Region:Europe

Author(s):Geetanshi

Product Code:KRAB5787

Pages:97

Published On:October 2025

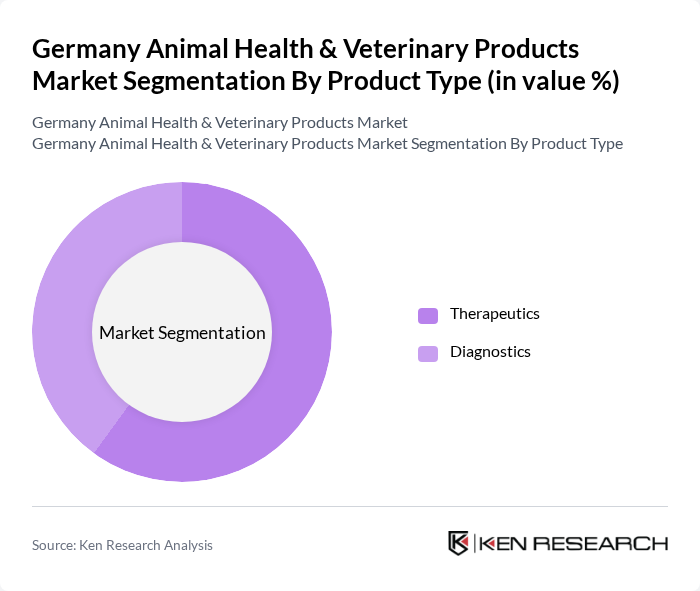

By Product Type:The market is segmented into two primary categories: Therapeutics and Diagnostics. Therapeutics includes treatments, vaccines, parasiticides, anti-infectives, and medical feed additives for animal health, while Diagnostics encompasses tools and tests used to identify diseases and health conditions in animals, including immunodiagnostic tests, molecular diagnostics, imaging, and clinical chemistry .

Among the product types, Therapeutics is the leading segment, driven by the increasing prevalence of diseases in both companion and livestock animals. The demand for vaccines, anti-infectives, and other therapeutic products has surged as pet ownership rises and livestock farming becomes more intensive. This segment's growth is also supported by advancements in veterinary pharmaceuticals and a growing focus on preventive healthcare, which encourages pet owners and farmers to invest in high-quality therapeutic solutions .

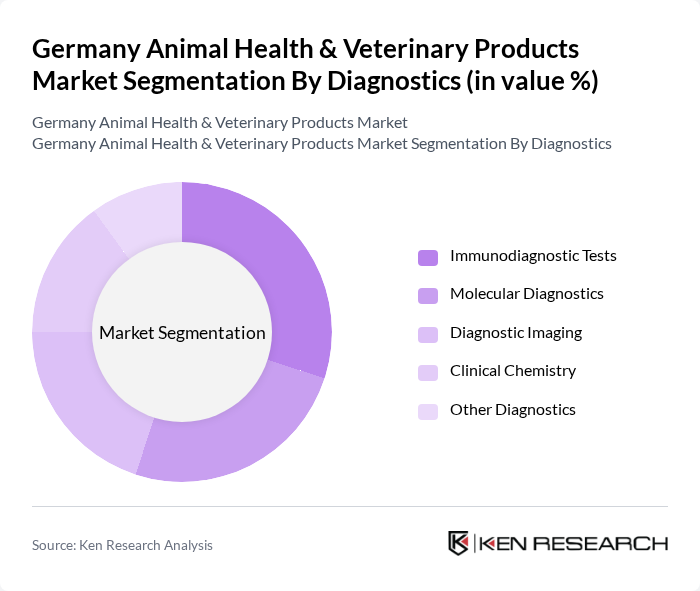

By Diagnostics:The diagnostics segment is further divided into Immunodiagnostic Tests, Molecular Diagnostics, Diagnostic Imaging, Clinical Chemistry, and Other Diagnostics. This segmentation allows for a comprehensive understanding of the various diagnostic tools available in the market .

The Immunodiagnostic Tests sub-segment is currently leading the diagnostics market, attributed to their rapid and accurate results in detecting various diseases. The increasing focus on preventive healthcare and early disease detection among pet owners and livestock farmers has driven the demand for these tests. Additionally, advancements in technology have improved the efficiency and accuracy of diagnostic tools, further boosting their adoption in veterinary practices .

The Germany Animal Health & Veterinary Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boehringer Ingelheim Animal Health, Zoetis Inc., Merck Animal Health (MSD Animal Health), Bayer Animal Health, Elanco Animal Health, Ceva Animal Health, Virbac S.A., Vetoquinol S.A., Dechra Pharmaceuticals PLC, IDEXX Laboratories, Inc., Neogen Corporation, Phibro Animal Health Corporation, Kemin Industries, Inc., QIAGEN N.V., and Heska Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany Animal Health & Veterinary Products Market appears promising, driven by technological advancements and a growing focus on animal welfare. As telemedicine becomes more prevalent, it is expected to enhance access to veterinary care, particularly in rural areas. Additionally, the increasing consumer preference for organic and natural products will likely shape product offerings, encouraging innovation and sustainability within the industry. These trends will foster a more responsive and responsible market environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Therapeutics Diagnostics |

| By Therapeutics | Vaccines Parasiticides Anti-infectives Medical Feed Additives Other Therapeutics |

| By Diagnostics | Immunodiagnostic Tests Molecular Diagnostics Diagnostic Imaging Clinical Chemistry Other Diagnostics |

| By Animal Type | Dogs and Cats Horses Ruminants Swine Poultry Other Animals |

| By End-User | Veterinary Clinics Animal Hospitals Livestock Farms Pet Owners Research Institutions |

| By Distribution Channel | Veterinary Clinics Online Retail Pharmacies Direct Sales Distributors |

| By Region | Northern Germany Southern Germany Eastern Germany Western Germany |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 150 | Veterinarians, Clinic Managers |

| Animal Health Product Distributors | 100 | Sales Managers, Distribution Coordinators |

| Livestock Farmers | 80 | Farm Owners, Animal Husbandry Managers |

| Pet Owners | 100 | Pet Owners, Animal Caregivers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

The Germany Animal Health & Veterinary Products Market is valued at approximately USD 2.8 billion, reflecting a robust growth trajectory driven by increasing pet ownership, advancements in veterinary medicine, and rising awareness of animal health.