Argentina E-Health and Telemedicine Market Overview

- The Argentina E-Health and Telemedicine Market is valued at USD 935 million, based on a five-year historical analysis. Growth is primarily driven by the increasing adoption of digital health solutions, the rising prevalence of chronic diseases, and the need for remote healthcare services. The COVID-19 pandemic notably accelerated telemedicine uptake, while ongoing trends such as the expansion of virtual care platforms, integration of artificial intelligence in diagnostics, and government-led digital health initiatives continue to support market expansion .

- Buenos Aires, Córdoba, and Rosario are the dominant cities in the Argentina E-Health and Telemedicine Market. Buenos Aires, as the capital, has a higher concentration of healthcare facilities and technology startups, while Córdoba and Rosario benefit from their strategic locations and growing healthcare infrastructure, making them key players in the telemedicine landscape .

- The regulatory framework for telemedicine in Argentina is governed by Resolution 282/2020 issued by the Ministry of Health, which establishes operational standards for telehealth services, including requirements for patient data protection, professional licensing, and interoperability of digital platforms. This resolution ensures that patients have access to remote consultations and healthcare services nationwide, enhancing the overall healthcare delivery system .

Argentina E-Health and Telemedicine Market Segmentation

By Component:The segmentation of the market by component includes hardware, software, and services. The hardware segment encompasses devices such as telemedicine carts, diagnostic equipment, and remote monitoring devices. The software segment includes applications, electronic health record platforms, and telehealth management systems. The services segment covers virtual consultations, remote patient monitoring, and digital health support provided to patients and healthcare providers .

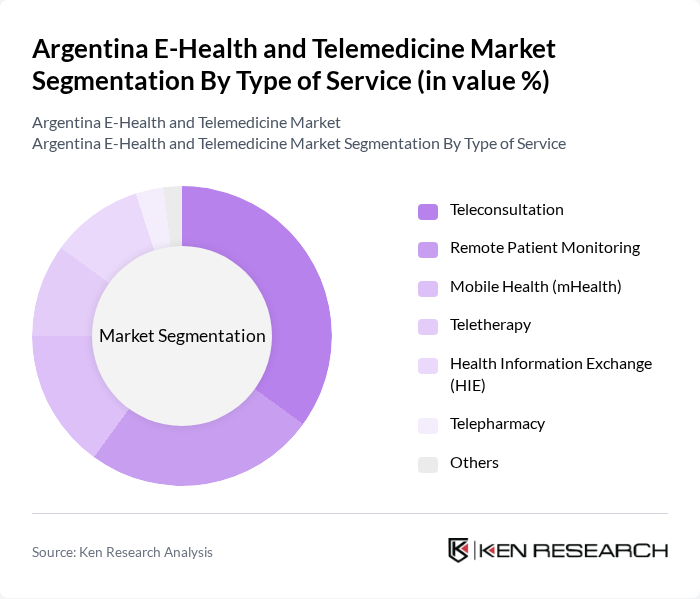

By Type of Service:The market is segmented by type of service, which includes teleconsultation, remote patient monitoring, mobile health (mHealth), teletherapy, health information exchange (HIE), telepharmacy, and others. Teleconsultation remains the most common service, enabling patients to consult with healthcare professionals remotely. Remote patient monitoring and mHealth are increasingly adopted for chronic disease management and preventive care, while teletherapy and telepharmacy are gaining traction for mental health and medication management .

Argentina E-Health and Telemedicine Market Competitive Landscape

The Argentina E-Health and Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Sancor Seguros, Telemedicina Argentina, Doctoralia, Medtronic Argentina, Caredoc, Salud Virtual, Axxon, Cuidar Salud, CiberSalud, Grupo Sancor Salud, DabaDoc, Medicus, Omint, Swiss Medical Group, E-Health Argentina contribute to innovation, geographic expansion, and service delivery in this space.

Argentina E-Health and Telemedicine Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:Argentina's internet penetration rate reached88%, with over40 millionusers accessing online services. This growth facilitates the adoption of e-health solutions, as more individuals can access telemedicine platforms. The World Bank projects that byin future, internet users in Argentina will increase by approximately2 million, further enhancing the potential for telemedicine services. This connectivity is crucial for remote consultations and health monitoring, driving the e-health market forward.

- Rising Demand for Remote Healthcare Services:The COVID-19 pandemic significantly accelerated the demand for remote healthcare services in Argentina, with telemedicine consultations increasing bysubstantially. Byin future, it is estimated that40%of healthcare consultations will be conducted remotely, driven by patient preferences for convenience and safety. This shift is supported by a growing awareness of telehealth benefits, leading to increased investments in digital health solutions and platforms across the country.

- Government Initiatives Supporting Telemedicine:The Argentine government has implemented various initiatives to promote telemedicine, including the establishment of the National Telemedicine Program. This program aims to enhance healthcare access, especially in underserved areas. Inin future, the government plans to allocateUSD 10 millionto expand telehealth infrastructure, which will facilitate the integration of telemedicine into the national healthcare system, thereby driving market growth and improving patient outcomes.

Market Challenges

- Regulatory Hurdles:The telemedicine sector in Argentina faces significant regulatory challenges, including the lack of a unified framework for telehealth services. As ofin future, only15provinces have established telemedicine regulations, creating inconsistencies across the country. This fragmented regulatory environment complicates the implementation of telehealth solutions, hindering market growth. Byin future, addressing these regulatory issues will be crucial for fostering a more conducive environment for telemedicine adoption.

- Limited Infrastructure in Rural Areas:Approximately8%of Argentina's population resides in rural areas, where healthcare infrastructure is often inadequate. Many rural regions lack reliable internet access, which is essential for telemedicine services. Inin future, only50%of rural households had internet connectivity, limiting the reach of e-health solutions. Byin future, improving infrastructure in these areas will be vital to ensure equitable access to telehealth services and to overcome this significant market challenge.

Argentina E-Health and Telemedicine Market Future Outlook

The future of the Argentina e-health and telemedicine market appears promising, driven by technological advancements and increasing consumer acceptance. As the government continues to invest in digital health initiatives, the integration of artificial intelligence and data analytics into telemedicine solutions is expected to enhance service delivery. Additionally, the growing aging population will necessitate more remote healthcare options, further propelling market growth. Byin future, these trends will likely lead to a more robust and accessible telehealth ecosystem across the country.

Market Opportunities

- Expansion of Mobile Health Applications:The mobile health application market in Argentina is projected to grow significantly, with over5 milliondownloads expected byin future. This growth presents opportunities for developers to create innovative health apps that cater to local needs, enhancing patient engagement and self-management of health conditions. Such applications can bridge gaps in healthcare access, particularly in remote areas.

- Partnerships with Local Healthcare Providers:Collaborations between telemedicine companies and local healthcare providers are becoming increasingly important. Byin future, it is anticipated that at least30%of telehealth services will be delivered through partnerships, enhancing service delivery and patient trust. These partnerships can facilitate better integration of telehealth into existing healthcare systems, improving overall patient care and outcomes.