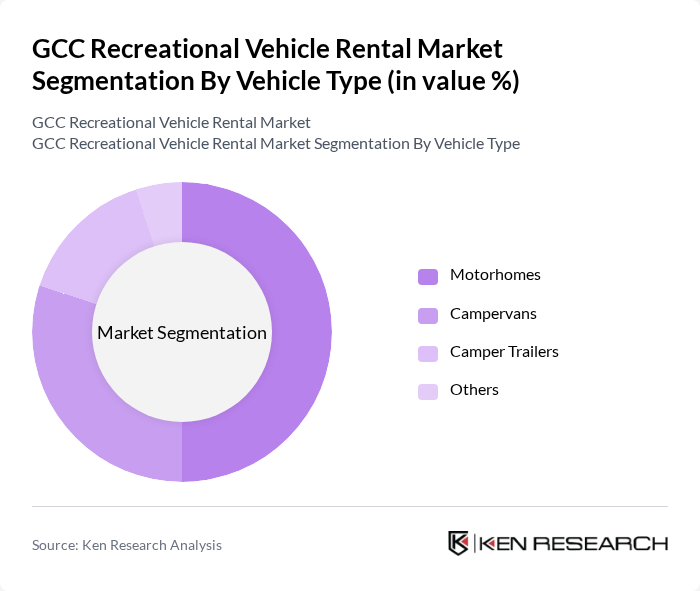

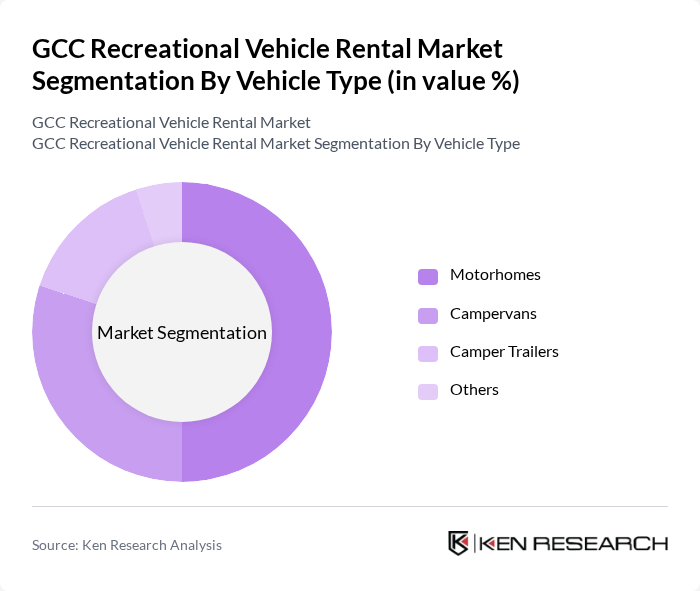

By Vehicle Type:The vehicle type segmentation includes Motorhomes, Campervans, Camper Trailers, and Others. Motorhomes are the most popular choice among consumers due to their spaciousness and amenities, making them ideal for family trips and long journeys. Campervans are favored for their compact size and ease of maneuverability, while camper trailers offer a cost-effective option for those who own a vehicle capable of towing. The "Others" category includes unique vehicles that cater to niche markets, such as specialty adventure vehicles and luxury custom RVs.

