Region:Global

Author(s):Rebecca

Product Code:KRAC0168

Pages:83

Published On:August 2025

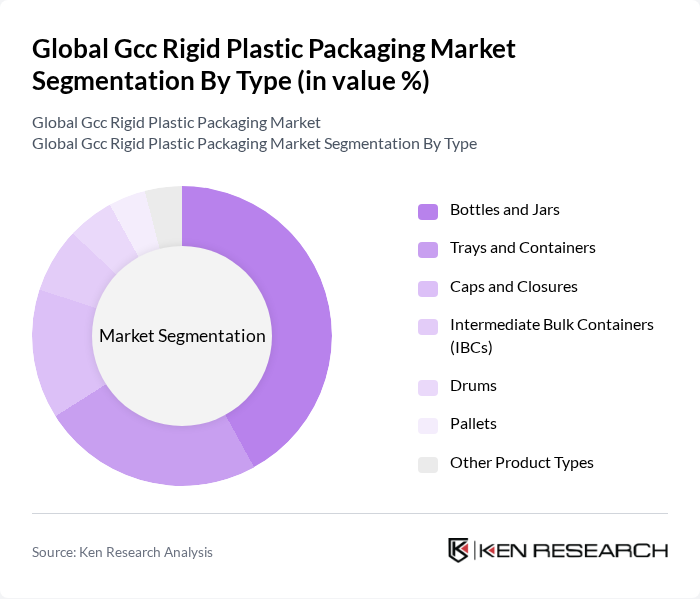

By Type:The rigid plastic packaging market is segmented into bottles and jars, trays and containers, caps and closures, intermediate bulk containers (IBCs), drums, pallets, and other product types. Bottles and jars are the most dominant sub-segment, accounting for approximately 42–43% of the market, driven by their extensive use in the beverage, personal care, and healthcare industries. Trays and containers play a crucial role in food packaging, especially for ready-to-eat meals and food service applications. Caps and closures remain essential for beverage, personal care, and pharmaceutical packaging, while other product types—including custom molded and specialized packaging—serve diverse industrial and consumer needs.

By End-User Industry:The end-user segmentation includes food, food service, beverage, healthcare, cosmetics and personal care, industrial, building and construction, automotive, and other end-user industries. The food and beverage industry is the leading segment, accounting for more than half of the market demand, driven by rising packaged food consumption and the need for safe, hygienic, and sustainable packaging solutions. The healthcare segment is the fastest-growing, propelled by increased demand for sanitary and tamper-evident packaging for pharmaceuticals and health supplements.

The Global GCC Rigid Plastic Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Berry Global, Inc., Sealed Air Corporation, Sonoco Products Company, Mondi Group, Zamil Plastic Industries Ltd., Takween Advanced Industries, Packaging Products Company Ltd., INDEVCO Group, Almarai Company, Alpla Group, Napco National, Al Watania Plastics, Al Bayader International, Huhtamaki Oyj contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC rigid plastic packaging market appears promising, driven by ongoing innovations in sustainable materials and smart packaging technologies. As consumer preferences continue to evolve towards eco-friendly and safe packaging solutions, companies are likely to invest in research and development to meet these demands. Additionally, the expansion of e-commerce is expected to further boost the market, as online retailers increasingly seek efficient and protective packaging options to enhance customer satisfaction and reduce returns.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles and Jars Trays and Containers Caps and Closures Intermediate Bulk Containers (IBCs) Drums Pallets Other Product Types |

| By End-User Industry | Food (Candy and Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, Seafood, Pet Food, Other Food Products) Food Service (QSRs, FSRs, Coffee & Snack Outlets, Retail, Institutional, Hospitality, Other Food Service Sectors) Beverage Healthcare Cosmetics and Personal Care Industrial Building and Construction Automotive Other End-User Industries |

| By Resin Type | Polyethylene (PE) Polypropylene (PP) Polyethylene Terephthalate (PET) Polystyrene (PS) and Expanded Polystyrene (EPS) Polyvinyl Chloride (PVC) Other Resin Types |

| By Application | Packaging for Food Products Packaging for Non-Food Products Packaging for Medical Products Packaging for Personal Care Products Other Applications |

| By Distribution Channel | Direct Sales Retail E-commerce Distributors Other Channels |

| By Country | United Arab Emirates Saudi Arabia Qatar Rest of GCC |

| By Price Range | Economy Mid-Range Premium Other Price Ranges |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Engineers, Product Development Managers |

| Pharmaceutical Packaging Solutions | 80 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging | 100 | Brand Managers, Supply Chain Coordinators |

| Industrial Packaging Applications | 60 | Operations Managers, Procurement Specialists |

| Sustainability Initiatives in Packaging | 50 | Sustainability Officers, Corporate Social Responsibility Managers |

The Global GCC Rigid Plastic Packaging Market is valued at approximately USD 4.5 billion, driven by increasing demand for sustainable packaging solutions, particularly in the food and beverage sector, which constitutes over half of the market demand.