Region:Europe

Author(s):Rebecca

Product Code:KRAA6880

Pages:97

Published On:September 2025

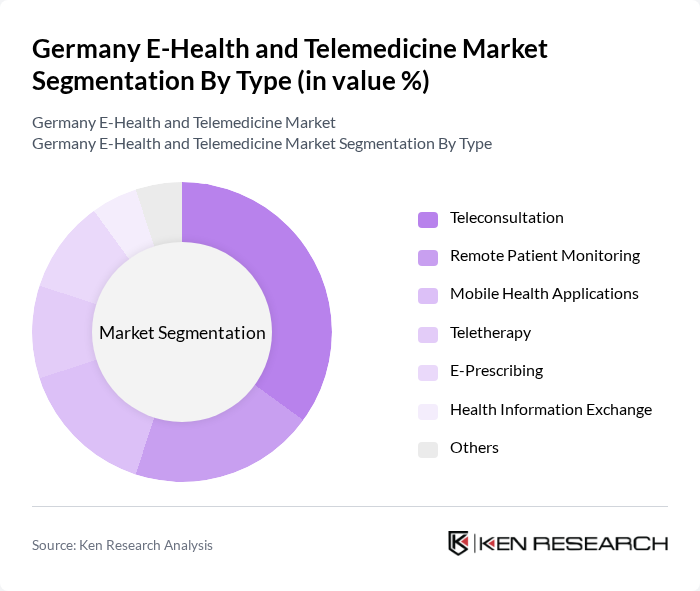

By Type:The e-health and telemedicine market can be segmented into various types, including Teleconsultation, Remote Patient Monitoring, Mobile Health Applications, Teletherapy, E-Prescribing, Health Information Exchange, and Others. Among these, Teleconsultation has emerged as a leading segment due to its convenience and accessibility, allowing patients to consult healthcare professionals from the comfort of their homes. The increasing acceptance of virtual consultations, especially during the pandemic, has significantly contributed to its dominance.

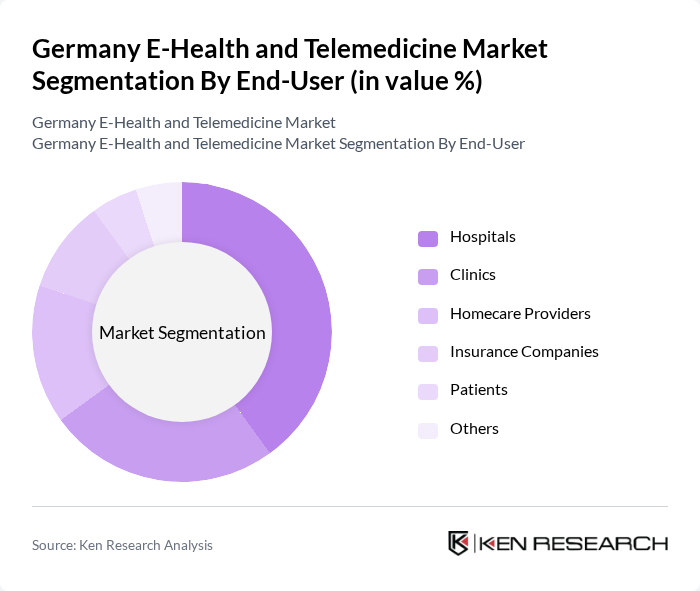

By End-User:The market can also be segmented by end-users, which include Hospitals, Clinics, Homecare Providers, Insurance Companies, Patients, and Others. Hospitals are the dominant end-user segment, as they increasingly adopt telemedicine solutions to enhance patient care and streamline operations. The need for efficient patient management and the integration of telehealth services into existing healthcare systems have made hospitals a key player in the e-health landscape.

The Germany E-Health and Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, SAP SE, TeleClinic, Doctolib, Zava, Kry, HealthTap, Ada Health, Cluno, Medgate, Dacadoo, MyTherapy, Vivy, 1Doc3, Telemedico contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-health and telemedicine market in Germany appears promising, driven by technological advancements and changing consumer behaviors. By future, the integration of AI and machine learning in healthcare is expected to revolutionize patient care, enhancing diagnostic accuracy and treatment personalization. Additionally, the expansion of telehealth services into rural areas will address healthcare disparities, ensuring broader access to essential services. As regulatory frameworks evolve, they will likely facilitate smoother operations for telehealth providers, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Remote Patient Monitoring Mobile Health Applications Teletherapy E-Prescribing Health Information Exchange Others |

| By End-User | Hospitals Clinics Homecare Providers Insurance Companies Patients Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Services Rehabilitation Services Others |

| By Distribution Mode | Direct Sales Online Platforms Partnerships with Healthcare Providers Telehealth Networks Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Bundled Services Freemium Models Others |

| By Technology | Video Conferencing Tools Mobile Applications Cloud-Based Platforms Wearable Devices Others |

| By User Demographics | Age Groups Gender Socioeconomic Status Geographic Location Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 100 | Healthcare Administrators, Telehealth Program Managers |

| Patients Using E-Health Services | 150 | Patients, Caregivers, Health Insurance Representatives |

| Healthcare Technology Developers | 80 | Product Managers, Software Engineers, UX Designers |

| Regulatory Bodies and Policy Makers | 50 | Health Policy Analysts, Regulatory Affairs Specialists |

| Healthcare Providers and Practitioners | 120 | Doctors, Nurses, Telehealth Coordinators |

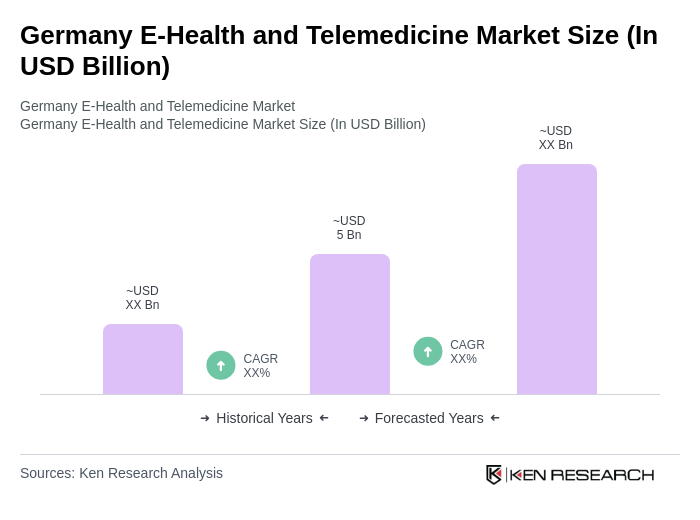

The Germany E-Health and Telemedicine Market is valued at approximately USD 5 billion, reflecting significant growth driven by the adoption of digital health solutions, the rise in chronic diseases, and increased demand for remote healthcare services, especially accelerated by the COVID-19 pandemic.