Region:Middle East

Author(s):Shubham

Product Code:KRAD0806

Pages:87

Published On:August 2025

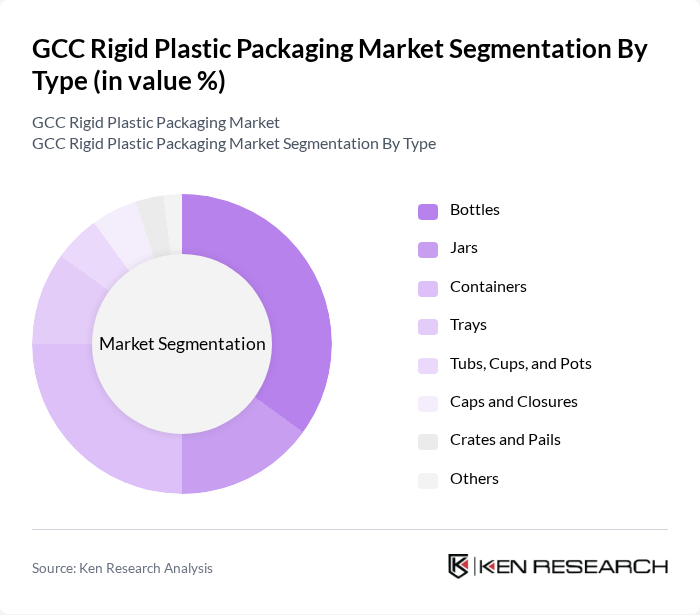

By Type:The rigid plastic packaging market is segmented into bottles, jars, containers, trays, tubs, cups, pots, caps, closures, crates, pails, and others. Among these, bottles and containers are the most dominant segments due to their versatility and widespread use in the food and beverage industry. The increasing demand for bottled beverages and ready-to-eat meals has significantly contributed to the growth of these subsegments. The use of rigid plastic packaging in food and beverage applications is further driven by its ability to provide durability, shelf stability, and product safety .

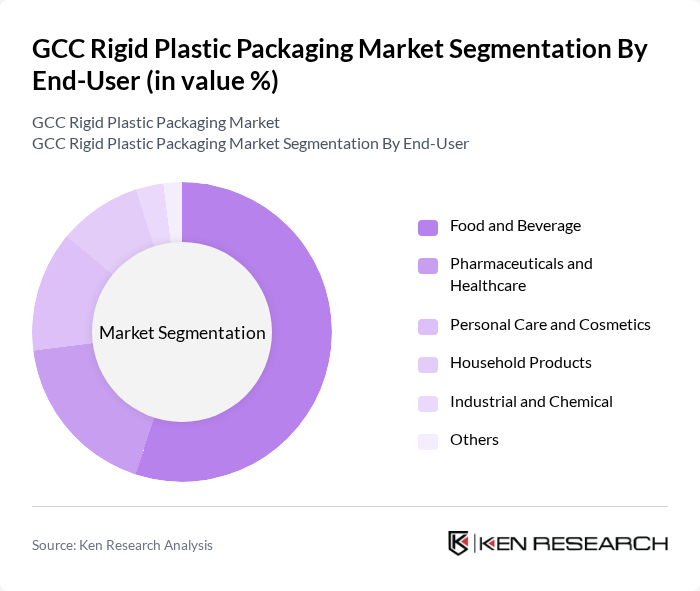

By End-User:The end-user segmentation includes food and beverage, pharmaceuticals and healthcare, personal care and cosmetics, household products, industrial and chemical, and others. The food and beverage sector is the largest consumer of rigid plastic packaging, driven by the increasing demand for packaged food products and beverages. This trend is further supported by the growing health consciousness among consumers, leading to a rise in the consumption of packaged goods. The pharmaceutical industry is also a rapidly growing end-user segment due to the need for sanitary and tamper-evident packaging solutions .

The GCC Rigid Plastic Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zamil Plastic Industries Ltd., Takween Advanced Industries, Packaging Products Company (PPC), Al Bayader International, Gulf Plastic Industries Co. SAOG, National Plastic Factory LLC, Interplast Co. Ltd. (Harwal Group), Abu Dhabi National Industrial Projects Co. (ADNIP), Al Jabri Plastic Factory, Al Watania Plastics, Al Amer Packaging Industries, Alpla Gulf (ALPLA Group), Al Rashed Plastic Factory, Al Khaleej Plastic Industries, Arabian Gulf Manufacturers Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The GCC rigid plastic packaging market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt smart packaging technologies, the integration of IoT and QR codes will enhance product traceability and consumer engagement. Additionally, the focus on circular economy practices will encourage recycling initiatives, fostering a sustainable packaging ecosystem. These trends indicate a dynamic market landscape, where innovation and sustainability will play pivotal roles in shaping future developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles Jars Containers Trays Tubs, Cups, and Pots Caps and Closures Crates and Pails Others |

| By End-User | Food and Beverage Pharmaceuticals and Healthcare Personal Care and Cosmetics Household Products Industrial and Chemical Others |

| By Material Type | Polyethylene (PE) – HDPE, LDPE Polypropylene (PP) Polyethylene Terephthalate (PET) Polyvinyl Chloride (PVC) Polystyrene (PS) Bioplastics and Others |

| By Application | Packaging Storage Transportation Display Others |

| By Distribution Channel | Direct Sales Retail E-commerce Distributors Others |

| By Price Range | Economy Mid-range Premium |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Rest of GCC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 100 | Packaging Managers, Product Development Leads |

| Healthcare Packaging Solutions | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging | 80 | Brand Managers, Supply Chain Coordinators |

| Industrial Packaging Applications | 50 | Operations Managers, Procurement Specialists |

| Recycling and Sustainability Initiatives | 40 | Sustainability Officers, Environmental Compliance Managers |

The GCC Rigid Plastic Packaging Market is valued at approximately USD 4.5 billion, reflecting a significant growth driven by the demand for sustainable packaging solutions and the expansion of the food and beverage sector in the region.