Region:Asia

Author(s):Geetanshi

Product Code:KRAE1209

Pages:83

Published On:December 2025

By Technology:The technology segment of the APAC Artificial Intelligence market includes various subsegments such as Machine Learning, Natural Language Processing, Computer Vision, Robotics & Automation, and Expert Systems & Others. Machine Learning is currently the leading technology due to its wide-ranging applications in predictive analytics, recommendation engines, fraud detection, and process automation across sectors like finance, retail, healthcare, and manufacturing. Natural Language Processing follows, driven by the increasing demand for chatbots, virtual assistants, multilingual customer service, and text analytics in banking, e?commerce, and public services. Computer Vision is gaining traction in sectors like healthcare (medical imaging), automotive (ADAS and autonomous systems), retail (video analytics), and public safety. Robotics & Automation is being adopted in manufacturing, warehousing, logistics, and electronics assembly, particularly in countries such as Japan, South Korea, and China, to address productivity and labor constraints. Expert Systems & Others, including knowledge-based systems and emerging generative AI tools, are also becoming significant contributors, especially in complex decision support, content creation, and specialized industrial applications.

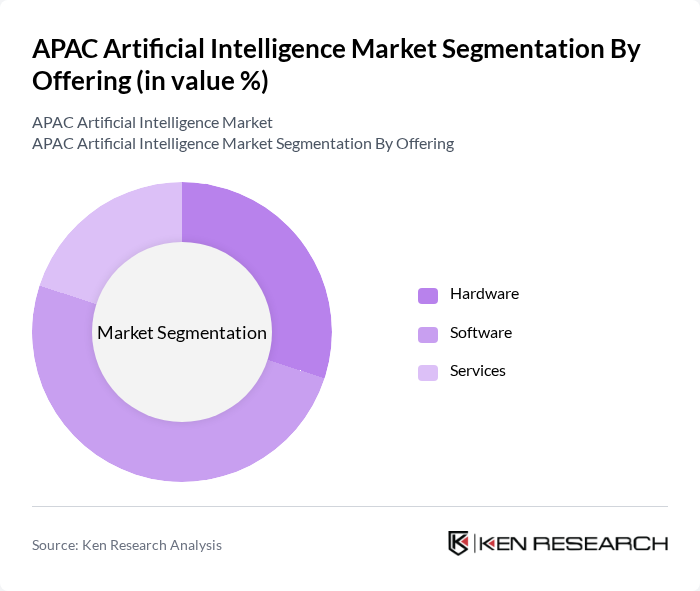

By Offering:The offering segment encompasses Hardware, Software, and Services. Software is the dominant subsegment, driven by the increasing demand for AI platforms, cloud-based solutions, and applications that facilitate data analysis, real-time decision-making, and automation in enterprises of all sizes. Hardware follows, as organizations invest in advanced computing systems, including GPUs, AI accelerators, edge devices, and high-performance storage, to support intensive AI workloads and on-device inference. Services, including AI strategy consulting, system integration, model development, and managed services, are also crucial as businesses seek expert guidance to design, implement, and scale AI solutions within existing IT and operational environments.

The APAC Artificial Intelligence market is characterized by a dynamic mix of regional and international players. Leading participants such as Alibaba Cloud (China), Baidu, Inc. (China), Tencent Cloud (China), Huawei Cloud (China), SenseTime Group Inc. (China), NEC Corporation (Japan), Fujitsu Limited (Japan), SoftBank Group Corp. / Arm & Vision Fund (Japan), Naver Corporation (South Korea), Samsung SDS Co., Ltd. (South Korea), LINE Yahoo Corporation (Japan), Wipro Limited (India), Infosys Limited (India), Tata Consultancy Services Limited (India), Appier Group Inc. (Taiwan) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC artificial intelligence market is poised for transformative growth, driven by technological advancements and increasing integration across sectors. As organizations prioritize digital transformation, AI adoption is expected to permeate various industries, enhancing operational efficiency and customer experiences. The focus on ethical AI practices and governance frameworks will shape the regulatory landscape, ensuring responsible AI deployment. Furthermore, collaboration between governments and private sectors will foster innovation, paving the way for sustainable growth and competitive advantages in the global market.

| Segment | Sub-Segments |

|---|---|

| By Technology | Machine Learning Natural Language Processing Computer Vision Robotics & Automation Expert Systems & Others |

| By Offering | Hardware Software Services |

| By Business Function | Marketing & Sales Service Operations & Customer Support Supply Chain & Logistics Risk Management & Compliance Human Resources & Others |

| By Deployment Mode | Cloud On-premises Hybrid |

| By Industry Vertical | Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Retail & E-commerce Manufacturing & Industrial IT & Telecommunications Government & Public Sector Automotive & Transportation Energy & Utilities Education & Others |

| By Application | Predictive Analytics & Forecasting Image & Video Analytics Speech & Voice Recognition Virtual Assistants & Chatbots Fraud Detection & Cybersecurity Recommendation & Personalization Engines Others |

| By Country | China India Japan South Korea ASEAN Oceania Rest of Asia-Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Applications | 100 | Healthcare IT Managers, Clinical Data Analysts |

| Financial Services AI Integration | 85 | Risk Management Officers, Data Scientists |

| Manufacturing Automation Solutions | 70 | Operations Managers, Production Engineers |

| Retail AI Customer Experience | 90 | Marketing Directors, Customer Experience Managers |

| AI in Transportation and Logistics | 75 | Logistics Coordinators, Supply Chain Analysts |

The APAC Artificial Intelligence market is valued at approximately USD 63 billion, reflecting significant growth driven by the adoption of AI technologies across various sectors, including healthcare, finance, and manufacturing.