Region:Europe

Author(s):Rebecca

Product Code:KRAB5267

Pages:92

Published On:October 2025

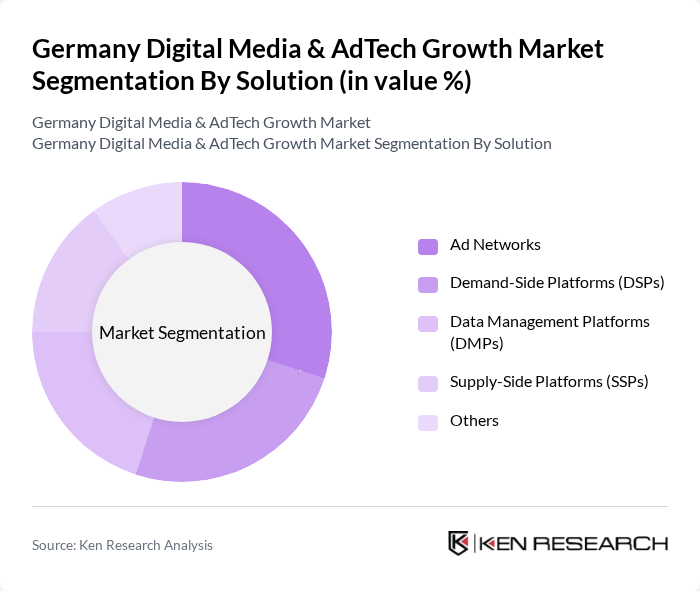

By Solution:The market is segmented into various solutions that cater to different aspects of digital advertising. The primary solutions include Ad Networks, Demand-Side Platforms (DSPs), Data Management Platforms (DMPs), Supply-Side Platforms (SSPs), and Others. Each of these solutions plays a crucial role in facilitating the buying and selling of digital advertising space, optimizing ad placements, and managing data for targeted advertising. Ad Networks and DSPs remain the most widely adopted solutions, driven by the need for automation and efficiency in digital ad transactions .

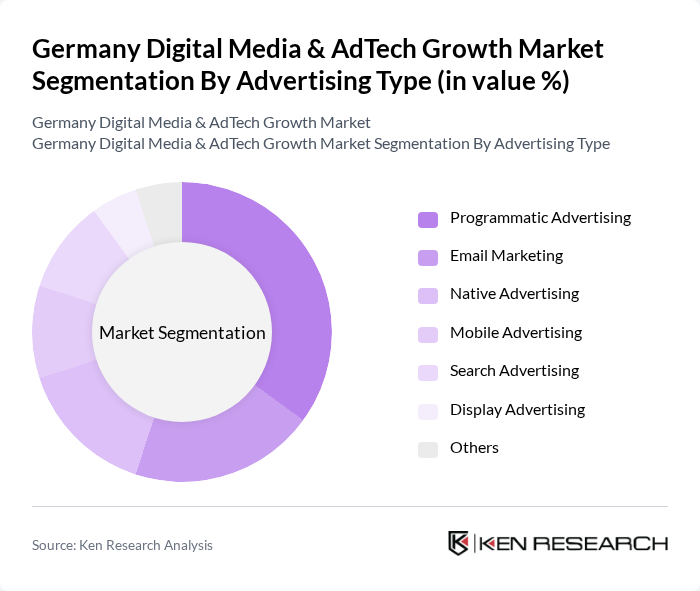

By Advertising Type:The advertising types in this market include Programmatic Advertising, Email Marketing, Native Advertising, Mobile Advertising, Search Advertising, Display Advertising, and Others. Each type serves different marketing strategies and consumer engagement methods, with programmatic advertising leading the way due to its efficiency and effectiveness in targeting specific audiences. Mobile and social media advertising have seen significant growth, reflecting the increasing use of smartphones and social platforms for digital engagement .

The Germany Digital Media & AdTech Growth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adform, Criteo, Google Germany GmbH, Meta Platforms Ireland Ltd. (Germany Branch), Ströer SE & Co. KGaA, The Trade Desk Germany GmbH, MediaMath, Xandr (Microsoft Advertising), Taboola Germany GmbH, Outbrain Germany GmbH, Teads Deutschland GmbH, AdColony (Digital Turbine Germany), Sizmek by Amazon, Quantcast Deutschland GmbH, United Internet Media GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German digital media and AdTech market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly adopt omnichannel marketing strategies, the integration of AI and data analytics will enhance targeting and personalization. Furthermore, the growing emphasis on sustainability in advertising practices will shape brand strategies, aligning them with consumer values. These trends indicate a dynamic landscape where innovation and adaptability will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Solution | Ad Networks Demand-Side Platforms (DSPs) Data Management Platforms (DMPs) Supply-Side Platforms (SSPs) Others |

| By Advertising Type | Programmatic Advertising Email Marketing Native Advertising Mobile Advertising Search Advertising Display Advertising Others |

| By Enterprise Size | Large Enterprise Small and Medium Enterprise (SME) |

| By Platform | Web Mobile Others |

| By Industry Vertical | Media & Entertainment IT & Telecom Education Healthcare Retail & Consumer Goods BFSI Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Media Agencies | 60 | Agency Executives, Media Planners |

| AdTech Solution Providers | 50 | Product Managers, Sales Directors |

| Brand Marketing Teams | 70 | Marketing Managers, Brand Strategists |

| Consumer Insights Analysts | 40 | Data Analysts, Market Researchers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Representatives |

The Germany Digital Media & AdTech Growth Market is valued at approximately USD 32 billion, driven by the increasing adoption of digital advertising strategies, e-commerce growth, and the importance of data analytics in marketing.