South Africa E-Health and Telemedicine Market Overview

- The South Africa E-Health and Telemedicine Market is valued at USD 1.05 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital health solutions, rising healthcare costs, and the need for improved access to medical services, especially in rural areas. The COVID-19 pandemic has further accelerated the shift towards telemedicine, as patients and providers sought safer alternatives to in-person consultations .

- Key cities such as Johannesburg, Cape Town, and Durban dominate the South African E-Health and Telemedicine Market due to their advanced healthcare infrastructure, high internet penetration, and a growing population that is increasingly tech-savvy. These urban centers are also home to numerous healthcare providers and technology companies that are innovating in the telemedicine space, making them pivotal in driving market growth .

- In 2023, the South African government implemented the National Health Insurance (NHI) Bill, which aims to provide universal health coverage to all citizens. This regulation encourages the integration of telemedicine services into the public healthcare system, promoting accessibility and affordability of healthcare services across the nation. The National Health Insurance Bill, 2023, issued by the Parliament of South Africa, mandates the inclusion of digital health and telemedicine solutions within the national health strategy, requiring public and private providers to comply with interoperability and data protection standards to facilitate nationwide access to healthcare .

South Africa E-Health and Telemedicine Market Segmentation

By Type:The market is segmented into various types, including Real-time Telemedicine, Store-and-Forward Telemedicine, Remote Patient Monitoring, Mobile Health Applications, Telepsychiatry, Teledermatology, and Others. Among these, Real-time Telemedicine is currently the leading sub-segment, driven by the increasing demand for immediate medical consultations and the convenience of virtual visits. The rise in smartphone usage and internet accessibility has further propelled this segment, making it a preferred choice for both patients and healthcare providers .

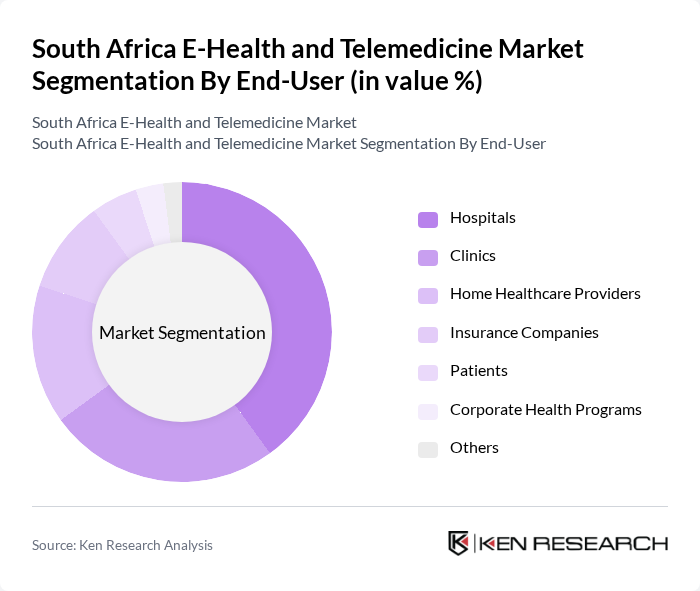

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare Providers, Insurance Companies, Patients, Corporate Health Programs, and Others. Hospitals are the dominant end-user segment, as they increasingly adopt telemedicine solutions to enhance patient care and streamline operations. The need for efficient patient management and the ability to provide remote consultations have made hospitals the primary users of telehealth services, significantly contributing to market growth .

South Africa E-Health and Telemedicine Market Competitive Landscape

The South Africa E-Health and Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telkom SA SOC Ltd, Life Healthcare Group, Netcare Limited, Mediclinic International, Discovery Health, Clicks Group Limited, Dis-Chem Pharmacies, HealthConnect, 1Life Healthcare, MyPocketHealth, Vula Mobile, Hello Doctor, The Biovac Company (Pty) Ltd, HealthQ Technologies, YAPILI, LifeLine South Africa contribute to innovation, geographic expansion, and service delivery in this space.

South Africa E-Health and Telemedicine Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, South Africa's smartphone penetration is projected to reach approximately 32 million users, representing a significant increase from 32 million in the past. This surge facilitates access to e-health applications and telemedicine services, enabling patients to connect with healthcare providers remotely. The World Bank reports that mobile internet subscriptions have also risen to 80% of the population, further enhancing the potential for digital health solutions across urban and rural areas.

- Rising Demand for Remote Healthcare Services:The COVID-19 pandemic has accelerated the demand for remote healthcare services, with telemedicine consultations increasing significantly in recent times. According to the South African Medical Association, approximately 60% of patients now prefer virtual consultations due to convenience and reduced travel costs. This shift is expected to continue, driven by a growing awareness of the benefits of remote healthcare, particularly in underserved regions where access to traditional healthcare is limited.

- Government Initiatives Promoting Digital Health:The South African government has committed to investing R1.2 billion in digital health initiatives in future, aimed at improving healthcare access and efficiency. This includes the implementation of the National Health Insurance Bill, which emphasizes the integration of e-health solutions. Additionally, the Department of Health is actively promoting telemedicine as a means to enhance healthcare delivery, particularly in rural areas, thereby fostering a supportive environment for e-health growth.

Market Challenges

- Limited Internet Connectivity in Rural Areas:Despite advancements in technology, approximately 30% of South Africa's rural population still lacks reliable internet access. The International Telecommunication Union reports that this digital divide hampers the adoption of e-health services, as many potential users cannot connect to telemedicine platforms. This challenge is particularly pronounced in provinces like Limpopo and Eastern Cape, where infrastructure development is lagging behind urban centers, limiting healthcare access.

- Regulatory Hurdles and Compliance Issues:The e-health sector in South Africa faces significant regulatory challenges, including compliance with the Protection of Personal Information Act (POPIA). Healthcare providers must navigate complex legal frameworks, which can delay the implementation of telemedicine services. According to the South African Health Products Regulatory Authority, over 50% of telehealth startups report difficulties in meeting regulatory requirements, which can stifle innovation and slow market growth.

South Africa E-Health and Telemedicine Market Future Outlook

The South African e-health and telemedicine market is poised for significant growth, driven by technological advancements and increasing consumer acceptance. In future, the integration of artificial intelligence and machine learning in healthcare is expected to enhance diagnostic accuracy and patient engagement. Additionally, partnerships between tech companies and local healthcare providers will likely foster innovation, improving service delivery. As the government continues to support digital health initiatives, the market is set to evolve, addressing existing challenges and expanding access to quality healthcare services.

Market Opportunities

- Expansion of Telehealth Services:The growing acceptance of telehealth presents a substantial opportunity for service providers. With an estimated 40% of South Africans expressing interest in using telehealth services in future, companies can capitalize on this trend by developing user-friendly platforms that cater to diverse patient needs, particularly in rural areas where traditional healthcare access is limited.

- Development of Mobile Health Applications:The mobile health application market is expected to grow significantly, with projections indicating a rise to 15 million downloads in future. This growth is driven by increasing smartphone usage and the demand for health management tools. Companies that focus on creating innovative, localized health apps can tap into this expanding market, providing essential services like appointment scheduling and medication reminders.