Region:Europe

Author(s):Geetanshi

Product Code:KRAD0125

Pages:83

Published On:August 2025

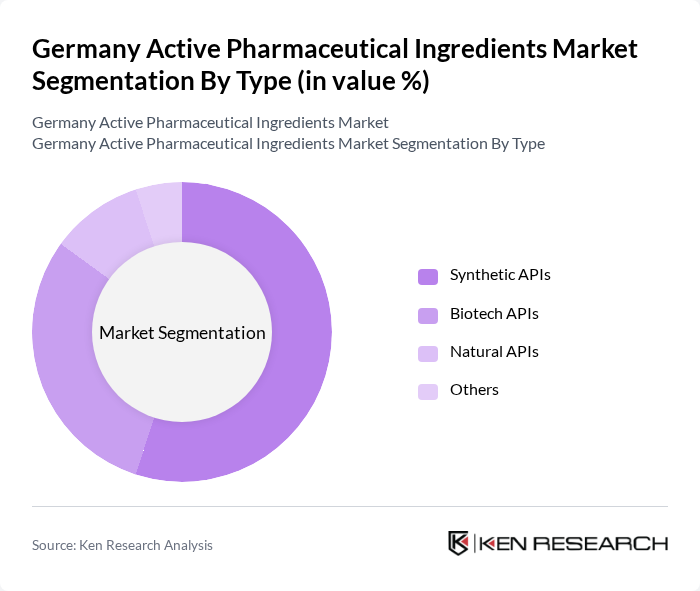

By Type:The market is segmented into Synthetic APIs, Biotech APIs, Natural APIs, and Others. Among these, Synthetic APIs continue to dominate the market due to their widespread use across multiple therapeutic areas, established manufacturing processes, and cost-effectiveness. Biotech APIs are gaining significant traction, driven by the increasing burden of chronic diseases, the rising demand for targeted therapies, and the rapid adoption of biosimilars. Natural APIs, while still a niche segment, are witnessing steady growth due to the rising consumer preference for herbal and natural products and the expansion of nutraceutical applications .

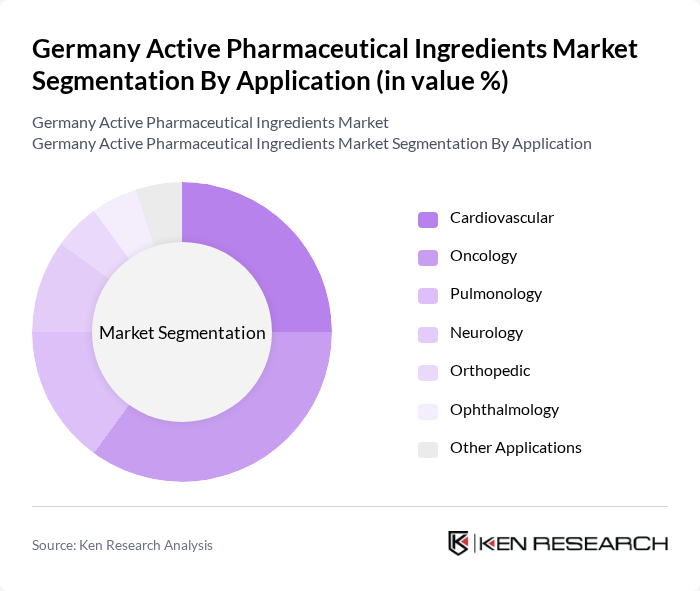

By Application:The applications of active pharmaceutical ingredients include Cardiovascular, Oncology, Pulmonology, Neurology, Orthopedic, Ophthalmology, and Other Applications. The Oncology segment is the leading application area, driven by the rising incidence of cancer, increasing investment in cancer research, and the growing pipeline of oncology drugs. Cardiovascular applications also hold a significant share, reflecting the high prevalence of cardiovascular diseases and the increasing demand for related therapies. Pulmonology, neurology, and other therapeutic areas are also witnessing growth due to the expanding pharmaceutical manufacturing base and the introduction of novel therapies .

The Germany Active Pharmaceutical Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Boehringer Ingelheim GmbH, Merck KGaA, Evonik Industries AG, Siegfried Holding AG, Wacker Chemie AG, Lonza Group AG, Hovione, Aenova Group, Famar Health Care Services, Cambrex Corporation, Recipharm AB, Piramal Pharma Solutions, Aurobindo Pharma Limited, BioNTech SE, Sanofi S.A., and Novartis AG contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Germany active pharmaceutical ingredients market appears promising, driven by ongoing innovations and a focus on sustainability. The shift towards biologics and personalized medicine is expected to accelerate, with investments in R&D projected to reach €1.5 billion in future. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and quality control, positioning Germany as a key player in the global pharmaceutical landscape. The emphasis on sustainable practices will also shape the market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic APIs Biotech APIs Natural APIs Others |

| By Application | Cardiovascular Oncology Pulmonology Neurology Orthopedic Ophthalmology Other Applications |

| By End-User | Pharmaceutical Companies Contract Manufacturing Organizations (CMOs) Research Institutions Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North Germany South Germany East Germany West Germany |

| By Regulatory Compliance | EU Regulations National Regulations International Standards Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing | 100 | Production Managers, Quality Control Officers |

| Regulatory Affairs | 60 | Regulatory Affairs Managers, Compliance Officers |

| API Sourcing and Procurement | 50 | Procurement Managers, Supply Chain Analysts |

| Research and Development | 40 | R&D Directors, Formulation Scientists |

| Market Access and Pricing | 40 | Market Access Managers, Pricing Analysts |

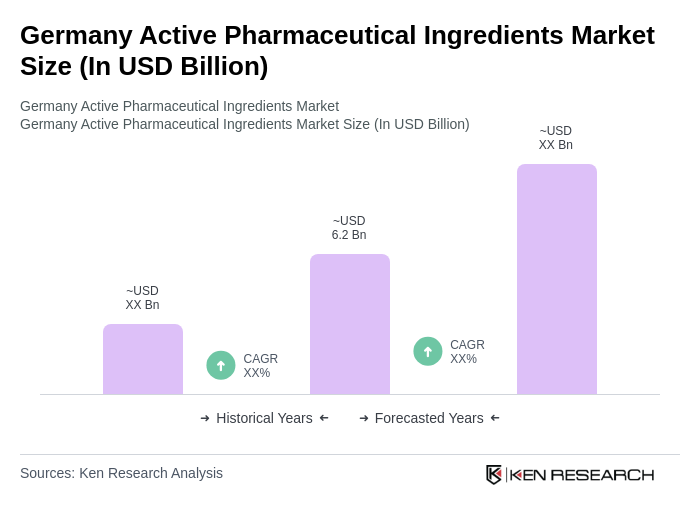

The Germany Active Pharmaceutical Ingredients Market is valued at approximately USD 6.2 billion, reflecting a robust growth driven by increasing pharmaceutical demand, an aging population, and a strong regulatory framework that fosters innovation in drug manufacturing.