Region:Middle East

Author(s):Rebecca

Product Code:KRAD4941

Pages:81

Published On:December 2025

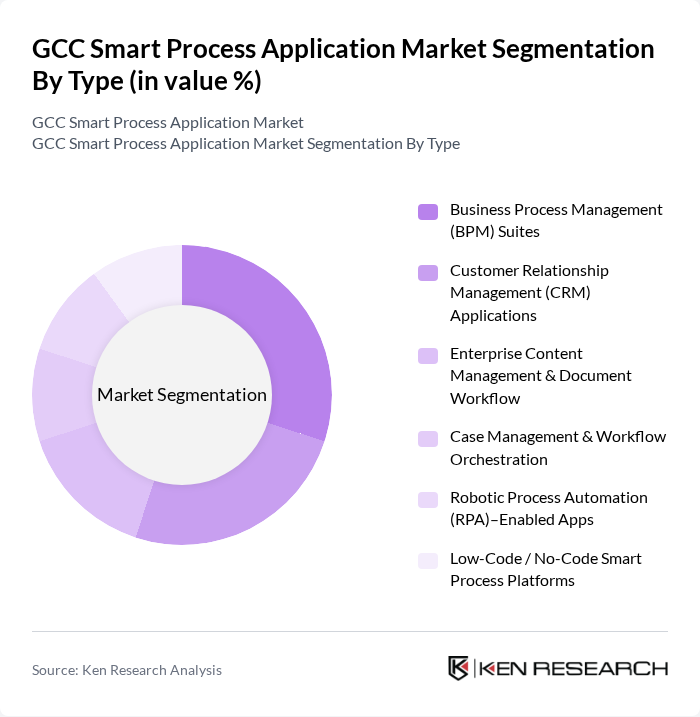

By Type:The market is segmented into various types of smart process applications, including Business Process Management (BPM) Suites, Customer Relationship Management (CRM) Applications, Enterprise Content Management & Document Workflow, Case Management & Workflow Orchestration, Robotic Process Automation (RPA)–Enabled Apps, and Low-Code / No-Code Smart Process Platforms. Each of these sub-segments plays a crucial role in enhancing operational efficiency and customer engagement.

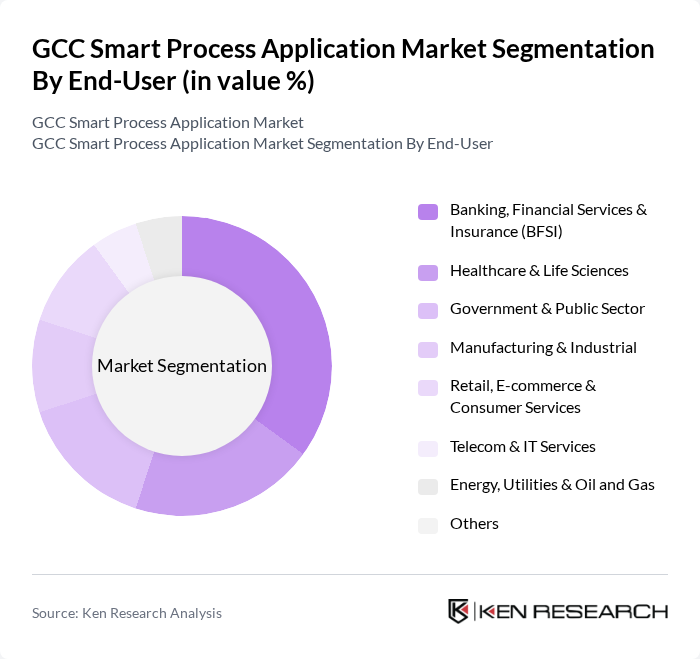

By End-User:The end-user segmentation includes Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Government & Public Sector, Manufacturing & Industrial, Retail, E-commerce & Consumer Services, Telecom & IT Services, Energy, Utilities & Oil and Gas, and Others. Each sector has unique requirements and is increasingly leveraging smart process applications to enhance operational efficiency and customer satisfaction.

The GCC Smart Process Application Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, International Business Machines Corporation (IBM), Salesforce, Inc., ServiceNow, Inc., Pegasystems Inc., Appian Corporation, Zoho Corporation Pvt. Ltd., Nintex Global Ltd., QlikTech International AB, TIBCO Software Inc., UiPath Inc., Automation Anywhere, Inc., Kissflow Inc., Newgen Software Technologies Ltd., Majid Al Futtaim – e?Solutions & Digital Labs, STC Solutions (Saudi Telecom Company), Etisalat by e& – Digital & Cloud Services, Inovar (Inovar Technologies – GCC Digital Transformation Partner) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC smart process application market appears promising, driven by technological advancements and increasing digital transformation initiatives. In future, the integration of artificial intelligence and machine learning into smart applications is expected to enhance decision-making processes significantly. Additionally, the growing emphasis on sustainability and eco-friendly practices will likely influence the development of innovative solutions that align with regional goals for economic diversification and environmental responsibility, fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Business Process Management (BPM) Suites Customer Relationship Management (CRM) Applications Enterprise Content Management & Document Workflow Case Management & Workflow Orchestration Robotic Process Automation (RPA)–Enabled Apps Low-Code / No-Code Smart Process Platforms |

| By End-User | Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Government & Public Sector Manufacturing & Industrial Retail, E?commerce & Consumer Services Telecom & IT Services Energy, Utilities & Oil and Gas Others |

| By Deployment Model | On-Premises Public Cloud Private Cloud Hybrid |

| By Industry Vertical | Telecommunications & IT Energy, Utilities & Oil and Gas Transportation, Logistics & Smart Mobility Government, Smart Cities & Public Administration Banking, Financial Services & Insurance (BFSI) Healthcare, Education & Social Services Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Technology | Artificial Intelligence & Machine Learning Big Data & Advanced Analytics Robotic Process Automation (RPA) Intelligent Document Processing & OCR Low-Code / No-Code Development Others |

| By Policy Support | National Digital Transformation Programs E?Government & Smart City Initiatives Tax Incentives & Investment-Friendly Regulations R&D Funding, Innovation Hubs & Sandboxes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Smart Applications | 120 | IT Managers, Healthcare Administrators |

| Financial Services Automation | 100 | Chief Technology Officers, Operations Managers |

| Manufacturing Process Optimization | 90 | Production Managers, Supply Chain Analysts |

| Retail Sector Digital Transformation | 110 | Retail Managers, E-commerce Directors |

| Government Smart Initiatives | 80 | Policy Makers, IT Directors |

The GCC Smart Process Application Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by digital transformation initiatives across various sectors, including banking, healthcare, and government.