Region:Middle East

Author(s):Dev

Product Code:KRAA3554

Pages:98

Published On:September 2025

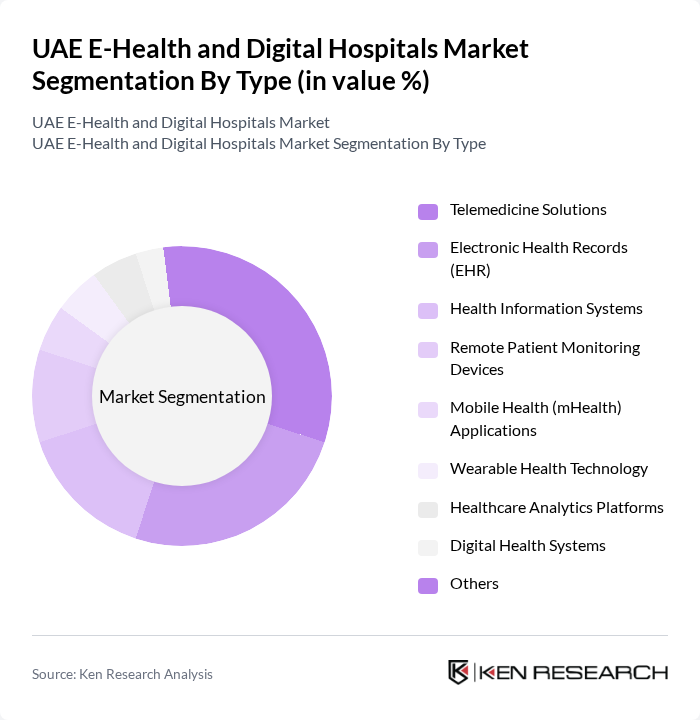

By Type:The market is segmented into various types, including Telemedicine Solutions, Electronic Health Records (EHR), Health Information Systems, Remote Patient Monitoring Devices, Mobile Health (mHealth) Applications, Wearable Health Technology, Healthcare Analytics Platforms, Digital Health Systems, and Others. Among these, Telemedicine Solutions are leading due to the increasing demand for remote consultations and healthcare accessibility, especially post-pandemic. The convenience and efficiency of telemedicine have made it a preferred choice for both patients and healthcare providers. The adoption of EHR and mobile health applications is also accelerating, driven by regulatory support and the need for integrated patient management .

By End-User:The end-user segmentation includes Hospitals (Public & Private), Clinics & Polyclinics, Home Healthcare Providers, Insurance Companies, Government Health Agencies, Pharmacies, and Others. Hospitals, both public and private, dominate this segment due to their extensive need for digital health solutions to manage patient data and improve service delivery. The increasing patient load and the need for efficient healthcare management systems are driving hospitals to adopt e-health technologies. Clinics and home healthcare providers are also rapidly adopting digital tools to expand their service offerings and improve patient engagement .

The UAE E-Health and Digital Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daman (National Health Insurance Company), Abu Dhabi Health Services Company (SEHA), Mediclinic Middle East, NMC Health, Al Zahra Hospital Dubai, Cleveland Clinic Abu Dhabi, Emirates Health Services (EHS), Healthigo, Vezeeta, Okadoc, Medcare Hospitals & Medical Centres, Aster DM Healthcare, Dubai Health Authority (DHA), Al Noor Hospitals Group, HealthPlus Network, Abu Dhabi Telemedicine Centre, TruDoc Healthcare, Health at Hand, NextGen Healthcare, InstaPract contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE E-Health and Digital Hospitals Market appears promising, driven by ongoing technological advancements and a commitment to enhancing healthcare delivery. As the government continues to invest in digital health initiatives, the integration of AI and machine learning into healthcare applications is expected to grow. Additionally, the focus on preventive healthcare will likely lead to increased adoption of remote monitoring solutions, further transforming patient care and engagement in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Solutions Electronic Health Records (EHR) Health Information Systems Remote Patient Monitoring Devices Mobile Health (mHealth) Applications Wearable Health Technology Healthcare Analytics Platforms Digital Health Systems Others |

| By End-User | Hospitals (Public & Private) Clinics & Polyclinics Home Healthcare Providers Insurance Companies Government Health Agencies Pharmacies Others |

| By Application | Chronic Disease Management Mental Health Services Emergency Care Preventive Healthcare Rehabilitation Services Maternal & Child Health Others |

| By Distribution Channel | Direct Sales Online Platforms (Web & Mobile) Distributors Partnerships with Healthcare Providers Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Bundled Services Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Mobile Technologies AI-Driven Platforms IoT-Enabled Devices Others |

| By User Demographics | Age Groups Gender Socioeconomic Status Geographic Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Services | 80 | Healthcare Executives, IT Managers |

| Remote Patient Monitoring | 60 | Nurses, Care Coordinators |

| Digital Health Records Implementation | 50 | Hospital Administrators, Compliance Officers |

| Patient Engagement Platforms | 40 | Marketing Managers, Patient Experience Officers |

| Healthcare Mobile Applications | 45 | App Developers, UX Designers |

The UAE E-Health and Digital Hospitals Market is valued at approximately USD 620 million, reflecting significant growth driven by the adoption of digital health technologies and government initiatives aimed at enhancing healthcare services.