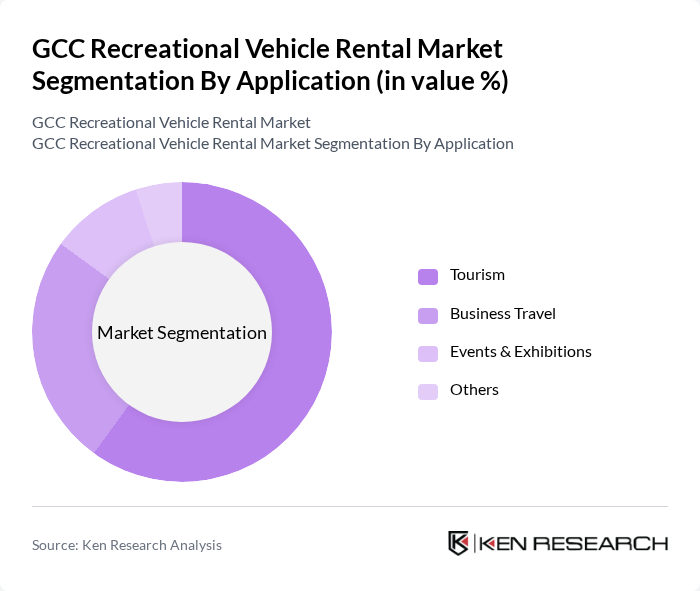

By Application:The application segmentation includes Tourism, Business Travel, Events & Exhibitions, and Others. Tourism is the leading application segment, driven by the increasing number of tourists seeking unique travel experiences and adventure travel. Business travel is also significant, as companies often rent vehicles for corporate retreats and client meetings. Events and exhibitions contribute to the market as well, with many organizations opting for RV rentals for convenience and comfort during large gatherings. The "Others" category encompasses specialty uses such as film production, mobile clinics, and promotional tours.

GCC Recreational Vehicle Rental Market Competitive Landscape

The GCC Recreational Vehicle Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apollo Motorhomes UAE, Motorhome Rental Middle East, Go Camper Dubai, Dubai Motorhome, Campers & Dunes, Luxury Motorhome Rental Dubai, Road Trip Arabia, Gozoop RV Rentals, Nomad RV Rentals, Caravan King Qatar, Gulf Motorhomes, Qatar Motorhome Rentals, Saudi Campers, Oman Motorhome Rentals, Bahrain RV Rentals contribute to innovation, geographic expansion, and service delivery in this space.

GCC Recreational Vehicle Rental Market Industry Analysis

Growth Drivers

- Increasing Tourism Activities:The GCC region is witnessing a surge in tourism, with over 32 million international visitors expected in future, according to the World Tourism Organization. This influx is driven by major events like Expo 2020 in Dubai and the FIFA World Cup in Qatar. The growing number of tourists is creating a higher demand for recreational vehicle rentals, as travelers seek flexible and unique ways to explore the region's diverse landscapes and attractions.

- Rising Disposable Income:The average disposable income in the GCC countries is approximately $32,000 per capita, according to the International Monetary Fund. This increase in disposable income allows consumers to spend more on leisure activities, including recreational vehicle rentals. As families and individuals prioritize travel and outdoor experiences, the demand for RV rentals is expected to grow significantly, catering to a more affluent customer base.

- Expansion of Rental Services:The number of recreational vehicle rental companies in the GCC has increased by 25% from 2022 to 2023, according to industry reports. This expansion is driven by the growing recognition of RVs as a viable travel option. Enhanced service offerings, including delivery and pick-up options, are making rentals more accessible. As competition increases, companies are likely to innovate and improve customer experiences, further driving market growth.

Market Challenges

- High Initial Investment Costs:Starting a recreational vehicle rental business in the GCC requires significant capital investment, often exceeding $500,000 for a fleet of vehicles. This high entry barrier can deter potential entrepreneurs and limit market competition. Additionally, ongoing maintenance and operational costs can further strain financial resources, making it challenging for new entrants to establish a foothold in the market.

- Regulatory Compliance Issues:The GCC region has stringent regulations governing vehicle rentals, including licensing and safety standards. For instance, companies must comply with local laws that require regular inspections and certifications, which can be costly and time-consuming. Non-compliance can lead to hefty fines or business closures, creating a challenging environment for rental companies trying to navigate these complex regulatory landscapes.

GCC Recreational Vehicle Rental Market Future Outlook

The future of the GCC recreational vehicle rental market appears promising, driven by increasing tourism and a growing interest in outdoor activities. As disposable incomes rise, consumers are likely to seek more personalized travel experiences. Additionally, the integration of technology in rental services, such as mobile booking platforms, will enhance customer convenience. Companies that adapt to these trends and focus on sustainability will likely capture a larger market share, positioning themselves for long-term success in this evolving landscape.

Market Opportunities

- Development of Luxury RV Rentals:The demand for luxury RV rentals is on the rise, with an estimated market potential of $200 million by future. As affluent travelers seek unique experiences, companies can capitalize on this trend by offering high-end vehicles equipped with modern amenities, catering to a niche market that values comfort and exclusivity.

- Partnerships with Travel Agencies:Collaborating with travel agencies can significantly enhance visibility and customer reach. By forming strategic partnerships, rental companies can tap into established customer bases, potentially increasing bookings by 15-20%. This approach not only boosts sales but also provides travel agencies with additional offerings, enhancing their service portfolio.