Region:Middle East

Author(s):Dev

Product Code:KRAB7254

Pages:94

Published On:October 2025

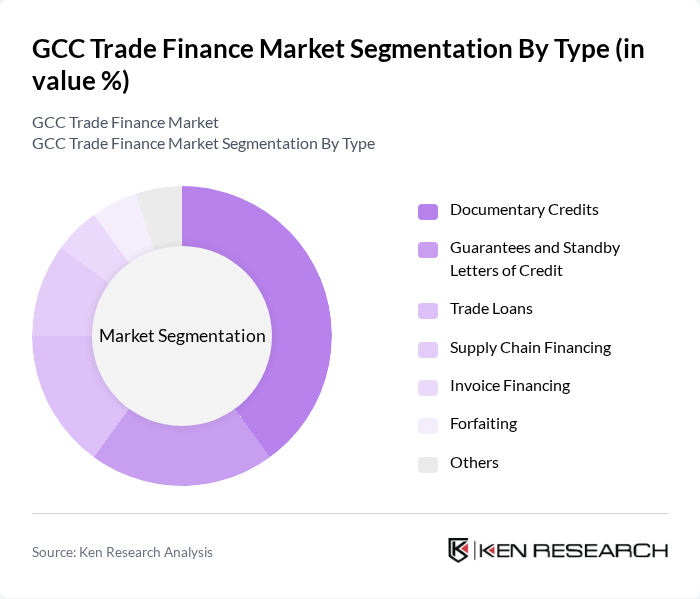

By Type:The segmentation by type includes various financial instruments used in trade finance. The subsegments are Documentary Credits, Guarantees and Standby Letters of Credit, Trade Loans, Supply Chain Financing, Invoice Financing, Forfaiting, and Others. Among these, Documentary Credits are the most widely used due to their reliability and security in international trade transactions.

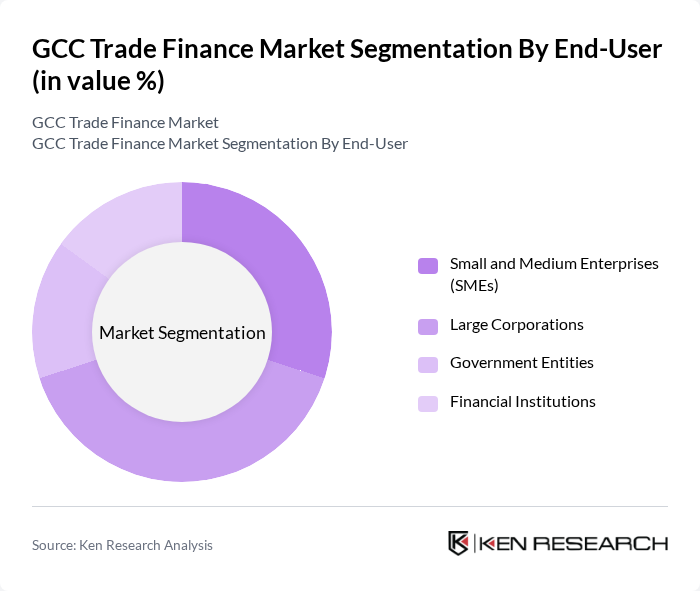

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Financial Institutions. SMEs are increasingly utilizing trade finance solutions to enhance their export capabilities, while large corporations leverage these services to manage their complex supply chains effectively.

The GCC Trade Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Qatar National Bank, Abu Dhabi Commercial Bank, National Bank of Kuwait, Saudi British Bank, Al Baraka Banking Group, Gulf Bank, Bank of Bahrain and Kuwait, Arab National Bank, Mashreq Bank, First Abu Dhabi Bank, Qatar Islamic Bank, Riyad Bank, Bank Al Jazira, Oman Arab Bank contribute to innovation, geographic expansion, and service delivery in this space.

The GCC trade finance market is poised for significant transformation, driven by technological advancements and evolving business needs. As digital transformation accelerates, financial institutions are expected to enhance their service offerings, integrating AI and machine learning to streamline processes. Additionally, sustainability will become a focal point, with increasing demand for green financing solutions. These trends will likely reshape the competitive landscape, fostering innovation and collaboration among stakeholders in the trade finance ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Documentary Credits Guarantees and Standby Letters of Credit Trade Loans Supply Chain Financing Invoice Financing Forfaiting Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Government Entities Financial Institutions |

| By Industry | Manufacturing Retail Agriculture Construction Energy Transportation Others |

| By Region | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By Financing Type | Short-term Financing Medium-term Financing Long-term Financing |

| By Payment Method | Cash in Advance Open Account Consignment |

| By Policy Support | Subsidies Tax Exemptions Trade Agreements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Trade Finance | 100 | Trade Finance Managers, Relationship Managers |

| Exporters in Oil & Gas | 80 | Export Managers, Financial Controllers |

| Importers in Consumer Goods | 70 | Supply Chain Managers, Procurement Officers |

| Logistics Providers | 60 | Operations Managers, Business Development Executives |

| Government Trade Agencies | 50 | Policy Advisors, Trade Analysts |

The GCC Trade Finance Market is valued at approximately USD 50 billion, reflecting a significant increase driven by rising trade activities, economic diversification, and the expansion of e-commerce in the region.