Region:Africa

Author(s):Rebecca

Product Code:KRAB5273

Pages:85

Published On:October 2025

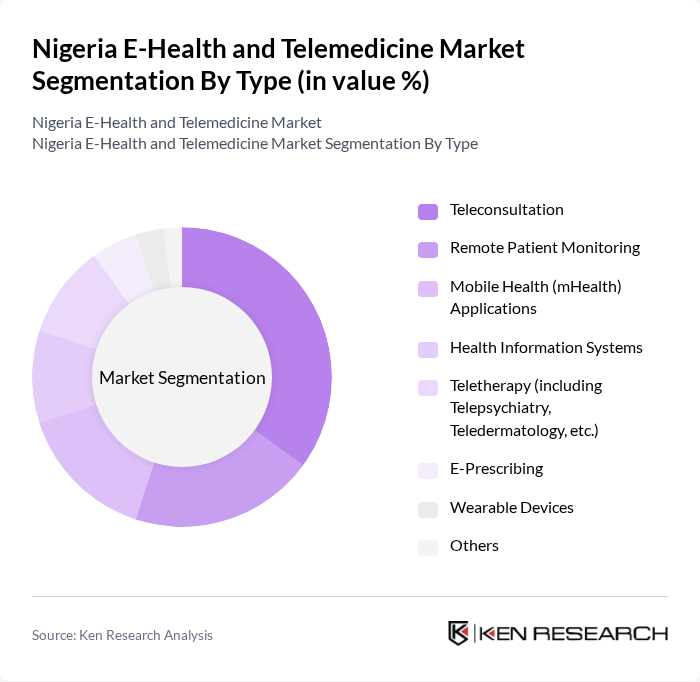

By Type:The market is segmented into Teleconsultation, Remote Patient Monitoring, Mobile Health (mHealth) Applications, Health Information Systems, Teletherapy (including Telepsychiatry, Teledermatology, etc.), E-Prescribing, Wearable Devices, and Others. Teleconsultation leads the segment, driven by demand for virtual consultations, convenience, and safety, particularly during and after the pandemic. The adoption of remote monitoring devices and mobile health apps is also rising, supported by growing chronic disease prevalence and increased digital literacy .

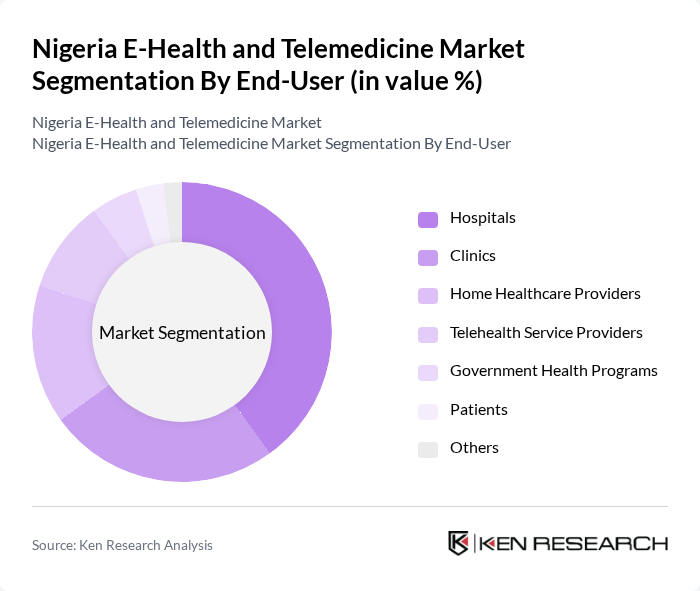

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare Providers, Telehealth Service Providers, Government Health Programs, Patients, and Others. Hospitals are the leading end-user segment, reflecting their rapid adoption of telemedicine to enhance patient care, streamline operations, and manage patient flow. Clinics and home healthcare providers are also increasing their use of digital health platforms, while telehealth service providers are expanding outreach in both urban and rural settings .

The Nigeria E-Health and Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as HealthPlus, mDoc, LifeBank, Vezeeta, DabaDoc, 54gene, Medsaf, Jumia Health, Doctoora, Wellvis Health, Helium Health, E-Health Africa, Reliance Health, DrugStoc, Infiuss Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's e-health and telemedicine market appears promising, driven by technological advancements and increasing healthcare demands. With the anticipated rise in smartphone usage and internet connectivity, more individuals are expected to engage with telehealth services. Additionally, ongoing government support and investment in digital health initiatives will likely enhance service delivery. As healthcare providers adopt innovative technologies, the market is poised for significant transformation, improving access to quality healthcare across diverse populations in Nigeria.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Remote Patient Monitoring Mobile Health (mHealth) Applications Health Information Systems Teletherapy (including Telepsychiatry, Teledermatology, etc.) E-Prescribing Wearable Devices Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Telehealth Service Providers Government Health Programs Patients Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Care Rehabilitation Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Retail Pharmacies Partnerships with Healthcare Providers Others |

| By Technology | Cloud-Based Solutions Mobile Applications Web-Based Platforms AI-Driven Devices IoT-Enabled Devices Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Value-Based Pricing Others |

| By Regulatory Compliance | CE Marking FDA Approval ISO Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 100 | CEOs, Product Managers, Technology Officers |

| Healthcare Professionals | 120 | Doctors, Nurses, Health Administrators |

| Patients Using E-Health Services | 150 | Patients, Caregivers, Health Advocates |

| Health Insurance Companies | 60 | Policy Analysts, Claims Managers, Underwriters |

| Technology Developers in E-Health | 50 | Software Engineers, UX Designers, Product Developers |

The Nigeria E-Health and Telemedicine Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the adoption of digital health platforms and increased internet penetration, particularly accelerated by the COVID-19 pandemic.