Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2403

Pages:87

Published On:October 2025

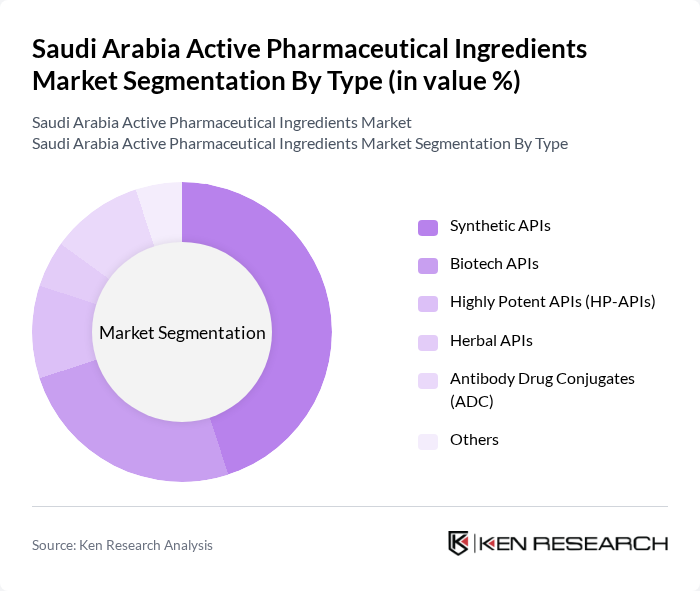

By Type:

The market is segmented into various types, including Synthetic APIs, Biotech APIs, Highly Potent APIs (HP-APIs), Herbal APIs, Antibody Drug Conjugates (ADC), and Others. Among these, Synthetic APIs dominate the market due to their widespread application in various therapeutic areas and established manufacturing processes. The demand for Biotech APIs is also on the rise, driven by advancements in biotechnology and the increasing prevalence of chronic diseases. The market is witnessing a trend towards personalized medicine, which is further boosting the demand for HP-APIs and ADCs.

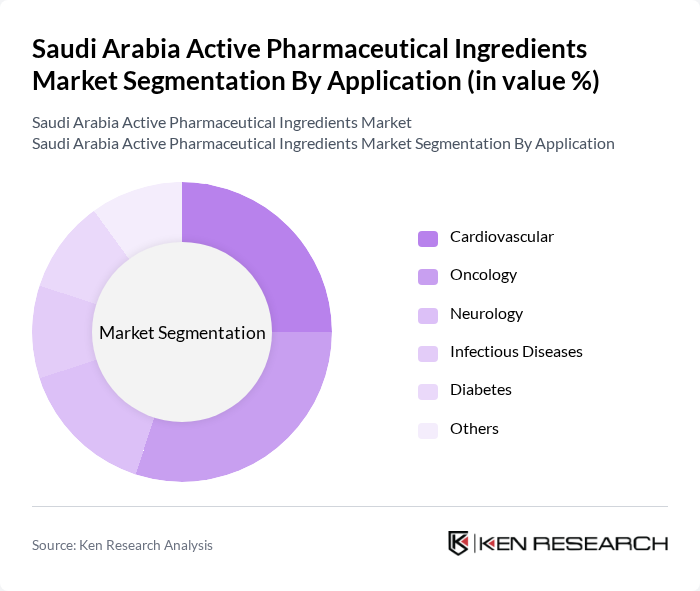

By Application:

The applications of Active Pharmaceutical Ingredients include Cardiovascular, Oncology, Neurology, Infectious Diseases, Diabetes, and Others. The Oncology segment is currently leading the market due to the rising incidence of cancer and the increasing focus on targeted therapies. Cardiovascular applications also hold a significant share, driven by the growing prevalence of heart diseases. The demand for Neurology-related APIs is increasing as awareness of neurological disorders rises, further diversifying the market.

The Saudi Arabia Active Pharmaceutical Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Tabuk Pharmaceuticals Manufacturing Company, Jamjoom Pharma, Saudi Chemical Company, AJA Pharma, Hikma Pharmaceuticals, Gulf Pharmaceutical Industries (Julphar), Pfizer Saudi Limited, Sanofi Saudi Arabia, Novartis Saudi Arabia, Bayer Saudi Arabia, GlaxoSmithKline Saudi Arabia, Al-Jazeera Pharmaceutical Industries, Badr Pharma, United Pharmaceuticals Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia active pharmaceutical ingredients market appears promising, driven by increasing investments in local manufacturing and a growing focus on biopharmaceuticals. As the government continues to implement supportive policies, the market is expected to witness enhanced production capabilities and technological advancements. Additionally, the rising demand for personalized medicine and biologics will likely shape the industry landscape, encouraging innovation and collaboration among key stakeholders in the pharmaceutical sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic APIs Biotech APIs Highly Potent APIs (HP-APIs) Herbal APIs Antibody Drug Conjugates (ADC) Others |

| By Application | Cardiovascular Oncology Neurology Infectious Diseases Diabetes Others |

| By End-User | Pharmaceutical Companies Contract Manufacturing Organizations (CMOs/CDMOs) Research Institutions Hospitals & Clinics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Price Range | Low Price Mid Price High Price |

| By Regulatory Compliance | SFDA Approved FDA Approved EMA Approved Local Regulatory Approved |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 95 | Production Managers, Quality Control Heads |

| Regulatory Affairs | 65 | Regulatory Managers, Compliance Officers |

| API Distributors | 80 | Supply Chain Managers, Sales Directors |

| Healthcare Providers | 70 | Pharmacists, Hospital Procurement Officers |

| Research Institutions | 60 | Research Scientists, Academic Professors |

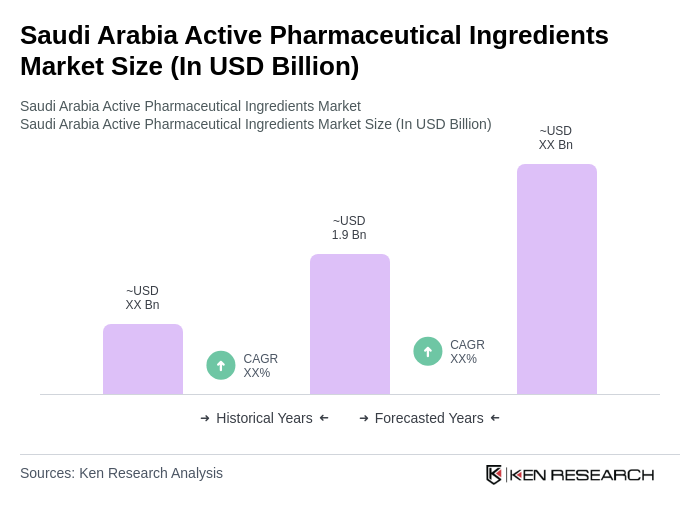

The Saudi Arabia Active Pharmaceutical Ingredients Market is valued at approximately USD 1.9 billion, reflecting significant growth driven by increasing pharmaceutical demand, advancements in biotechnology, and a focus on enhancing healthcare infrastructure.