Region:Middle East

Author(s):Shubham

Product Code:KRAD5549

Pages:89

Published On:December 2025

By Display Technology:The display technology segment includes various types of surgical displays that cater to different surgical needs. The subsegments are LED?backlit LCD Surgical Displays, OLED Surgical Displays, 3D Surgical Displays, 4K / Ultra?High?Definition Surgical Displays, and Others (Projected, CRT, and Legacy Technologies). LED?backlit LCD Surgical Displays are currently leading the market due to their cost?effectiveness, proven reliability, and widespread adoption in hospitals globally and within the Middle East and Africa region. OLED displays are gaining traction for their superior contrast ratios, color accuracy, and wide viewing angles, particularly in high?end integrated operating rooms, while 4K / Ultra?High?Definition displays are becoming increasingly popular for their high resolution and detail rendition that enhance depth perception and surgical precision in minimally invasive and robotic procedures.

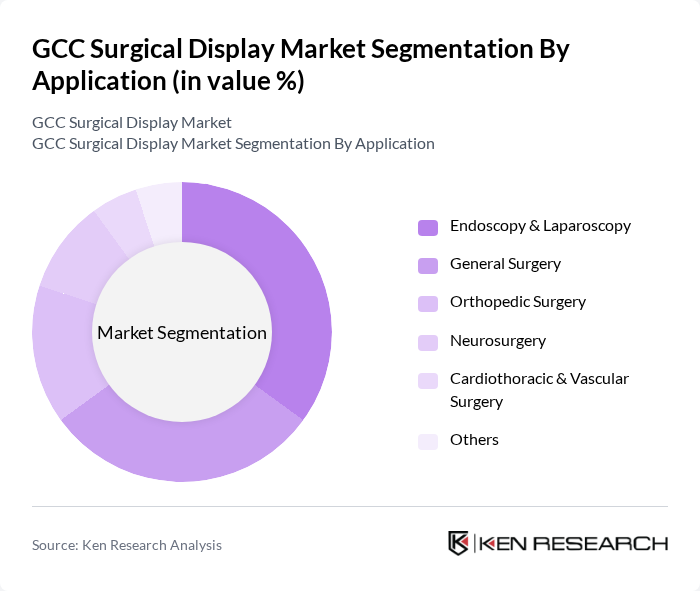

By Application:The application segment encompasses various surgical fields utilizing surgical displays, including Endoscopy & Laparoscopy, General Surgery, Orthopedic Surgery, Neurosurgery, Cardiothoracic & Vascular Surgery, and Others. Endoscopy & Laparoscopy is the leading application area, driven by the increasing preference for minimally invasive procedures and the need for high?resolution, real?time visualization throughout the GCC and broader Middle East and Africa. General Surgery follows closely, as it encompasses a wide range of procedures performed in digital and hybrid operating rooms, where multi?modality imaging and stable color reproduction are essential. The demand for advanced imaging technologies, including 4K and 3D displays, across orthopedic, neurosurgery, and cardiothoracic & vascular surgery is further propelling the adoption of surgical displays for complex interventions and image?guided surgeries.

The GCC Surgical Display Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barco NV, EIZO Corporation, Sony Group Corporation, Stryker Corporation, Olympus Corporation, STERIS plc, LG Electronics Inc., Shenzhen JLD Display Technology Co., Ltd. (Reshin), NDS Surgical Imaging (Novanta Inc.), Mindray Medical International Limited, BenQ Medical Technology Corporation, Shenzhen Beacon Display Technology Co., Ltd., FSN Medical Technologies, Advantech Co., Ltd., TRUMPF Medizin Systeme GmbH + Co. KG contribute to innovation, geographic expansion, and service delivery in this space, with portfolios spanning full?HD, 4K, and, increasingly, 3D surgical monitors tailored for endoscopy, laparoscopy, hybrid ORs, and image?guided interventions.

The future of the GCC surgical display market appears promising, driven by ongoing technological innovations and increasing healthcare investments. As healthcare facilities continue to adopt integrated surgical solutions, the demand for high-definition and 3D displays is expected to rise. Furthermore, the growing trend of telemedicine and remote surgeries will likely create new avenues for surgical display applications, enhancing accessibility and efficiency in surgical procedures across the region.

| Segment | Sub-Segments |

|---|---|

| By Display Technology | LED?backlit LCD Surgical Displays OLED Surgical Displays D Surgical Displays K / Ultra?High?Definition Surgical Displays Others (Projected, CRT, and Legacy Technologies) |

| By Application | Endoscopy & Laparoscopy General Surgery Orthopedic Surgery Neurosurgery Cardiothoracic & Vascular Surgery Others |

| By End?User | Public Hospitals Private Hospitals Ambulatory Surgical Centers Specialty Clinics Academic & Research Institutions |

| By Display Resolution | Full HD (1080p) K / UHD (2160p) K and Above Others (Below Full HD) |

| By Screen Size | Less than 27?inch ? to 32?inch ? to 42?inch Above 42?inch |

| By Connectivity | Wired Connectivity Wireless Connectivity Hybrid (Wired + Wireless) |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Surgical Departments | 120 | Surgeons, Surgical Coordinators |

| Healthcare IT Management | 90 | IT Managers, System Administrators |

| Medical Device Procurement | 80 | Procurement Officers, Supply Chain Managers |

| Biomedical Engineering Teams | 70 | Biomedical Engineers, Product Development Leads |

| Healthcare Policy Makers | 60 | Health Administrators, Policy Analysts |

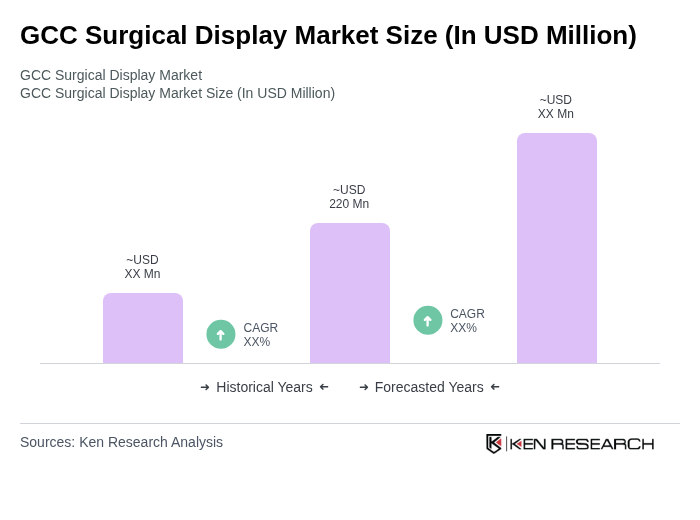

The GCC Surgical Display Market is valued at approximately USD 220 million, reflecting significant growth driven by advancements in medical imaging technology and increasing demand for minimally invasive surgeries across the region.