Region:Europe

Author(s):Geetanshi

Product Code:KRAB5248

Pages:92

Published On:October 2025

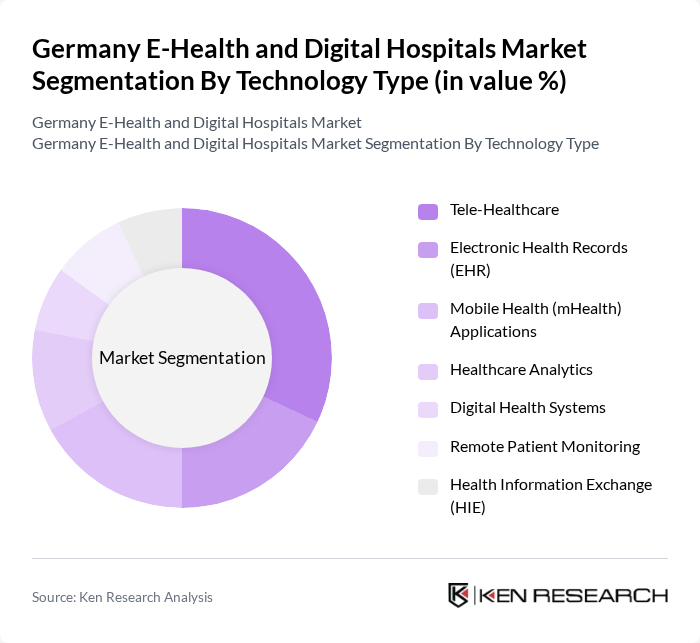

By Technology Type:The technology type segmentation includes various subsegments such as Tele-Healthcare, Electronic Health Records (EHR), Mobile Health (mHealth) Applications, Healthcare Analytics, Digital Health Systems, Remote Patient Monitoring, and Health Information Exchange (HIE). Among these, Tele-Healthcare is the leading subsegment in terms of revenue generation, driven by the surge in telemedicine adoption and remote care delivery. Electronic Health Records (EHR) remain critical for streamlining patient data management and improving healthcare delivery, with increasing digitization and interoperability requirements driving further adoption. The growing use of mHealth applications and healthcare analytics is also notable, reflecting the demand for real-time health monitoring and data-driven decision-making .

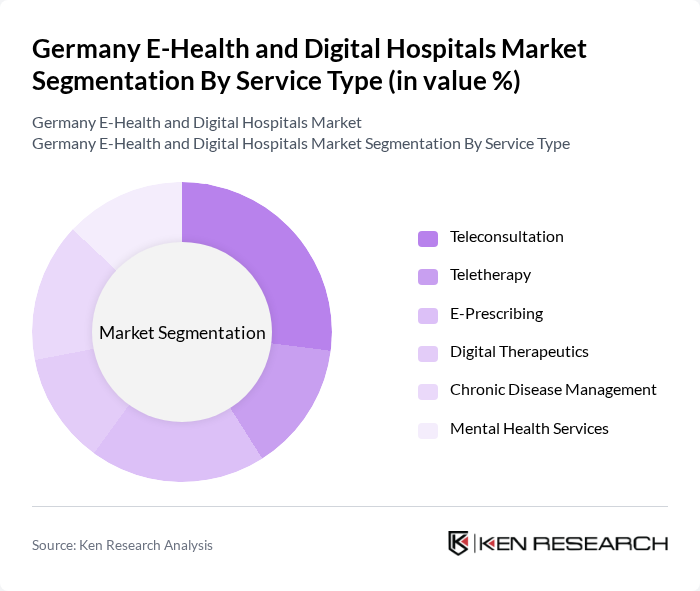

By Service Type:The service type segmentation encompasses Teleconsultation, Teletherapy, E-Prescribing, Digital Therapeutics, Chronic Disease Management, and Mental Health Services. Teleconsultation is currently the dominant service type, driven by the growing acceptance of remote consultations among patients and healthcare providers. The convenience and accessibility of teleconsultation services have significantly increased their usage, especially during the COVID-19 pandemic, leading to a lasting shift in patient care delivery. E-prescribing and digital therapeutics are also gaining traction as regulatory frameworks and reimbursement policies evolve .

The Germany E-Health and Digital Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, SAP SE, TeleClinic, Doctolib, Zava, Kry, Ada Health, CompuGroup Medical SE, Medgate, Vivy, Epic Systems Corporation, Telefónica Deutschland, Orange Business Services, Vodafone Germany, 1Doc3 contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-health and digital hospitals market in Germany appears promising, driven by ongoing technological advancements and supportive government policies. As telemedicine becomes increasingly mainstream, healthcare providers are expected to invest more in digital solutions. The focus on patient-centric care will likely lead to enhanced user experiences and improved health outcomes. Furthermore, the integration of AI and data analytics will facilitate more personalized healthcare, paving the way for innovative treatment approaches and operational efficiencies.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Tele-Healthcare Electronic Health Records (EHR) Mobile Health (mHealth) Applications Healthcare Analytics Digital Health Systems Remote Patient Monitoring Health Information Exchange (HIE) |

| By Service Type | Teleconsultation Teletherapy E-Prescribing Digital Therapeutics Chronic Disease Management Mental Health Services |

| By End-User | Hospitals Clinics Ambulatory Care Centers Home Healthcare Providers Insurance Companies Patients |

| By Deployment Mode | Cloud-Based On-Premise Hybrid |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Services Rehabilitation Services Others |

| By Distribution Mode | Direct Sales Online Platforms Partnerships with Healthcare Providers Telehealth Networks Others |

| By Region | North Germany South Germany East Germany West Germany Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Adoption in Hospitals | 100 | Chief Information Officers, IT Managers |

| Telemedicine Services Utilization | 80 | Healthcare Providers, Telehealth Coordinators |

| Patient Engagement with E-Health Solutions | 60 | Patients, User Experience Researchers |

| Regulatory Impact on Digital Health | 50 | Healthcare Policy Analysts, Compliance Officers |

| Investment Trends in E-Health Technologies | 40 | Venture Capitalists, Healthcare Investors |

The Germany E-Health and Digital Hospitals Market is valued at approximately USD 14.3 billion, reflecting significant growth driven by the adoption of digital health technologies and government initiatives promoting telemedicine.