Region:Europe

Author(s):Dev

Product Code:KRAA5877

Pages:91

Published On:September 2025

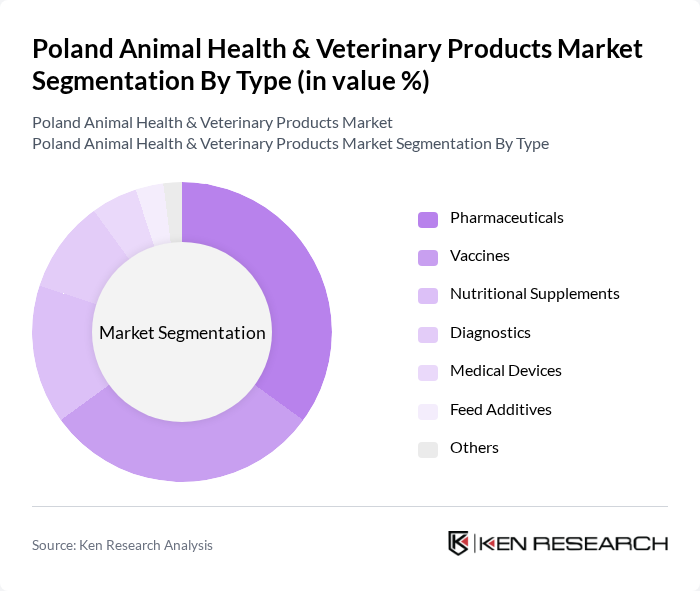

By Type:The market is segmented into various types, including Pharmaceuticals, Vaccines, Nutritional Supplements, Diagnostics, Medical Devices, Feed Additives, and Others. Each of these subsegments plays a crucial role in ensuring the health and productivity of animals, with pharmaceuticals and vaccines being the most significant contributors due to their essential role in disease prevention and treatment.

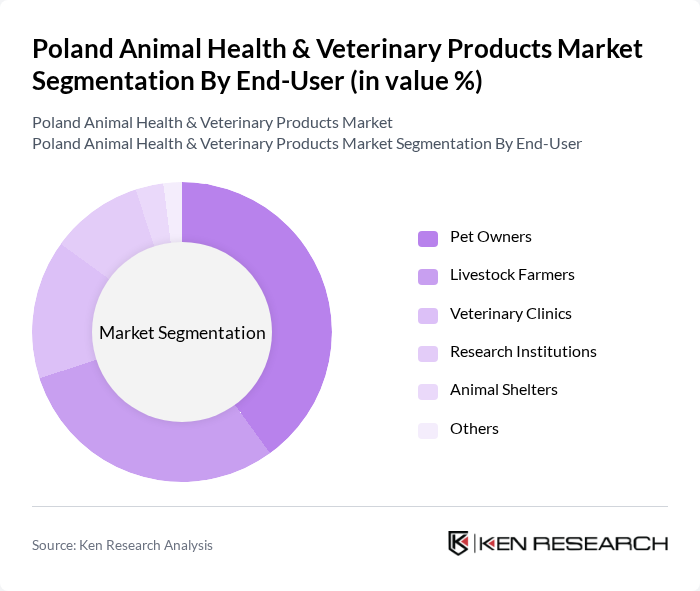

By End-User:The end-user segmentation includes Pet Owners, Livestock Farmers, Veterinary Clinics, Research Institutions, Animal Shelters, and Others. Pet owners and livestock farmers are the primary consumers of veterinary products, driven by the increasing trend of pet humanization and the need for healthy livestock to ensure food security.

The Poland Animal Health & Veterinary Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, Bayer Animal Health, Cegelec, Vetoquinol S.A., Dechra Pharmaceuticals PLC, Virbac S.A., Phibro Animal Health Corporation, Neogen Corporation, Alltech, IDEXX Laboratories, Inc., Vetmedin, Trouw Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland Animal Health & Veterinary Products Market appears promising, driven by a combination of technological advancements and changing consumer preferences. The integration of telemedicine and digital health solutions is expected to enhance accessibility and efficiency in veterinary care. Additionally, the growing trend towards preventive healthcare and organic products will likely shape the market landscape, encouraging innovation and investment in sustainable veterinary practices, ultimately benefiting both animals and their owners.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Vaccines Nutritional Supplements Diagnostics Medical Devices Feed Additives Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics Research Institutions Animal Shelters Others |

| By Product Formulation | Injectable Oral Topical Feed-Through Others |

| By Distribution Channel | Veterinary Clinics Online Retail Pharmacies Agricultural Supply Stores Others |

| By Animal Type | Companion Animals Livestock Aquaculture Others |

| By Region | Northern Poland Southern Poland Eastern Poland Western Poland Others |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Animal Feed Manufacturers | 80 | Production Managers, Quality Control Officers |

| Livestock Farms | 120 | Farm Owners, Animal Health Managers |

| Veterinary Product Distributors | 90 | Sales Representatives, Distribution Managers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

The Poland Animal Health & Veterinary Products Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased pet ownership, livestock production, and awareness of animal health issues.